Four AIM stars: Fevertree, Boohoo, AB Dynamics, YouGov

This high-profile foursome has just announced important results. Here’s how they fared.

22nd April 2020 13:27

by Graeme Evans from interactive investor

This high-profile foursome has just announced important results. Here’s how they fared.

A dividend hike and plenty of Covid-19 defiance showed the best of AIM today as investors digested results from highly-rated Fevertree Drinks (LSE:FEVR), Boohoo (LSE:BOO), AB Dynamics (LSE:ABDP) and YouGov (LSE:YOU).

The updates were positive for shares in all but AB Dynamics, with the vehicle testing firm unlikely to be out of favour for long given its strong reputation and high-growth record.

For investors starved of dividend income, Fevertree's annual results included a welcome final pay-out of 9.88p a share for payment in June. That's slightly lower than a year earlier, but the total for 2019 is still 4% higher than a year ago at 15.08p, worth more than £17 million.

Today's dividend award reflects the positive tone within the company's annual results, with good progress in key markets prior to Covid-19 particularly noticeable in the United States after the introduction of a new pricing strategy in January.

About 45% of its revenues are generated from the on-trade channel, but Fevertree looks to be well placed to cope with the shutdown of bars and restaurants thanks to a low level of fixed costs and a strong balance sheet boasting £128.3 million of cash at year-end.

The mood is also helped by strong sales in the off-trade (supermarkets, convenience stores, off-licences), both from initial buying ahead of lockdown and robust home consumption of tonics and other mixers in recent weeks.

Shares jumped 17% to 1,593p today after co-founder and CEO Tim Warrillow added that the company looked to be well placed once the current disruption and uncertainty ends.

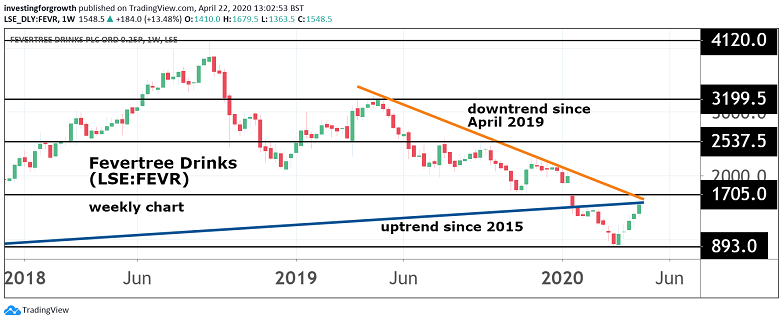

Source: TradingView Past performance is not a guide to future performance

The rally puts the stock back to where it was in the aftermath of a shock profits warning in January, when Fevertree reported a quiet Christmas for its core UK market. This came as a big shock to investors asked to pay way over 30 times earnings for the shares.

With shares down by 35% year-to-date for a price/earnings multiple of 26.6x, Numis Securities reiterated its price target of 2,500p today. Liberum also has Fevertree as its top pick in the staples sector.

The broker added:

“The market is excessively focusing on Fevertree's slowing UK growth and Covid-19 whilst underappreciating the strong balance sheet, asset-light business model, and improving traction in international markets. The update today is encouraging.”

Liberum is also positive on Boohoo after the fast-fashion business returned to year-on-year sales growth during April. Results for the year to the end of February were also impressive, with a 30 basis points increase in the all-important earnings margin to 10.2%.

Boohoo has £241 million of cash on its balance sheet and, with a monthly cash burn of under £10 million, looks well placed to survive the extreme scenario of a full shut-down of the business over the next few months.

- Two coronavirus stocks where momentum favours the brave

- Greatland Gold: another AIM success story up 330%

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

While the company itself is not providing forward guidance, analysts at Jefferies reckon first quarter sales could grow by between 5% and 10%. They have a price target of 395p, whereas Liberum has reinstated its “buy” recommendation with a 330p target.

The stock stood at 290p this morning after rising another 6% to continue the fightback from 155p seen in mid-March. Boohoo, which also trades as PrettyLittleThing and Nasty Gal, had been at a record high of 327p in January.

Source: TradingView Past performance is not a guide to future performance

Market research and data analytics firm YouGov is on a similar trajectory, helped by today's half-year results showing a 35% jump in earnings per share to 8.7p. Trading since February has been in line with expectations, with no material impact so far from Covid-19.

While it anticipates the pandemic could lead clients to delay projects, default or request longer payment terms, it points out that it has strong cash balances and no debt. Shares in 2019's AIM growth stock of the year jumped 11% to 658p today. They were 762p in February, only to fall back to 400p a month later.

Source: TradingView Past performance is not a guide to future performance

AB Dynamics was the odd one out among today's AIM results foursome, with shares down over 10% at one point after reporting the deferral of some larger orders due to Covid-19.

Shares were later little changed at around 1,510p, however, as investors capitalised on an opportunity to pick up one of 2019's best performing AIM stocks for almost a third of its price in November.

Source: TradingView Past performance is not a guide to future performance

The Wiltshire-based company is regarded as a global leader in the design and manufacture of advanced testing systems, including the robots used in the development of self-driving vehicles.

Half-year results today showed adjusted operating profit up by 34% with margins stable, while the group ended the period with £35 million of cash. Despite AB withdrawing guidance and suspending its interim dividend, Cantor Fitzgerald reiterated its “buy” recommendation.

Liberum added that the company was well placed to weather the current storm and to continue investment in product development. The broker added:

“The longer-term thesis is unchanged. This is a high-quality, high-returns business in a long-term growth market.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.