Future looks bright for these American banks

With the Federal Reserve in rate-cutting mode, our overseas investing expert still likes these lenders.

25th September 2019 10:43

by Rodney Hobson from interactive investor

With the Federal Reserve in rate-cutting mode, our overseas investing expert still likes these lenders.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It's hard to stand up to Donald Trump when he is at his most bombastic, and even the Federal Reserve Board has succumbed to his rhetoric and reduced interest rates despite the lack of any economic reason for doing so.

Low interest rates are generally seen as bad for bank profits, but there is no reason for investors to avoid shares of well capitalised companies in the sector at this stage.

Third-quarter banking results out next month should be positive and may propel shares higher.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Buy International Shares

The quarter-point interest rate reduction from an already low level on 18 September was not prompted by fears of recession. On the contrary, growth in the US continues to be robust, certainly in comparison with Japan, where more than a decade of growth has been lost, or Europe, where even the powerhouse of Germany is in danger of stagnating.

Nor is there a real fear of deflation. Trump's tax reforms have pumped billions of dollars into the economy and near full employment will continue to underpin wage rates. In fact, inflation has picked up modestly of late, with core consumer prices after stripping out volatile energy and food prices edging up to 2.4% compared with 1.7% a year ago.

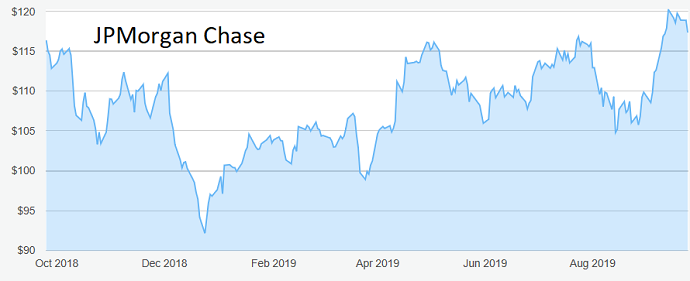

Source: interactive investor Past performance is not a guide to future performance

President Trump has over the past few months demanded that the Fed, which is supposedly independent and free to act on economic considerations alone, should reduce interest rates to zero, or even into negative territory as has happened in Japan and some European countries. Ex-Fed chairman Alan Greenspan thinks it will happen soon.

The economic figures suggest he is wrong unless Trump forces the policy on the current Fed committee. It seems unlikely that they will succumb to the humiliation of bending to his will to that extent.

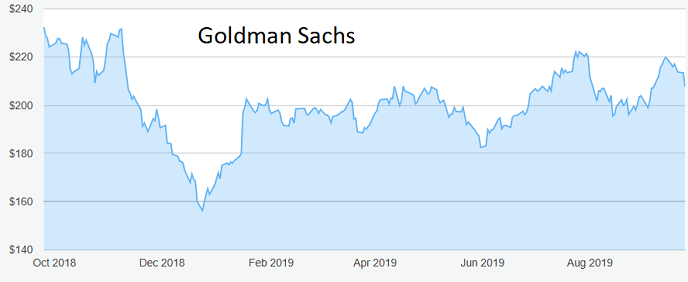

Source: interactive investor Past performance is not a guide to future performance

The future therefore looks bright for the main American banks, which are in much better shape to meet any future crisis than they were 10 years ago. All have passed the stress tests imposed to prevent a repeat and the most recent results, for the second quarter, generally beat analysts' expectations.

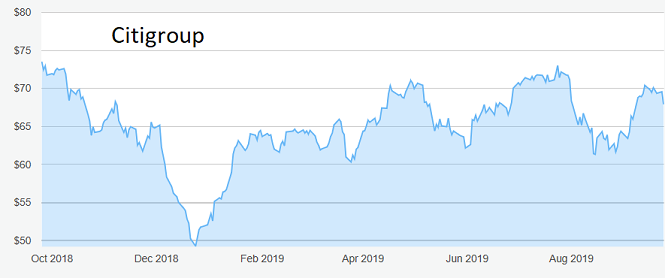

Rather encouragingly, they all seemed to have a different success story to tell, indicating that various aspects of the US economy are ripe for exploitation. JPMorgan Chase (NYSE:JPM), pointed to higher net interest income; Goldman Sachs Group (NYSE:GS) saw an increase in revenue from equities trading; Citigroup (NYSE:C) was helped by stronger consumer lending.

Source: interactive investor Past performance is not a guide to future performance

As always, investors should bear in mind possible negatives. Morgan boss Jamie Dimon is worried about business sentiment while trade tensions with China persist, although he is generally optimistic about the creation of jobs and rising wages in the US.

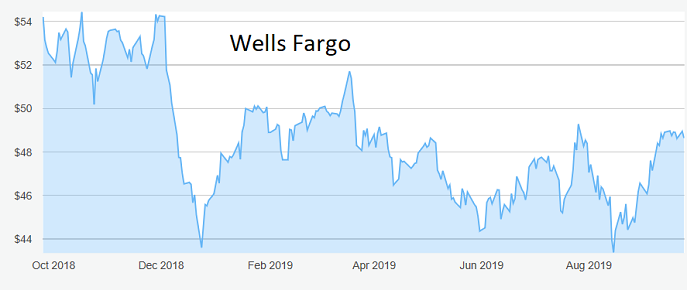

More serious was a warning from Wells Fargo (NYSE:WFC) that the outlook for cost cuts was more cautious, although even here there were higher earnings to offset this concern.

Source: interactive investor Past performance is not a guide to future performance

Banks have generally underperformed the general stock market, so there is some scope for them to play catch-up after generally moving sideways over the past two years.

While lower interest rates mean margins between borrowing and lending rates are squeezed, they are also good for shares generally and will keep the strong US economy rolling, so the bull market should have longer to run. Cyclical stocks such as banks still have their appeal.

Source: interactive investor Past performance is not a guide to future performance

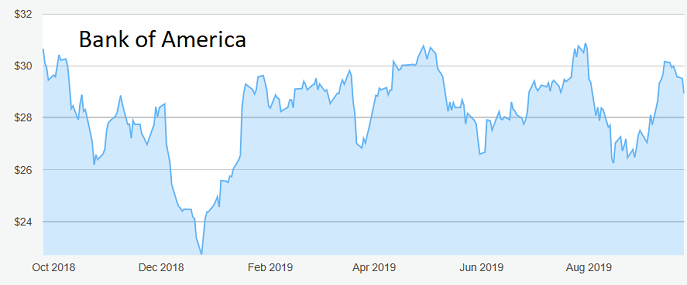

Hobson's Choice: Wells Fargo looks good at up to $50 with the yield currently near 4%, and that advice also applies to Bank of America (NYSE:BAC), although the yield is less tempting at just over 2%. It could be good tactics to wait to see if the opportunity recurs to buy JPMorgan Chase below $115, when the yield will be nearly 3%. Citigroup, with a yield around 2.7%, is worth considering below $70.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.