Five new investment trusts: Are they a buy?

Investment trust launches have been coming thick and fast of late. We assess their credentials here.

8th February 2019 10:05

by Tom Bailey from interactive investor

Investment trust launches have been coming thick and fast of late. We assess their credentials here.

The open-ended active management industry frets about the rise of passive funds and ETFs, but there seems to be no lack of interest from the public in investment trusts.

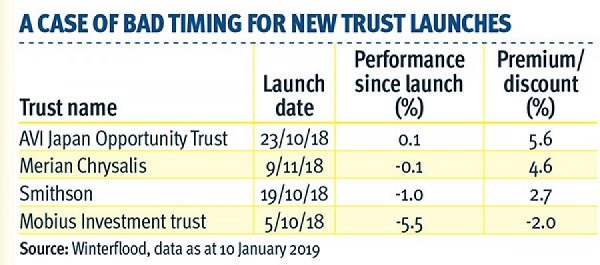

In 2018, there were 19 investment trust IPOs, which raised £3 billion. In contrast, in 2017 there were 15 investment trust IPOs, which raised £2.5 billion, and in 2016 there were four, raising £964 million. Judging by the number of launches over the past year, the investment trust sector continues to thrive, whether that is because of their relative outperformance over the long term compared with open-ended funds or the attraction of the closed-ended structure.

In this review, we will highlight some of the stand-out trusts that have launched in recent months, explain how they invest and outline where they might best sit in an investor's portfolio.

AVI Japan Opportunity Trust (AJOT)

AVI Japan Opportunity Trust (LSE:AJOT), managed by Joe Bauernfreund, looks to invest in a very specific type of company. A business must be small (valued at less than £500 million), and it must have a lot of cash on its balance sheet and no debt.

Peter Walls, manager of the Unicorn Mastertrust fund, says:

"Bauernfreund believes there are extraordinary under-valuations in a range of cash-rich, over-capitalised Japanese small ¬firms."

Bauernfreund is looking for cash-rich companies for a specific reason. He hopes to use changing corporate governance norms to unlock the huge cash piles built up by Japanese companies over Japan's deflationary years. Bauernfreund estimates that around 500 companies have at least 30% cash to market cap, notes Ben Yearsley at Shore Financial Planning.

Baked into this strategy is faith in Japan's corporate governance reform. Yearsley says: "The AVI team intends to actively engage with company management to facilitate change, unlock value and start using its cash to better effect. Companies showing better corporate governance are typically being rewarded by the stock market."

The fear, however, is that corporate governance reform may slow – as may already be happening.

The trust's annual management fee is 1% of either the market cap or NAV, depending on which is lower, which makes the trust neither cheap nor expensive. The trust has a buyback policy for whenever its discount slips below 5%.

Investors, however, should regard the trust as a long-term investment that may take a while to pay off. Yearsley says:

"Investors might get bored waiting for returns to come, and it won’t be a smooth ride. However, it is a fascinating investment opportunity that you would pair with a more mainstream Japan fund."

Merian Chrysalis (MERI)

In the 20th century, companies often went public to raise capital to invest in the heavy machinery on which their businesses relied. "The world has now changed," says Nick Greenwood, manager of Miton Global Opportunities (LSE:MIGO).

Companies now have different sources of finance, while the growing importance of intangible assets has reduced the need for heavy capital investment. As a result, more firms are remaining private for longer.

However, this trend has been frustrating for investors. Analysis by Merian shows that companies grow their revenue far more quickly in the two years prior to listing than in the two years following a stock market floatation, so most investors have missed out on the stronger growth by the time companies go public.

With this in mind, a number of investment trusts that focus on unquoted businesses have emerged in recent years.

One of the latest is Merian Chrysalis (LSE:MERI), which focuses on investing in firms within a couple of years of their flotation.

Yearsley says:

"One key driver of the launch is the fact that firms are staying private for longer to allow founders to realise more value, thus depriving new investors of high-growth opportunities."

Merian's annual fee is low, at 0.5%. Moreover, that fee won't apply until 90% of the funds raised are invested. Investors should note, though, that a performance fee of 20% of returns kicks in when returns exceed of 8% a year.

