Fund spotlight: Foresight Global Real Infrastructure

8th November 2021 11:50

by Liberty Godfrey from interactive investor

interactive investor analyst Liberty Godfrey examines a fund that offers plenty of inflation protection.

FP Foresight Global Real Infrastructure fund invests in the publicly traded shares of companies that own or operate real infrastructure or renewable energy assets anywhere in the world. In addition, the fund only invests in companies delivering a net social or environmental benefit and meets the principles of the United Nations Global Compact, which are a set of guidelines for investing ethically.

There are three main elements to the process. First, they look at certain fundamentals, including how a business operates and the strength of its cash flow.

Second, there’s ongoing active engagement, including meeting with the management team and assessing its long-term strategy to ensure it continues to align with the fund’s investment objective.

And third, sustainability is a core part of the investment process, all holdings are assessed to ensure they are delivering a net environmental or social benefit, and are upholding their responsibilities to the planet and people in areas such as human rights, labour, the environment and anti-corruption.

The fund was launched in June 2019 andhas grown to a size of £596 million. It sits within the Investment Association’s (IA) Global sector. The fund is managed by the highly experienced team of Nick Scullion, Mark Brennan and Eric Bright. It has a yield of 2.7%.

- ii COP26 hub: see tips, news, comment and analysis from our experts

- ESG funds have outperformed over three and five years

- Top 10 most-popular investment funds: October 2021

Drilling down into the fund

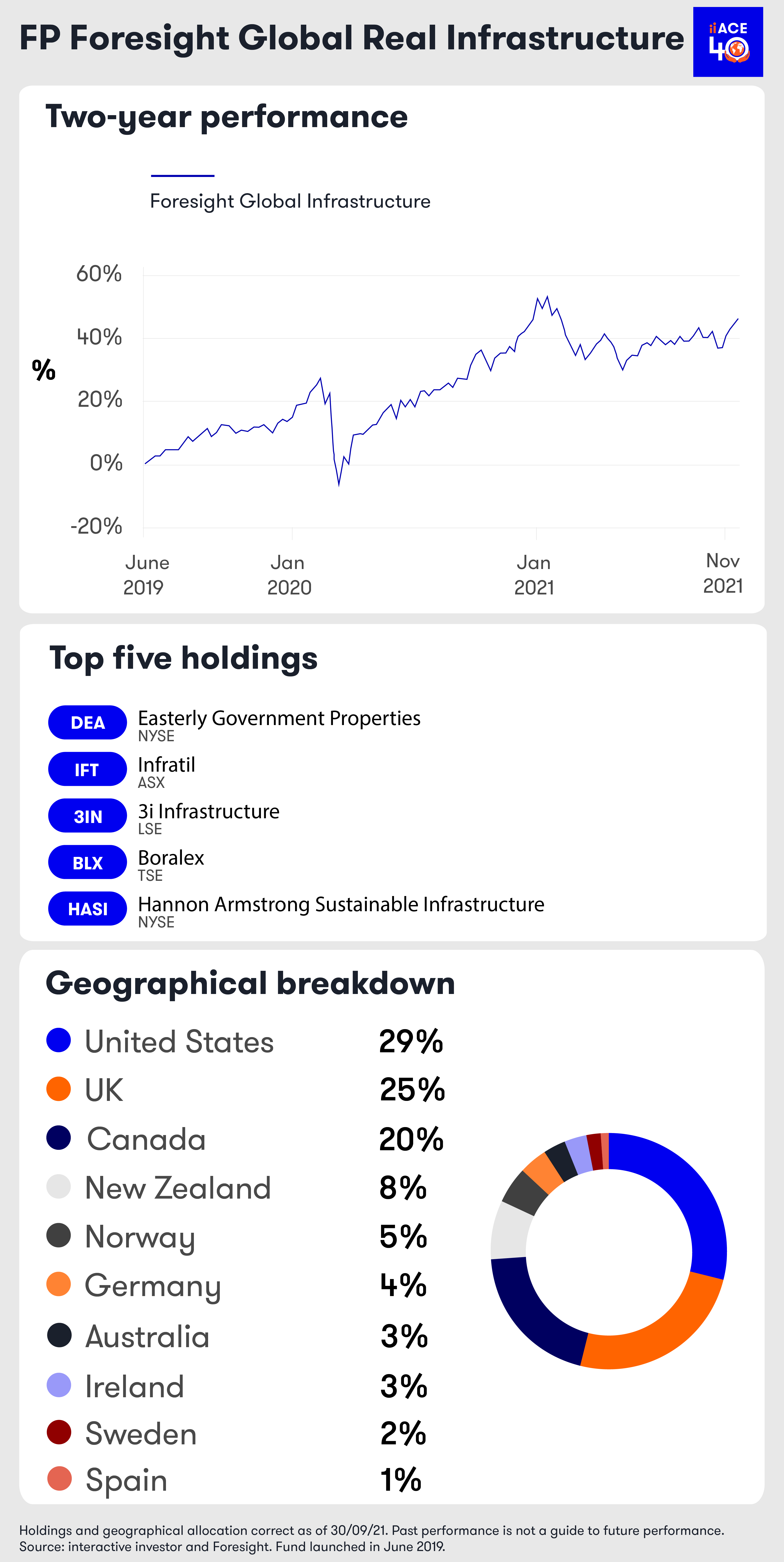

The fund aims to invest in 25 to 35 companies, currently there’s 31 holdings. The concentrated portfolio results in the companies having a meaningful impact on the performance. The fund has a private equity approach, with around two-thirds of assets in some type of investment vehicle including investment trusts and REITs.

The fund is highly exposed to North America with 35% in the US and 24% in Canada. In addition, 19% is held in the UK, and there are other smaller exposures to New Zealand, Norway and Spain.

The fund has around 45% of the portfolio invested in renewables, including energy generation and storage, as well as having exposure to hospitals, schools and bridges. The fund has a long-term investment horizon of more than 20 years.

