Five funds driving this portfolio to a record high

Saltydog analyst explains how smart trades and top funds helped its most cautious portfolio outperform.

8th July 2019 12:15

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst explains how smart trades and top funds helped its most cautious portfolio outperform.

Saltydog Portfolio at record high

Last week our most cautious portfolio, the Tugboat, ended the week at just over £65,400, setting a new all-time high.

At Saltydog Investor we believe that to make your current savings work harder you need to take a few simple steps:

- Take advantage of the low-cost fund supermarket platforms and discount brokers.

- Use tax-efficient wrappers like ISAs and SIPPs. The government has set up various schemes to encourage us to save more, and it is important to take full advantage of these.

- Manage risk. By understanding how different funds are classified it is possible to tailor your portfolio to match your appetite for excitement.

- Regularly monitor your progress and be prepared to change tack as conditions vary.

We launched our first 'demonstration' portfolio in November 2010 to help our members see how our principles could be put into action. We transferred £40,000 of our own money onto a trading platform and have been reporting on it ever since. Every week we look at the fund and sector performance from the previous week and decide if we need to make any changes. Since we started the portfolio it has gone up by 63%, with an average annual return of 5.9%.

We wanted to design a portfolio that would avoid any major drops in the markets, but still make reasonable progress when conditions are favourable.

Each week we provide performance data on Unit Trusts, Investment Trusts, OEICs and ETFs. This portfolio only invests in Unit Trusts and OEICs. When we review these funds, we break them down into their Investment Association sectors and then group them into our own Saltydog Groups, based on their historic volatility.

The groups are:

- Safe Haven – very low risk, but also very low returns.

- Slow Ahead – normally a low risk level and often with adequate returns.

- Steady as She Goes – generally medium risk, with potentially higher returns.

- Full Steam Ahead – higher risk, with potentially the best returns. There are quite a few sectors that fall into this risk category and so we split them into Emerging Markets and Developed markets.

By managing the amount invested in each group, it is possible to control the overall volatility of the portfolio. Because of the cautious nature of the Tugboat we decided that we would never invest more than 10% in funds from the 'Full Steam Ahead' groups and always keep at least 70% in cash or the Safe Haven / Slow Ahead Groups. The balance would sit in the 'Steady as She Goes' Group.

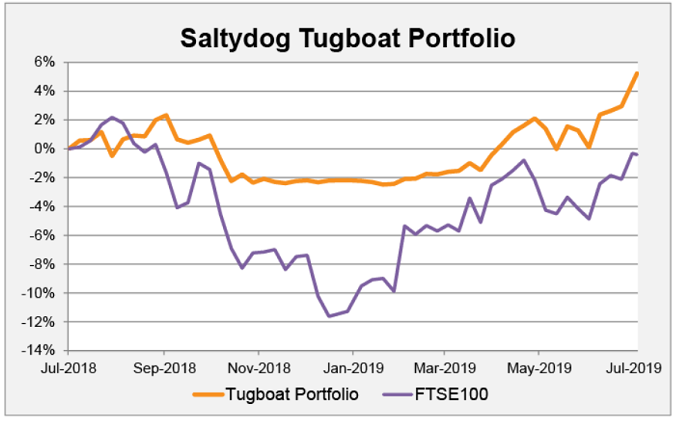

Over the last year, we've seen markets around the world drop and then recover. In contrast, our Tugboat portfolio remained relatively level for most of the downturn and has started to pick up in the last few months.

Source: Saltydog Past performance is not a guide to future performance

Between the beginning of July 2018 and the end of the year the FTSE 100 index fell by 11%, but our portfolio only dropped by 2%. The main reason we avoided the majority of the fall was because we were holding significant amounts of cash. The FTSE 100 had peaked in May and by the beginning of July had fallen by 3%. We had already increased the amount of cash that we were holding to 40% of the total portfolio value, and by the end of October it was up at 75%.

Since Christmas, global stock markets have recovered. The FTSE 100 is almost back to where it was in July and, when you take into account dividends, it is actually up by 4%.

We are now back in a situation where the Tugboat portfolio is nearly fully invested. The cash level has dropped to 11%, we have 59% invested in funds from the 'Slow Ahead' Group, 21% invested in funds from the 'Steady as She Goes' Group and 9% invested in funds from the 'Full Steam Ahead' Group.

In total, we are invested in eight funds. The two that we have held the longest are the AXA Framlington UK Mid Cap and Fidelity Global Technology funds; we bought these on the 24th January 2019 and they've seen price rises of 11.7% and 18.9% respectively.

Three of the other funds that we are holding have also gone up by more than 10% since we invested in them in February. They are the Liontrust Sustainable Future Managed, Janus Henderson Global Responsible Managed, and Baillie Gifford UK Equity Alpha funds.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.