Shares for the future: why I’m downgrading this complex company

Despite rating the business quite highly, a few issues have caused analyst Richard Beddard to slash his score. It explains this stock’s disappearance from the Decision Engine’s top 20.

16th May 2025 15:12

by Richard Beddard from interactive investor

For nearly two decades, Judges Scientific (LSE:JDG) has grown by acquiring small UK scientific instrument manufacturers, typically from retiring founders. The equipment these firms make is used in higher education for research, and by industry for research and development and in manufacturing.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Multi-bagger

The shares have been a great long-term investment because these are niche businesses with few direct competitors. Niches are a double-edged sword. They are easy to defend but sometimes difficult to expand.

Judges uses the handsome cash flows from these firms to buy more of them. There is no shortage in the UK, and they often fly below the radar of rival acquirers with fat wallets like private equity firms.

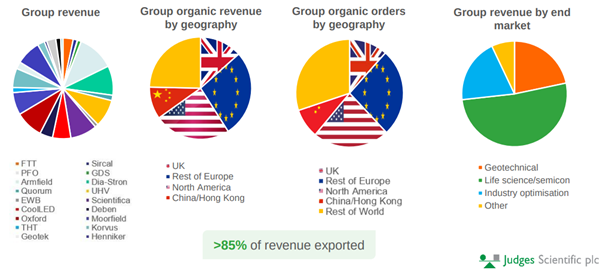

Happily, Judges’ subsidiaries have also grown under its ownership. The company says organic revenue has increased at a compound annual growth rate (CAGR) of 7% a year over the past 18 years, contributing 35% of total growth.

The result of this mostly acquisitive growth is a group of 18 manufacturers, some of which have bolted on smaller acquisitions.

Source: Judges investor presentation for year to December 2024

Complexity Risk

The biggest subsidiary requires special mention. It is GeoTek, a manufacturer of instruments for analysing geological cores (samples) acquired in 2022. This equipment is used by scientists in fundamental and environmental research, by governments to assess natural resources, and prospectors like oil, gas, and mining companies.

Inevitably, as Judges grows it needs to make bigger acquisitions if they are to have the same impact. Bigger acquisitions cost more because they tend to attract more buyers. The £80 million maximum consideration for GeoTek was seven times three-year average earnings before interest and tax (EBIT), which is the upper bound of what Judges will pay.

The price goes a long way to explaining why Judges’ financial obligations are 91% of operating capital, well above historic levels. The whopping addition of invested capital also helps to explain why return on total invested capital (ROTIC) was just below 10% in 2024.

Most of Judges’ businesses are straightforward manufacturers that operate with limited oversight, but bigger businesses tend to be more complex. GeoTek rents analysis machines out, provides geotechnical services, and participates in coring expeditions sponsored by national governments.

As Judges has grown it has beefed up its leadership, which gives me some confidence it can manage more complexity.

Judges’ principal dealmaker is founder David Cicurel. He is chief executive and also a large shareholder. The quality of his dealmaking is illustrated by the fact that Judges has never written down the value of a subsidiary.

- Stockwatch: is this the next candidate for big takeover premium?

- 10 hottest ISA shares, funds and trusts

Finances and operations are overseen by Brad Ormsby, chief financial officer of 10 years, chief operating officer Mark Lavelle, business development director Tim Prestidge, and commercial Director Ian Wilcock, a new appointment.

Lavelle and Prestidge were recruited from Halma, which is relevant because Halma’s still successful buy and build strategy has been something of a blueprint for Judges and other roll-ups.

With experience comes age, David Cicurel is 76 and Mark Lavelle is retiring in September 2026, but the company appears to be futureproofing its leadership by reconfiguring it into an executive committee of board executives and other senior managers.

Judges puts more emphasis on fostering growth within its subsidiaries than it used to, which may mitigate the risk of lower returns from acquisitions or less acquisition activity should, say, its totemic chief executive retire.

Fourth year of contraction out of 19 ‘aint bad

GeoTek left its imprint in the results for the year to December 2024, a rare year of contraction for Judges.

Revenue declined 2%, primarily because Geotek did not participate in a coring expedition during the year. Coring expeditions, which happen most years, bring in significant revenue, £7.5 million in 2023 by my calculation (5.5% of 2023 revenue).

Demand was generally weak, but particularly in China, which contributed only 10% of revenue, down from nearly 14% in 2023, a situation Judges says is reversing.

Profit fell by 21%, much more than revenue in 2024 because of high fixed costs, which squeezed margins albeit back towards their very respectable average of 14%. The company had also increased overheads in the expectation of growth, and was caught out by the subdued demand.

Good news comes in the form of the cash flow statement. Judges has put behind it the sub-par cash flow of recent years caused by stockpiling. Working capital is still high by historical standards, and the company is committed to reducing it.

- Cheap shares make UK a profitable market in an age of détente

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Judges made three modest-sized acquisitions during the year for a maximum total consideration of roughly £20 million. Two of them joined existing subsidiaries.

With contributions from new acquisitions, a stronger order book and a coring expedition underway, Judges should return to growth in the year to December 2025.

That said, every year Judges states it “thrives on peace and free trade”. This year it seems less certain of that than ever.

A brief note on geopolitics!

Judges Scientific has forced me to wrestle with one of the three horses of the apocalypse: increasing geopolitical tension (the other two are artificial intelligence and climate change).

The company warns that trade wars may not be good for business. At the same time government funding of academic research is under pressure, particularly in the USA.

