FTSE 100 shares round-up: Lloyds Bank, Diploma, Smiths Group

Just weeks after the tariff crash and the FTSE 100 index is closing in on record highs. City writer Graeme Evans runs through the stocks leading the latest rally.

20th May 2025 13:01

by Graeme Evans from interactive investor

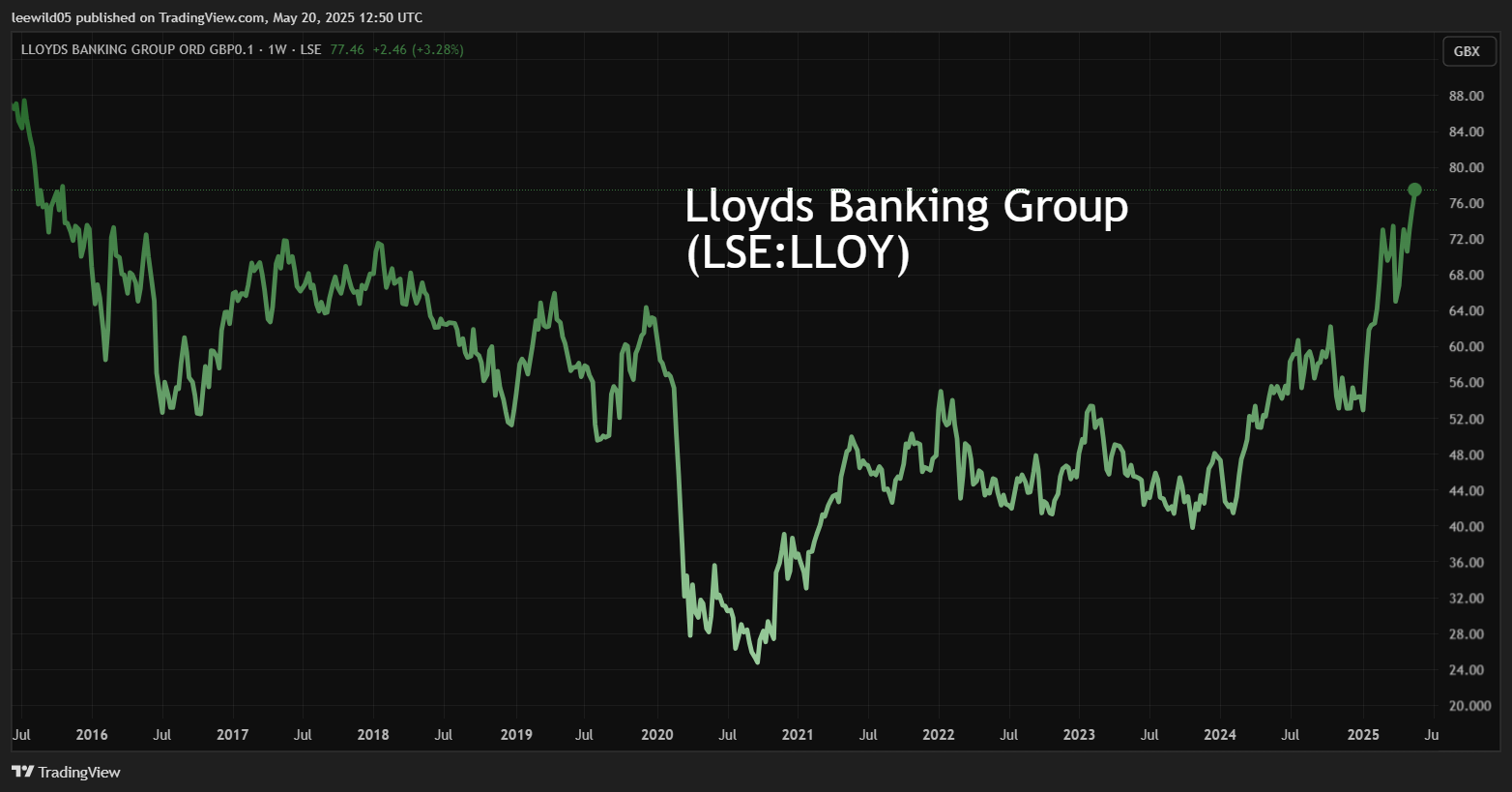

A near decade high for Lloyds Banking Group (LSE:LLOY) shares and the latest success of quality compounder Diploma (LSE:DPLM) today helped fuel another strong session for FTSE 100 investors.