That said, as Greenwood points out, that's not expensive for private equity. He says he would "much rather have 80% of something going up than 95% of something going nowhere".

One key risk with this trust, according to Greenwood, is that the theory on which the trust is built – that companies see their best growth in a few years before listing on the stock market – may not work out in practice.

Yearsley suggests there is no rush to invest. He says: "Private companies typically aren't revalued unless something meaningful happens – a new investor comes in at a higher price, for example. So why rush to invest? You can assess the trust over the next six months or so before pulling the trigger."

Smithson (SSON)

The most popular IPO this year has been Smithson (LSE:SSON), which raised £822.5 million, a record for an investment trust. The trust aims to replicate the investment philosophy of Terry Smith's Fundsmith, the company under which it was launched, but instead focus on global smaller companies.

According to Mick Gilligan, head of fund research at Killik & Co, the type of companies Smithson invests in usually outperform. They are high quality (in terms of balance sheet strength), the markets they operate in have high barriers to entry and the firms focus on organic growth, so they have a relatively low requirement for fresh capital.

The fear with Smithson, however, is that it might become a victim of its own success. Greenwood says:

"Every trust that has beaten the all-time issue has had trouble. There has been a curse."

The most obvious example is Neil Woodford's Patient Capital Trust (LSE:WPCT), which was previously the biggest investment trust launch. It has had a bumpy ride since launch almost three years ago, leaving those who bought on day one nursing paper losses. Other previous record breakers such as Fidelity China Special Situations (LSE:FCSS) have also floundered and got off to a tough start.

Nevertheless, Greenwood says there is no reason why Smithson should go the same way. He notes that Smithson has a broader scope, so there is less risk of something going wrong.

Smithson charges 0.9% of market cap. That incentivises the trust to keep trading at a premium, which is not good news for investors hoping to pick up a bargain. Beyond that, there is no discount control.

Mobius Investment Trust (MMIT)

Veteran emerging market investor Mark Mobius launched his new investment trust in September. However, despite Mobius's storied reputation, it failed to reach its £200 million target on launch.

However, Greenwood says there is no need to worry about the lack of initial interest. Despite Mobius Investment Trust (LSE:MMIT) missing its target, it can "still go away and start building a track record, and when investors are more comfortable, it can come back and issue more shares".

The trust's disappointing launch can, at least in part, be put down to the poor investor sentiment on emerging markets at the time, which still persists.

This, says Gilligan, makes Mobius Investment Trust attractive. "The key thing about the trust is that its timing is good. We are probably closer to the end of an emerging market sell-off than the start of one," says Gilligan. However, he notes that the trust is really for investors willing to buy and hold for 10 years or more.

Some of the concerns about the trust specifically relate to the past performance of Mobius. Jason Hollands, managing director at Tilney Bestinvest, said at the time of the trust’s launch:

"There has been a degree of scepticism in the market about what edge the new business might have over and above what the team was able to achieve at its former firm, Franklin Templeton."

Another factor to consider is the trust's discount control mechanism. The trust will buy back shares to keep the trust's discount at around 5%, well below the current emerging market sector discount average of 12%. The fees on the trust are also reasonable at 1% a year. Emerging market fees for trusts range from 0.75% to 4.25%, notes Gilligan.

Global Sustainability IT

Also playing on the unlisted theme is the Global Sustainability Trust, managed by Aberdeen Standard Investments. The trust aims to invest primarily in unlisted companies deemed to meet its environmental, social and governance targets.

Yearsley says: "The focus is on eight areas initially, including sustainable energy, water and sanitation, financial inclusion, and food and agriculture. The common denominator is that they all must have a positive impact on society and the environment."

This, he says, makes the trust "unique in the UK market".

However, the trust has run into some trouble. In December it announced that its offer period would be extended by more than a month, and at time of publication the trust had not launched. It cited "current political and market uncertainty" as the reason for the move.

Yearsley says investors would be best served by waiting a while before investing in the trust. He says: "As these companies will be unquoted, it is likely that the NAV will do little in the first year, so there is time to let the trust become fully invested before you buy."

He adds:

"You will have to be patient [if you do buy], though. It will take seven years plus in my view to get the best returns."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.