Fund spotlight: Jupiter Strategic Bond

6th December 2021 08:46

by Dzmitry Lipski from interactive investor

Our head of funds research offers a view on one of our Super 60 fund picks.

As we move into an environment where the central banks may start to raise interest rates in response to rising inflation expectations, investors are concerned that this could cause bond prices to fall and yields to rise.

Therefore, now more than ever, investors need to look beyond traditional ‘safe’ bonds and adopt a more flexible approach to address rising interest rates and inflation concerns. As such, strategic bond funds may be best placed to navigate the current environment.

What is it?

Jupiter Strategic Bond fund aims to provide income with the prospect of capital growth to provide a return higher than the Investment Association (IA) Sterling Strategic Bond sector average over the long term (at least five years), through investing in global bonds denominated in sterling or hedged back to sterling.

The fund is managed by the highly experienced Ariel Bezalel, head of fixed-income strategy at Jupiter, since its inception in June 2008, alongside Harry Richards, who has been a manager on the fund since 2019 and joined the firm in 2011. The pair are further supported by the wider, well-resourced fixed income team at Jupiter.

- Bond fund manager sounds alarm over central bank rate rise risk

- How fund investors can protect and profit from higher interest rates

This is a ‘go anywhere,’ high-conviction fund, meaning the managers are able to seek out the best opportunities within the fixed-interest universe on a global basis while carefully managing downside risk. The team adopts macroeconomic investing and dynamic asset allocation by focusing on asset allocation, security selection and duration management.

Bonds are picked based on the managers’ view of the global economy, assessing how much risk is appropriate to take, and which sectors and countries offer the best opportunities, considering factors such as inflation, interest rates and economic growth. The managers also integrate analysis of environmental, social and governance (ESG) considerations into their investment process.

What does it invest in?

Jupiter Strategic Bond fund has the freedom to invest across the globe as well as within a range of fixed-income securities including high-yield bonds, investment-grade bonds, government bonds and convertibles.

