Famous five: top overseas stocks for your ISA

After backing a handful of overseas stocks for an ISA two years ago, are these winners still a 'buy'?

10th March 2021 09:05

by Rodney Hobson from interactive investor

After backing a handful of overseas stocks for an ISA two years ago, are these winners still a 'buy'?

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The outlook was problematic for European companies when, two years ago, I suggested five companies for UK investors looking to spread their ISA investments overseas before the financial year end. It has turned out much tougher than anyone could have imagined. So how have the famous five selections fared since March 2019?

- Invest with ii: Open an ISA | ISA Investment Ideas | Top ISA Funds

The picks were solid, growing companies with worldwide brands in expanding markets, with good cash generation and growing profits, attributes that are particularly important for ISA selections.

- Murray International raises dividend, but underperforms due to lack of tech

- Open an ISA with interactive investor. Simply click here to find out how.

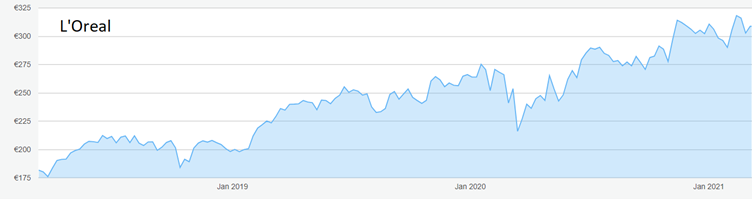

Life has been particularly tough for French company L'Oreal (EURONEXT:OR), the world's largest cosmetics company, during the pandemic with the widespread closure of non-essential stores selling products such as make-up, hair colour, skin care and perfume.

Even so, it easily outperformed the beauty products market with revenue and pre-tax profits down only 6% in 2020 to €28 billion and €5.5 billion respectively. Confident that it will again outperform what should be a recovering market this year, L’Oreal has raised the dividend to €4, a 3.9% increase on 2019.

Source: interactive investor. Past performance is not a guide to future performance

Chair and chief executive Jean-Paul Agon reckons that consumers’ appetite for beauty products remains intact across the world and that L’Oreal will be back to growing revenue and profits this year.

He will probably be right, as the company’s figures for the third and fourth quarter already showed a steady improvement, while the first half of this year will be up against less challenging comparatives.

Spending on beauty products had been growing at about 4% annually before the pandemic and that trend is likely to resume in due course, although this year’s figures will be distorted by the patchy return to normal in different parts of the globe.

The shares were below €240 in March 2019 and are now around €310. With the yield at 1.25% the case for buying is not overwhelming but the quality of this company should see a continuing rise in the share price.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

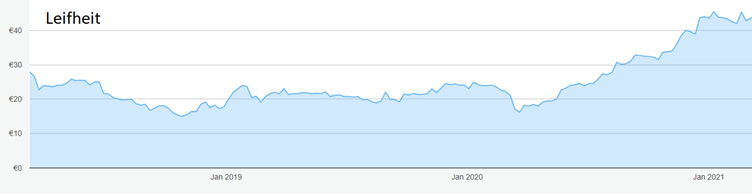

Household goods have not been held back to anything like the same extent, a factor that has helped German company Leifheit (XETRA:LEI), whose output includes mops, ironing boards and cleaning fluids.

Source: interactive investor. Past performance is not a guide to future performance

The shares moved sideways throughout 2019 and took a sharp dip 12 months ago, but the recovery since has been phenomenal, from €16.22 at the bottom to the current price around €43. The yield is comparable to that at L’Oreal and the argument that this is a quality company with a solid future is also similar.

Investors who bought two years ago at €22 on my suggestion have nearly doubled their money plus pocketing two years of dividends. There is no reason to sell out yet.

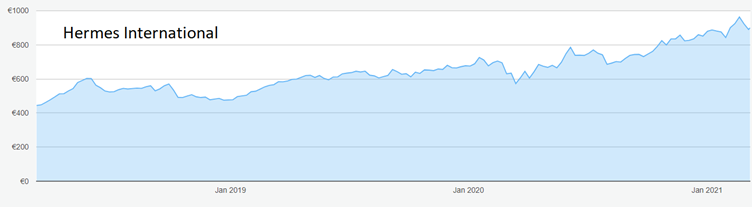

If you work on the basis that wherever you are in the world there is always someone with pots of money, you can understand why French luxury goods maker Hermes International (EURONEXT:RMS) has come through the past two years virtually unscathed.

Source: interactive investor. Past performance is not a guide to future performance

Shares in the high-end manufacturer in leather, lifestyle accessories, home furnishings, perfumery, jewellery, watches and ready-to-wear have risen 50% from under €600 to over €900.

The yield is only 0.5% but with sales in emerging markets driving growth the share price rise could continue.

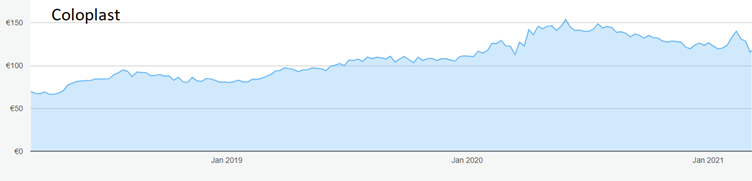

Danish healthcare company Coloplast (XETRA:CBHD) was at an all-time high at €97 at the end of March 2019 and it went on to peak at €153 last May, with the shares hardly affected by the stock market slump.

Source: interactive investor. Past performance is not a guide to future performance

My argument that demand would continue to grow for the stoma bags and incontinence products it makes seemed to have widespread support. The shares have, however, been sliding and are back just above €120, where the yield is 2.1%. This opens up another buying opportunity.

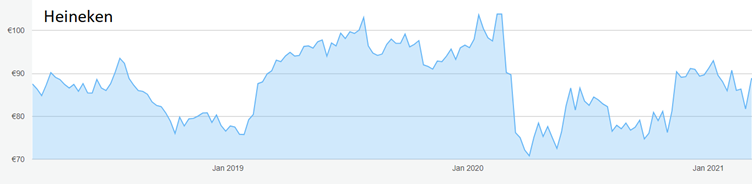

The one disappointment – though by no means an outright disaster – has been Dutch brewing company Heineken (EURONEXT:HEIA), which had a pretty horrendous pandemic.

Source: interactive investor. Past performance is not a guide to future performance

The shares had edged up from €94 two years ago to a peak of €104 before the stock market slump last year took them all the way down to €70 in pretty short order, as sales of Heineken beer were hit harder than those of notable rivals.

Things should pick up as life gets back to normal, but it could get worse before it gets better. Heineken made a net loss of €204 million in 2020, with volumes down 8.1%, and it is cutting 8,000 jobs.

The stock now stands just below €90, where the yield is 1.2%. It is worth considering while it remains below the original tip price.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.