FTSE 250 stocks: Winners and losers in 2019

A general election spurt leaves the mid-cap index up 25%, but which stock tripled and which fell 63%?

23rd December 2019 13:00

by Graeme Evans from interactive investor

A general election spurt leaves the mid-cap index up 25%, but which stock tripled and which fell 63%?

A select band of consumer-facing stocks defied the retail doom-mongers to deliver some stunning returns for investors in the FTSE 250 index over 2019.

With December's general election result the icing on the cake for investors, Pets at Home (LSE:PETS) and Dunelm (LSE:DNLM) managed to more than double in value while much-fancied Greggs (LSE:GRG), Marshalls (LSE:MSLH) and Games Workshop (LSE:GAW) continued their recent progress to rise by 75% or more.

The scale of these performances appear even more impressive in light of the challenges that faced UK-focused stocks in a year dominated by Brexit. The FTSE 250 index weathered the storm to hit a record high of 21,920 earlier this month, with technology-based stocks including Softcat (LSE:SCT), Computacenter (LSE:CCC) and Kainos (LSE:KNOS) among others doing particularly well.

There were just 38 stocks in negative territory, but unfortunately for many retail investors these included Marks & Spencer (LSE:MKS) after a decline of 8% in the year it was relegated from the FTSE 100 index, while there was a fall of 12.5% to 235.2p for widely-held Royal Mail (LSE:RMG).

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

FTSE 250 winners in 2019

Top billing in the FTSE 250 index, however, was reserved for media company Future (LSE:FUTR) after a transformative year in which it achieved a step change in both scale and in market value.

Shares are up a whopping 191% in 2019 to value Future at more than £1.4 billion as CEO Zillah Byng-Thorne delivers on a strategy that has involved major acquisitions in the United States.

Source: TradingView Past performance is not a guide to future performance

About 70% of revenues now come from Future's higher margin Media business, which consists of e-commerce, events and digital advertising in sectors such as technology, games and music. The remainder is from magazines, with titles including Classic Rock and FourFourTwo.

The shift in revenue mix and expanded scale helped to lift underlying margins to 25% in November's full-year results from 16% the year before. Revenues were up 70% to £221.5 million as adjusted earnings per shares surged 95% to 47.5p.

US revenues underpin the improvement and now account for 54% of revenues and 67% of Media revenues. With Future better placed to attract a more talented workforce, the company told investors in November it was trading ahead of expectations for the current financial year.

Pets at Home was the next biggest riser in the FTSE 250 after stronger-than-expected interim results in November were given an additional boost by the favourable election result.

As well as profitable market share gains in its retail stores, the investment story is built around the prospect of profit and cash growth from veterinary services. CEO Peter Pritchard believes the company can be the “best pet care business in the world”, a pledge he has backed up with a target to deliver 50% of sales from pet care services, compared with 35.4% currently.

This year's 142% share price rally to 275p marks an impressive turnaround for the stock, which floated at 245p in March 2014 only to fall back to 111p by November 2017.

Alongside Pets at Home and Next (LSE:NXT) in the FTSE 100 index, homewares chain Dunelm has been one of retail's other outstanding stocks of 2019. Its impressive share price performance looked to have run out of steam in October, only to be reinvigorated in December when the company said its migration to a new website had been executed without any disruption.

With the election removing uncertainty about festive trading, shares have powered through the 1,000p barrier for the first time and now stand 114% higher than the start of 2019.

Greggs shares also hit a record high this year after the sales momentum generated by publicity around its meat-free sausage roll triggered a succession of profit upgrades in 2019.

It appears that the vegan-friendly product is having a long-lasting impact on people's perception of the brand, leading to additional visits to shops and giving Greggs more of an opportunity to showcase its new store appearance and product menu.

The stock is now valued at a chunky 25.7 times 2020 earnings, but Greggs is cash generative and boasts a strong track record of expansion and sales upgrades, while it recently rewarded investors with a 35p special dividend alongside an 11% hike in its interim dividend.

Elsewhere in retail, it's been a spectacular end to 2019 for Mike Ashley's Frasers Group (LSE:FRAS) after December's half-year results and election result triggered a sharp rally for shares. The stock, which used to be known as Sports Direct International, is up 89%.

Shares in Games Workshop have also continued their unexpected charge, with demand for Warhammer fantasy miniatures leading the stock 96% higher in 2019 and giving the company a market value of almost £2 billion.

Among the technology stocks, fast-growing IT infrastructure firm Softcat again rewarded investors in 2019 as another special dividend rounded off a year of profit upgrades and strong trading.

Shares are up 92% so far this year, with Marlow-based Softcat benefiting from strong demand from public sector organisations and corporates concerned about cyber security or the need to use innovation to stay on top of regulations such as GDPR.