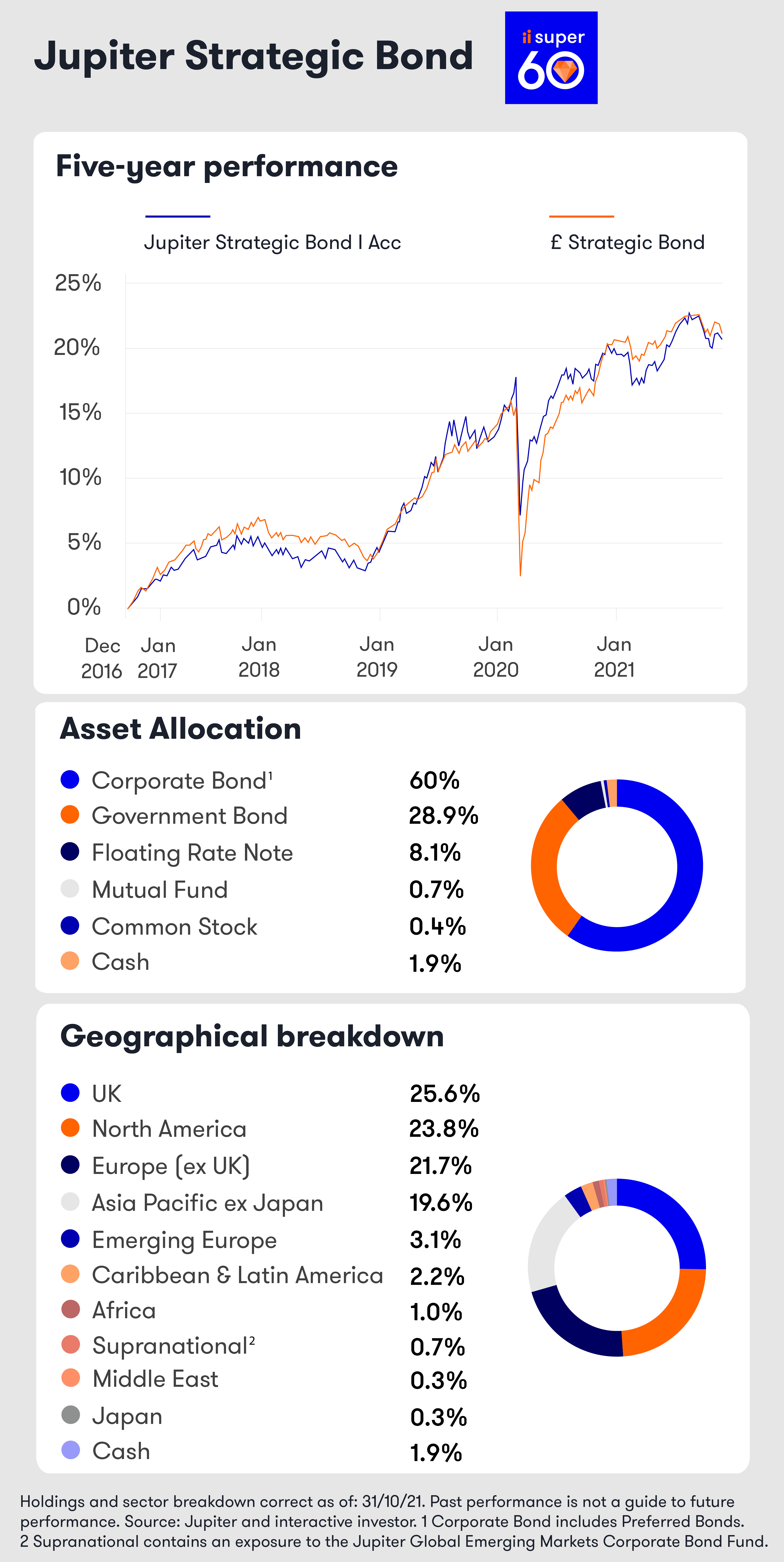

In terms of bond exposure, the portfolio is mainly made up of corporate bonds at 60% of the portfolio, this is followed by government bonds at around 30%, the floating rate notes at 8%, with an average credit rating of BBB-. They may also use derivatives to protect the strategy in a declining bond prices environment. The fund is around one quarter invested in the UK and around one quarter invested in North America. Other top geographical exposures include Europe ex UK and Asia-Pacific ex Japan.

How has it performed?

The fund has been performing in line with its objective. The experienced investment team have successfully manoeuvred through all market conditions, taking full advantage of the fund’s flexible mandate regarding sector allocation and security selection.

The fund has performed well over the longer term, outperforming the IA Sterling Strategic Bond peer group average over 10 years. Over the tough year of 2020, and in 2021, the fund performed roughly in line with its peer group average. It successfully protected capital, producing a positive return in both years.

The fund currently yields around 3.5% and distributes income quarterly.

| Fund/Index/Sector | 01/12/2020 - 30/11/2021 | 01/12/2019 - 30/11/2020 | 01/12/2018 - 30/11/2019 | 01/12/2017 - 30/11/2018 | 01/12/2016 - 30/11/2017 |

| Jupiter Strategic Bond Fund | 1.14 | 5.02 | 10.53 | -2.15 | 5.35 |

| Bloomberg Global Aggregate TR Hdg GBP | -0.83 | 4.35 | 8.16 | -1.05 | 2.01 |

| IA £ Strategic Bond Sector | 1.71 | 5.58 | 8.81 | -2.02 | 6.06 |

Source: Morningstar

- Trading secrets: how fund managers beat the market

- Hidden gems: 12 funds and trusts that deserve the limelight

- Falling funds: when should investors cut their losses?

Why do we recommend it?

Jupiter Strategic Bond fund features on the Super 60 as a Sterling Bond, Core recommendation. It is managed by a highly experienced managers, who have the flexibility to invest across the bond market, rather than being restricted by type of bond or region.

The fund has shown strong performance and resilience over the long term and provides an attractive yield. Given the fund’s flexibility and focus on downside protection, this makes it a strong core option for investors within a well-diversified portfolio.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.