Top 10 most-popular investment funds: October 2021

1st November 2021 15:40

by Nina Kelly from interactive investor

Surprises amid COP26 and a newcomer from a sector everyone is talking about.

In the run-up to the COP26 climate change summit in Glasgow, with the focus on cutting emissions and saving the planet, investor demand for commodities and natural resources funds surged, according to our monthly ranking of the most-bought funds on the interactive investor platform.

The TB Guinness Global Energy fund was October’s only newcomer and entered the top 10 in fifth place. The growth fund, which is predominantly invested in oil and gas, has delivered an eye-popping one-year return of 101%, leaving all other funds in our top 10 table in the shade.

- Invest with ii: Top Investment Funds | Index Tracker Funds | Sustainable Funds List

The specialist fund invests purely in companies in the energy sector, so it can be volatile. It has a concentrated portfolio, with 33 holdings currently, according to the 30 September factsheet. While the Guinness fund took a battering during global Covid-induced lockdowns when demand for oil and gas plummeted, it has recovered strongly since owing to post-pandemic energy demand. Holdings in its top 10 include Royal Dutch Shell (LSE:RDSB), BP (LSE:BP.), and Devon Energy (NYSE:DVN), and it has a heavy weighting to North America; US (33.9%) and Canada (15%). The fund has recently been bought by ii contributor Douglas Chadwick and is the subject of an article by him, which you can read here.

- Energy crisis: investor Q&A and share tips

- Bill Ackman: hot sectors and the economy in 2022

- Check out our award-winning stocks and shares ISA

The only ‘riser’ in the month of October was popular passive fundVanguard LifeStrategy 80% Equity, which moved into the coveted second spot, forcing ACE 40 ethical fund Baillie Gifford Positive Changeinto third place. Two other Vanguard LifeStrategy funds, the 60% and 100%, equity options held on to their places, in fourth and seventh place, respectively.

The slight slip in popularity for Baillie Gifford Positive Change is perhaps surprising given the backdrop of the COP26 summit and the “one minute to midnight” warning made by UK prime minister Boris Johnson. The only other Baillie Gifford fund in the top 10 was Baillie Gifford American, which would have received a boost from its top 10 holding Tesla (NASDAQ:TSLA), which in October became the first car maker to be valued at more than $1 trillion.