In mitigation, the geographical segments that together earn Judges the majority of revenue are the EU and the Rest of the World. Likewise, it has diverse customers in industry as well as academia.

Though the business and academic climate is cloudy, penalising the company’s score because it is a successful exporter serving a wide variety of customers seems perverse.

In the potentially apocalyptic case of war between the USA and China, also mentioned in Judges’ risk report, all bets are off for pretty much all companies, I think.

Scoring Judges

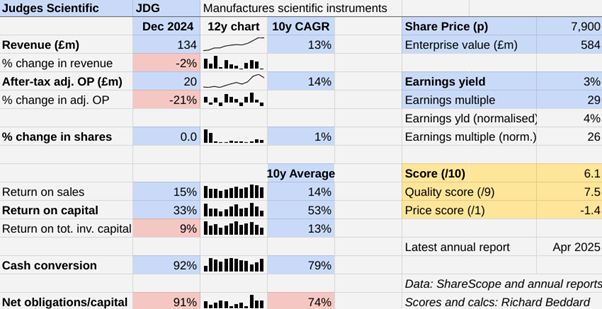

Judges Scientific | JDG | Manufactures scientific instruments | 14/05/2025 | 6.1/10 |

How successfully has Judges Scientific made money? | 3.0 | |||

Under founder and chief executive David Cicurel, JDG has achieved double digit revenue and profit CAGRs, high levels of profitability and strong cash flows by buying and operating niche manufacturers of scientific instruments | ||||

How big are the risks? | 2.0 | |||

As Judges Scientific grows, it is buying bigger, pricier and more complex businesses. These may be more risky and take longer to pay back the investment. At 91% of operating capital, financial obligations are high by my standards and Judges Scientific's | ||||

How fair and coherent is its strategy? | 2.5 | |||

Scientific instruments enable research, which is beneficial to humanity. The company's strategy is to roll up more businesses. It is also doing more to foster organic growth, which may mitigate any decline in the growth rate from acquisitions. | ||||

How low (high) is the share price compared to normalised profit? | -1.4 | |||

High. A share price of 7,900p values the enterprise at £584 million, about 26 times normalised profit. | ||||

A score of 6.1/10 indicates Judges Scientific is a somewhat speculative investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

Complexity and debt weigh on my confidence in a business I still rate quite highly. Judges’ relatively high share price reduces its score below 7, my benchmark for value, though.

* Prior to this update, Judges scored 7.3 and was ranked 20th in the Decision Engine.

20 Shares for the future

Here is the ranked list of Decision Engine shares that score more than 7 out of 10. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value.

4imprint Group (LSE:FOUR) and Churchill China (LSE:CHH) have published annual reports and are due to be re-scored.

Company | Description | Score | |

1 | Churchill China | Manufactures tableware for restaurants and eateries | |

2 | James Latham | Imports and distributes timber and timber products | |

3 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | |

4 | Howden Joinery | Supplies kitchens to small builders | |

5 | Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs | |

6 | Oxford Instruments | Manufacturer of scientific equipment for industry and academia | |

7 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | |

8 | Focusrite | Designs recording equipment, loudspeakers, and instruments for musicians | |

9 | Solid State | Assembles electronic systems (e.g. computers and radios) and distributes components | |

10 | Macfarlane | Distributes and manufactures protective packaging | |

11 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | |

12 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures, fixation devices and dressings | |

13 | YouGov | Surveys and distributes public opinion online | |

14 | Bunzl | Distributes essential everyday items consumed by organisations | 7.7 |

15 | James Halstead | Manufactures vinyl flooring for commercial and public spaces | |

16 | Porvair | Manufactures filters and laboratory equipment | |

17 | Games Workshop | Manufactures/retails Warhammer models, licences stories/characters | |

18 | 4Imprint | Sells promotional materials like branded mugs and tee shirts direct | |

19 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | |

20 | Jet2 | Flies holidaymakers to Europe, sells package holidays |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

20 more speculative shares

Shares that score 7 or less out of 10 are more speculative, either because their share prices are high in relation to normalised profit or because I am less confident in the businesses than I should be (or both!).

Company | Description | Score | |

21 | *Victrex* | Manufactures PEEK, a tough, light and easy to manipulate polymer | |

22 | *Treatt* | Sources, processes and develops flavours esp. for soft drinks | |

23 | Softcat | Sells hardware and software to businesses and the public sector | |

24 | *Tracsis* | Supplies software and services to the transport industry | |

25 | Auto Trader | Online marketplace for motor vehicles | |

26 | Volution | Manufacturer of ventilation products | |

27 | Dunelm | Retailer of furniture and homewares | |

28 | *Marks Electrical* | Online retailer of domestic appliances and TVs | |

29 | *Anpario* | Manufactures natural animal feed additives | |

30 | *RWS* | Translates documents and localises software and content for businesses | |

31 | Bloomsbury Publishing | Publishes books, and digital collections for academics and professionals | |

32 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | |

33 | Judges Scientific | Manufactures scientific instruments | 6.1 |

34 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | |

35 | Celebrus | Makes marketing and fraud prevention software, sells it as a service | |

36 | Garmin | Manufactures sports watches and instrumentation | |

37 | DotDigital | Provides automated marketing software as a service | |

38 | Cohort | Manufactures military technology, does research and consultancy | |

39 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | |

40 | Keystone Law | Runs a network of self-employed lawyers |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's score to see a breakdown (scores may have changed due to movements in share price)

Shares in *italics* score less than 6/9 for business quality and may be removed

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.