Fund spotlight: Mobius Investment Trust

interactive investor’s analysts share an update and offer a view on one of our Super 60 fund picks.

12th October 2020 13:58

by Teodor Dilov from interactive investor

interactive investor’s analysts share an update and offer a view on one of our Super 60 fund picks.

The Super 60 fund

Listen or read about our Super 60 fund, it’s your choice

Mobius Investment Trust (LSE:MMIT) is a specialist strategy designed to provide exposure to both emerging-market smaller companies and frontier markets. It is run by the highly regarded managers Mark Mobius and Carlos von Hardenberg, who have long and very successful track records of running similar emerging-market mandates.

The trust has a well-defined investment process and typically holds companies for five years-plus. The team seek to identify resilient business models that are mispriced by the market.

In addition, the trust differentiates itself from the majority of rival trusts by incorporating environmental, social and governance (ESG) criteria into their investment philosophy. The trust, through a corporate governance approach, looks to team up with businesses that are open to positive change. In theory, by making ESG improvements, firms will improve their operational and financial performance.

What does it invest in?

The team runs a highly concentrated portfolio of around 25 to 30 stocks, which are selected on the basis of their individual merits and after passing through the rigorous assessment of more than 40 proprietary metrics, as well as qualitative checks via meetings with company management.

The trust pays no attention to a particular index or benchmark and as a result it has very high active share of 98%, however, it is unlikely for a single country allocation to exceed 35% of the overall portfolio. Individual stocks could have a weighting of up to 10% and usually have a market capitalisation of $2 billion to $4 billion.

Currently, the trust’s top three sector exposures are Technology (circa 29%), Consumer Discretionary (c.19%) and Healthcare (c.18%). Meanwhile, on a geographical level the managers tend to find most opportunities in India (c.21%), Brazil (c.16%) and China (c.15%). Within the top 10 holdings, which represent around 57% of the entire portfolio, are companies such as the semiconductor IP provider eMemory Technology, steel tube manufacturer Apollo Tubes and the Russian internet company mail.ru.

Performance

Although the trust was launched two years ago, its managers have a long track record of delivering above-market returns from running similar emerging market portfolios. Since its inception on 1 October 2018, Mobuis Investment Trust has delivered a total return of 8.2% compared to 1.5% for the MSCI Emerging Markets Small Cap Index (as at 1 October 2020).

Looking at the managers’ previous track records, for example, Mark Mobius, the industry veteran who used to manage the Templeton Emerging Markets Smaller Companies fund, achieved a total return of 338% compared to 234% for the MSCI Emerging Market Small Cap index between March 2009 and March 2017.

The trust’s discount is currently trading above 10% at the time of writing owing to a current lack of investor demand for emerging-market trusts due to the challenging economic backdrop as a result of Covid-19. But, for longer-term investors with an appetite for risk, this is arguably an attractive entry point. Despite having the option, the managers do not employ gearing.

Investment growth

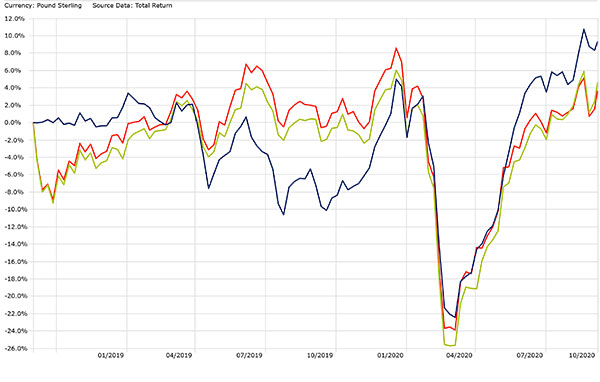

2 October 2018 to 7 October 2020

Mobius Investment Trust (blue), 9.3%

IShares MSCI Emerging Markets Small Cap ETF (green), 4.7%

MSCI Emerging Markets SMID NR USD (red), 3.7%

Source: Morningstar Direct

The ii view

Mobius Investment Trust provides exposure to exciting high-growth opportunities in the emerging and frontier markets space. Along with the potential for market-beating returns over the long term, the strategy also offers diversification benefits. However, investors should be aware that this trust is a high risk due to its smaller company bias and its return profile could deviate from the broader market. Therefore, it is best utilised as a satellite holding to complement core holdings in a diversified portfolio.

If you enjoyed this article, you may also like other funds picked for interactive investor's Super 60 range of high-conviction investment ideas. Click here to find out more.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.