Top holdings include Easterly Government Properties (NYSE:DEA), a US REIT, Infratil (ASX:IFT), a New Zealand-based infrastructure investment company, and Scatec, which is a Norwegian company specialising in renewable energy systems.

Around 70% of the underlying cash flows in the fund are linked to inflation, which is a big protection for the fund if inflation rises.

Performance

The fund has delivered strong performance since launch in 2019. Over two years to the end of September 2021 (the latest data available), the fund has outperformed its target of beating the UK Consumer Price Index (CPI) by 3% a year: 24% versus 9.9%.

The fund was hit hard by the Covid-19 market sell-off in the first three months of last year. However, it recovered relatively quickly in comparison to equity markets, as the underlying assets within the fund proved to be robust and required for the world, even during a pandemic.

| 01/10/2020 - 30/09/2021 | 01/10/2019 - 30/09/2020 | 01/10/2018 - 30/09/2019 | 01/10/2017 - 30/09/2018 | 01/10/2016 - 30/09/2017 | |

| FP Foresight Global Real Infrastructure A GBP Acc | 6.52 | 16.43 | — | — | — |

| UK CPI +3% | 6.17 | 3.55 | 4.76 | 5.49 | 6.05 |

| Morningstar sector: Equity Infrastructure | 14.70 | -8.52 | 15.92 | 0.94 | 8.11 |

Source: Morningstar. Data to 30 September 2021. Past performance is not a guide to future performance.

Why do we recommend it?

Foresight Global Real Infrastructure fund features on the ACE 40 as a specialist, core option. It also sits within the ACE ‘Embraces’ category, meaning the fund adopts a targeted or proactive approach to ethical investing in an effort to make a positive impact, which it does by only investing in companies that managers believe deliver a net social or environmental benefit and meet the principles of the UN Global Compact.

- Fund managers call for more action and fewer words on climate change

- Want to invest ethically? ii’s ACE 40 list of ethical investments can help

The fund is managed by highly experienced managers. It offers a unique, specialist exposure to real infrastructure assets and renewable energy, giving investors a way to gain exposure to support COP 26 initiatives. The fund has delivered strong performance since its launch and typically has low correlation to equities, as well as lower volatility than equities and alternatives.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.