Fund spotlight: Montanaro Better World

An interactive investor analyst offers a view on one of our ACE 40 fund picks.

30th November 2020 13:41

by Liberty Godfrey from interactive investor

An interactive investor analyst offers a view on one of our ACE 40 fund picks.

The ACE 40 fund

Listen or read about our ACE 40 fund, it’s your choice.

Extract taken from the latest Funds Fan podcast

Montanaro Better World aims to tackle some of the world’s major problems through investing in small and mid-cap high-quality companies that make a positive impact on society, and that show sound ESG (environmental, social and governance) practices.

The fund is managed by the highly experienced manager and industry veteran Charles Montanaro whose company has become a recognised specialist in the small-cap space. He also has the support of co-manager Mark Rogers and the wider team at Montanaro Asset Management.

The team focuses on growing companies that are profitable and have strong business models. Using a variety of screening tools, the managers filter their investable universe to around 200 potential candidates.

- Want to invest ethically? ii’s ACE 40 list of ethical investments can help

- interactive investor ethical list becomes ACE 40

What does it invest in?

The fund has a rather concentrated portfolio of around 50 stocks, but its global approach provides diversified revenue streams and themes.

Its largest allocation is to the US (43%), where the managers find most of their investment opportunities. Other exposures include Japan (8%), Australia (6%) and the UK (6%). On a sector level, the fund’s top allocations include healthcare (37%), information technology (28%) and industrials (16%). All figures are to the end of October.

Among its top holdings are SolarEdge (NASDAQ:SEDG), a provider of power optimiser, solar inverter and monitoring systems (4.1% weighting), Veeva (NYSE:VEEV), a life sciences cloud computing company (2.9%), and Kingspan (LSE:KGP), a building materials company (2.6%).

Why we like this fund’s ethical approach

Montanaro Better World sits within the ‘Embraces’ ACE Category, meaning the fund adopts a targeted approach to ethical investing in its aim to make a positive impact. The team follows six impact themes: environmental protection, green economy, healthcare, innovative technology, nutrition and well-being, each of which support the United Nations’ Sustainable Development Goals. In 2015, the UN set 17 goals seeking to address the world’s biggest challenges and all countries are aiming to achieve them by 2030.

The fund actively excludes companies with material revenue exposure in areas such as: the manufacturing or supply of weapons, tobacco, gambling, adult entertainment, alcohol, and oil and coal (exploration and production).

Performance

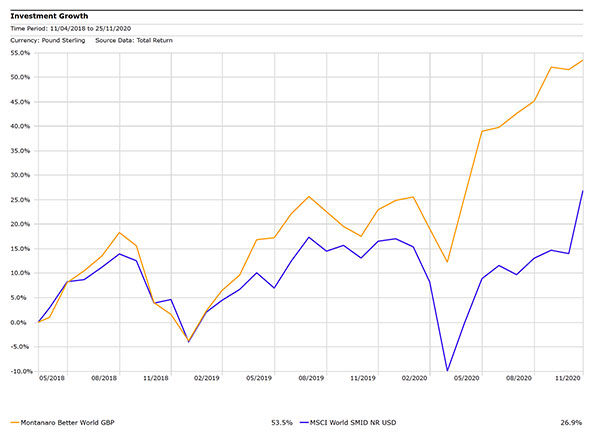

Since the fund launched in April 2018, it has delivered strong performance in excess of its MSCI World SMID benchmark. The fund has returned 53.5% versus 26.9% for the benchmark, to 25 November 2020.

The fund has seen large inflows so far this year of more than £157 million, resulting in the fund size reaching nearly £550 million.

Source: Morningstar

Why we recommend it?

Montanaro Better World is included on the ACE 40 as a global equities, smaller company option.

The fund is managed by a highly experienced manger within a specialist firm in the small- and medium-sized company space, renowned for its large team of analysts and high-quality small-cap research and follows an investment process that Montanaro Asset Management have been guided by long before the launch of the fund in 2018.

Along with its strong investment process within a global mandate and aim to make an impact over the long term, the fund offers access to some exciting and meaningful companies. As the portfolio may look very different from its peers and performance could substantially deviate from its benchmark, the fund is likely to appeal to investors with a longer investment horizon and high-risk tolerance in seeking sustainable growth.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.