Four cautious fund buys as stocks rebound

4th April 2022 15:01

by Douglas Chadwick from ii contributor

Saltydog Investor is deploying its giant cash pile but is still cautious on where markets are heading.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Although there is a war in Ukraine, record levels of inflation all over the world, and rising interest rates, most investment sectors made gains in March. This is a significant improvement on the previous month when nearly all of them fell.

But there were a few sectors that made gains in February. UK Direct Property went up by 0.65%, North American Smaller Companies made 1.08% and Japanese Smaller Companies rose by 1.99%. The best-performing sector was Latin America, which went up by 3.84%.

Last month, Latin America was still the best sector, rising by more than 14%.

Past performance is not a guide to future performance.

As well as providing fund and sector analysis every week, Saltydog Investor also runs a couple of demonstration portfolios showing what we are doing with our own money. They are both relatively cautious and we consider minimising our losses in adverse conditions as important as making gains when things are going well.

Therefore, it makes sense that for most of this year both portfolios have been predominantly in cash. At the beginning of March, the cash level in our Tugboat portfolio was 90%, and in the slightly more adventurous Ocean Liner it was 70%. During the month we have made a few investments bringing the cash level down to about 70% in the Tugboat and just under 50% in the Ocean Liner.

- How Saltydog invests: a guide to its momentum approach

- Funds and investment trusts with the punchiest portfolios

- A tactic to ride out the inflation storm using these funds and trusts

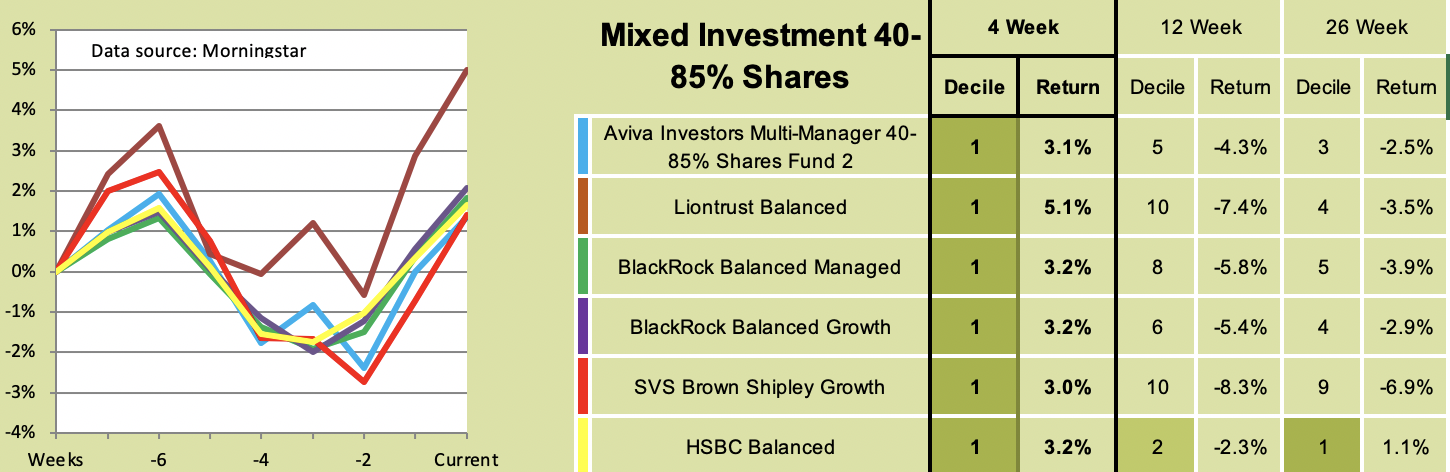

To limit the overall volatility of the portfolios we usually hold several funds from the “Slow Ahead” group but there is no point when all sectors are going down, as they were in February. However, in March the Mixed Investment 0-35% Shares sector went up by 0.49%, Mixed Investment 20-60% Shares sector made 1.52%, and Mixed Investment 40-85% Shares sector beat them both, gaining 2.83%.

Last week, we invested in a couple of funds from the Mixed Investment 40-85% Shares sector. We chose Liontrust Balanced and HSBC Balanced, which both appeared in our four-week table.

Past performance is not a guide to future performance.

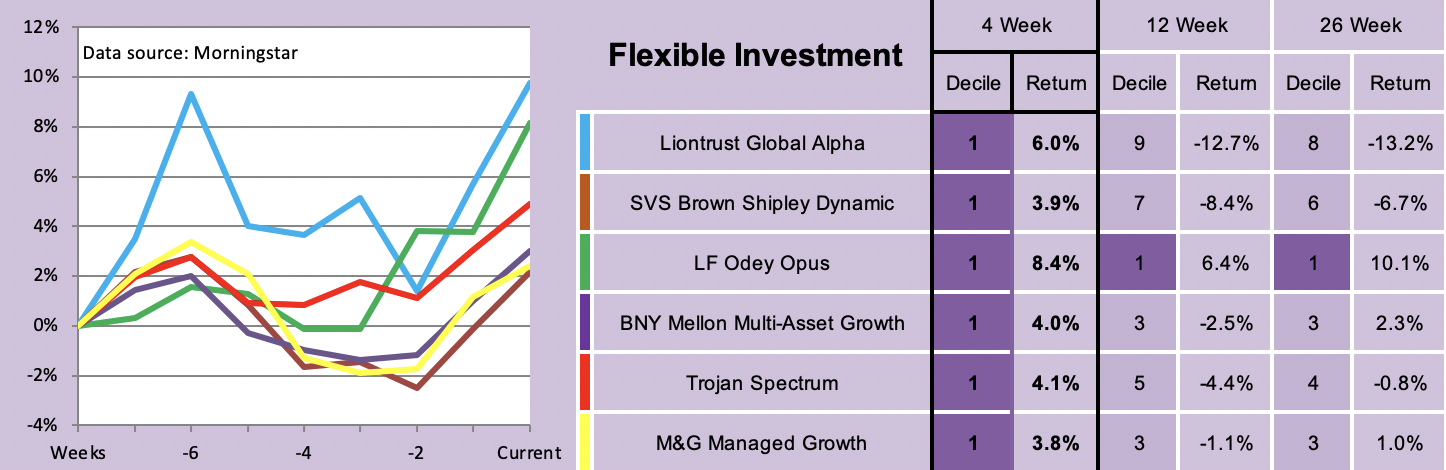

The leading sector from the more volatile “Steady As She Goes” group was Flexible Investment. We also added a couple of funds from this sector: Liontrust Global Alpha and LF Odey Opus.

Past performance is not a guide to future performance.

We already hold a number of funds from the “Full Steam Ahead” group and Specialist/Thematic sectors. These include the Liontrust Latin America, TB Guinness Global Energy and JPM Natural Resources funds, which have gone up by more than 10% since we went into them earlier this year.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.