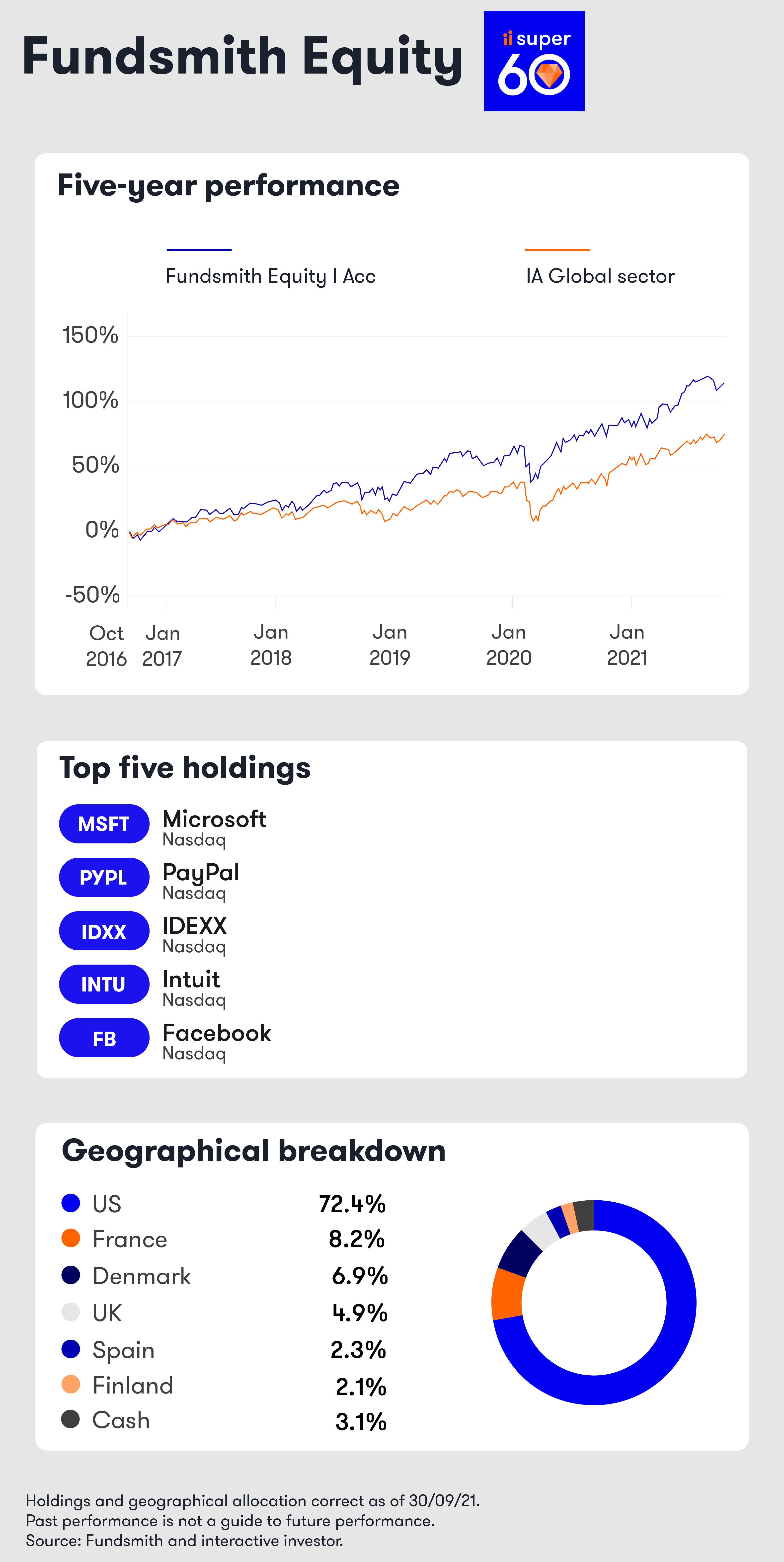

Also in October, interactive investor published its quarterly Private Investor Performance Index, which provides unique insights into customer portfolios. Terry Smith’s Fundsmith Equityis one of a handful of investments that has universal appeal among all age ranges. On a short-term view, Fundsmith Equity’s performance of late has been a little lacklustre because of its focus on growth shares amid the rotation to value, but investors remain loyal.

L&G Global Technology Index slid three places to eighth. It has been a mixed picture for big tech this US earnings season, with Microsoft (NASDAQ:MSFT) eclipsing Apple as the world’s most valuable company. Some of Apple (NASDAQ:AAPL)’s figures disappointed analysts, while tech shares are under pressure from the prospect of rising interest rates and global supply chain woes. Passive fund Vanguard US Equity Index, which also has a big exposure to tech, held on to its spot in ninth place.

- Don’t be shy, ask ii…how do I achieve geographical diversification?

- Subscribe for free to the ii YouTube channel for our latest interviews

Finally, Rathbone Global Opportunitiesfell two places. Among its 10 largest holdings are US computer chip-maker NVIDIA (NASDAQ:NVDA), financial software provider Intuit (NASDAQ:INTU), and US retailer Costco (NASDAQ:COST). In their quarterly update, published in September, fund managers James Thomson and Sammy Dow said: “Our technology exposure is still an important part of our growth portfolio, but we have reduced it from 29% to 20% this year to create the space for the industrials, consumer stocks, banks and medical technology names that we’ve been buying. We’ve done this as we’ve sought to build and maintain an appropriate balance between the tug-of-war between reopening and long-duration growth that will whipsaw markets.”

The fund that exited the top 10 in October was FSSA Japan Focus.

Top 10 most-popular investment funds: October 2021

| Rank | Fund | IA sector | Ranking change since previous month | 1-year return to 1 Nov (%) | 3-year return to 1 Nov (%) |

| 1 | Fundsmith Equity | Global | No change | 23.9 | 67 |

| 2 | Vanguard LifeStrategy 80% Equity | Mixed investment 40%-85% shares | Up one | 22.5 | 39.1 |

| 3 | Baillie Gifford Positive Change | Global | Down one | 37.8 | 164.9 |

| 4 | Vanguard LifeStrategy 60% Equity | Mixed investment 40%-85% shares | No change | 15.9 | 32.3 |

| 5 | TB Guinness Global Energy | Commodities and Natural Resources | New entry | 101.8 | -7.87 |

| 6 | Baillie Gifford American | North America | No change | 26.9 | 190.1 |

| 7 | Vanguard LifeStrategy 100% Equity | Global | No change | 29.2 | 45.7 |

| 8 | L&G Global Technology Index | Technology & Telecommunications | Down three | 36.3 | 127.4 |

| 9 | Vanguard US Equity Index | North America | No change | 33.2 | 70.7 |

| 10 | Rathbone Global Opportunities | Global | Down two | 24.6 | 80.9 |

Source: interactive investor. Note: the top 10 is based on the number of “buys” during the month of October.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.