The sweetened full-year guidance of conglomerate Smiths Group (LSE:SMIN) and the pursuit of dividend aristocracy by “all-weather” LondonMetric Property (LSE:LMP) also lifted the mood.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Having set a record closing high of 8,871 in early March, the FTSE 100 index reached lunchtime at 8,741 after rising for a fourth straight session as part of a month-long tariff recovery.

Lloyds advanced by another 1.7p to 77.6p, meaning the widely-held stock is up by 40% this year and by 21% since 7 April.

Source: TradingView. Past performance is not a guide to future performance.

The latest improvement came after the Financial Times reported yesterday that regulators are examining the ring-fencing regime under which UK lenders have to separate their high street and riskier commercial and investment banking operations.

An overhaul of the rules, which could be announced in the Chancellor’s Mansion House speech in July, has the potential to trigger significant cost and operational savings.

NatWest Group (LSE:NWG) also continued its recent strong progress by lifting another 6.2p to 515.8p in today’s session, while Barclays (LSE:BARC) rose 2.4p to 328.1p.

Other popular stocks in the spotlight included British Gas owner Centrica (LSE:CNA), which improved 3.2p to 155.2p after it generated £80 million from the sale of a major stake in the Cygnus gas field in the North Sea to FTSE 250-listed Ithaca Energy Ordinary Share (LSE:ITH).

- Stockwatch: is this still a growth share with legs?

- Shares for the future: why I’m downgrading this complex company

The best performance in the FTSE 100 was by industry supplier Diploma, whose beat-and-raise half-year results provided an emphatic response to any City fears of tariff disruption.

Diploma’s controls division smashed expectations by growing revenues 16% on an organic basis, including a strong showing by Chicago-based Windy City Wire after the maker of premium quality, low voltage wire and cable recorded double-digit growth.

There was also a strong contribution from the aerospace and defence-focused fasteners business Peerless, which exceeded 20% return on capital in its first year of ownership.

The Peerless performance continued Diploma’s strong record of accretive acquisitions, which together with operational leverage and cost discipline have delivered compound annual earnings growth of 16% over 15 years.

The company is now a well-established member of the FTSE 100, having doubled in value over the past three years to boast a current market capitalisation of about £6 billion.

The group now expects 8% organic growth for the year, up from 6% seen previously, and an operating margin of 22% compared with 21%.

Chief executive Johnny Thomson added: “The results are very strong. They demonstrate our sustainable quality compounding with excellent earnings growth at fantastic returns on capital.”

Reassurance on trading during the recent tariff turbulence also came from Smiths Group, which today lifted its full-year guidance towards the top end of its 6-8% organic revenue growth range.

The industrial conglomerate generates about 45% of sales in the US, but with the significant majority being produced locally.

The company continues to expect margin expansion of 40-60 basis points, while it is on track to make an announcement on the planned sale of Smiths Interconnect by the end of the year.

This will be followed by the separation of Smiths Detection by demerger or sale, leaving the group with flow and heat management through its John Crane and Flex-Tek operations.

The shares today rose 74p to a high for the year of 2,128p, which compares with 1,687p in early April and the new price target of analysts at JP Morgan Cazenove.

- Vodafone begins to ring the changes

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

LondonMetric shares rose 2p to 196p after the urban logistics-focused business reported a “remarkable year” in which earnings and dividend per share grew 21% and 18% respectively.

The company, which was created in 2013 through a merger of London & Stamford Property and Metric Property Investments, is now the UK’s leading triple net lease REIT — where the tenant is responsible for paying key expenses as well as the base rent.

This type of lease agreement and a focus on sectors with higher occupier contentment, such as urban warehousing, have enhanced its profile of reliable income growth.

The year to 31 March saw LondonMetric integrate the £3 billion of assets acquired through its LXi REIT takeover, transact on over £680 million of sales and acquisitions and deliver strong rental growth from 340 asset management initiatives.

The dividend for the year of 12p a share is 109% covered by earnings, including today’s quarterly dividend declaration of 3.3p.

It expects to build on a decade of dividend growth after guiding investors towards a 5.3% increase in its first quarterly dividend for the new financial year to 3p a share.

Chief executive Andrew Jones said: “With ten years of dividend progression under our belt, our all-weather portfolio is more capable than ever of delivering reliable, repetitive and growing income, and we remain firmly on track to achieving dividend aristocracy."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.