FTSE 250 losers in 2019

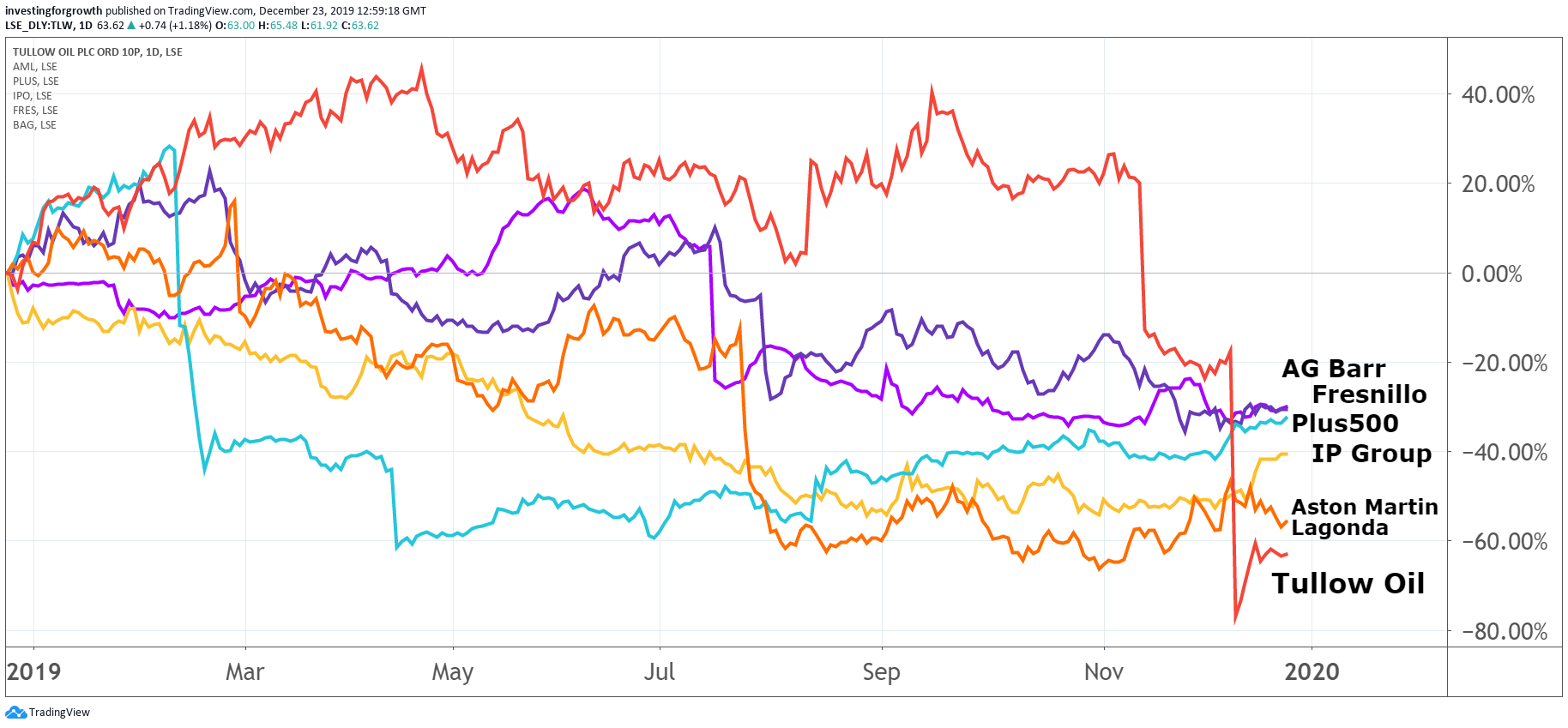

Source: TradingView Past performance is not a guide to future performance

Tullow Oil (LSE:TLW) provided the FTSE 250 index's biggest fall of 2019 after the Ireland-based company recently cut its 2020 production forecast and scrapped its dividend just a year after announcing it would start returning cash to shareholders following a four-year break. The stock is now valued at less than £1 billion after falling 63% over the year.

Shares in Aston Martin Lagonda (LSE:AML) also continued to struggle after the luxury car maker failed to convince investors about its prospects amid declining wholesale volumes. Much will now depend on the success of its first sport utility vehicle, the DBX, which enters the UK's already crowded 4x4 marketplace at a price of £158,000.

Aston has delivered a series of downgrades since its ill-fated IPO, when the stock was aggressively priced at 1,900p in one of 2018's highest profile flotations. Shares are 54% lower for 2019 at 520.6p, although that represents a recovery on 400p at the end of October.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.