Geopolitics could generate big profits for investors this year

4th January 2019 10:37

by Ceri Jones from interactive investor

Conflict is likely to trigger asset price dips that some investors will relish as opportunities to buy, writes Ceri Jones.

It would be easy to imagine that the US/China trade war and the US Federal Reserve's resolve to tighten monetary policy, which have been the two big fears hanging over the US stockmarket throughout 2018, are reaching some sort of stasis. The market certainly rejoiced when Fed chairman Jay Powell made the dovish comment that interest rates are "just below" the range of rates considered neutral. The Dow Jones Industrial Average index shot up by 600 points in one session, its best single-day gain since March.

The market believes Donald Trump is minded to negotiate with his Chinese counterpart president Xi Jinping, which would take the sting out of the trade conflict. Trump is highly conscious of his reputation and has been surprised by public opposition to his tariffs. In the most recent Gallup poll, two-thirds of respondents said his trade offensive against China is hurting the economy rather than helping it. The market has priced in an expectation that the US will increase tariffs on Chinese goods to 25% in January, so any retreat from that will be positive for stocks.

However, while the market's immediate interpretation of Powell's speech was that the Fed will hold back on rate rises and slow its quantitative tightening, the announcement confused investors and reintroduced uncertainty about future Fed policy not seen for years. The Fed’s obvious lack of conviction regarding the health of the US economy marks a real change in sentiment. Previously, much was made of the rise in US wage growth and how it reflected the lowest unemployment levels since 1969, so the consensus was that the Fed would require a substantial market fall of perhaps 10% or more before it would stop hiking US interest rates.

Interest rates are still only at 2.25%, but US household debt is higher than it was before the 2007/08 financial crisis. For example, mortgage debt stands at $13.45 trillion (£10.5 trillion) and student loans are at $1.6 trillion, so millions of US citizens will feel the pain if rates rise to what could rather quaintly be called historically normal levels, quickly putting the dampeners on consumer spending.

In navigating the tariff saga, Trump is negotiating with a different beast from the transparently self-interested businessmen he has been accustomed to dealing with. President Xi Jinping is very proud and has been steadily tightening his grip on the Chinese state. His propaganda machine is at full tilt. There is even a state-run TV show called Xi Jinping game show: How well do you know China's leader?

Adding to the uncertainty are president Vladimir Putin's belligerence towards Ukraine, the Brexit debacle and the vexed Italian budget discussions, so there is a lot to worry nervous investors.

However, it is at a time like this – when suddenly everything that had seemed clear suddenly becomes opaque – that buying opportunities often present themselves. We’ve already seen greater volatility and a shift to defensive value stocks. Sectors such as healthcare and consumer staples have benefited from trouble in the tech sector, where stocks such as Facebook, Netflix and Baidu are down by more than 40%.

I'm not advocating buying US stocks, which remain on high valuations. However, emerging market stocks have been brutally sold down and UK stocks, which have taken the full brunt of Brexit, could recover over the next year or so.

Prime time for UK play

Let's consider the situation in the UK, where newspaper headlines have been full of horrifying Brexit warnings, while politicians and City hotshots have vented their fears. First we had environment secretary Michael Gove admitting that there might be a shortage of the chemicals we need to treat water if the UK leaves the EU without a deal. Our water industry is reliant on chemicals imported from the EU.

Then Bank of England governor Mark Carney piled in, warning that businesses are not ready for a no-deal outcome and that in a worst case scenario the economy would shrink by 8%, the pound sink, unemployment and interest rates soar and an Englishman’s castle lose a third of its value.

Meanwhile, the prospect of a tax-raising Labour prime minister moving into Number 10 is becoming imaginable. At the moment, Jeremy Corbyn is determined to hold out against backing a second referendum and wait until Theresa May's deal is rejected by MPs, an outcome that looks increasingly likely. Labour will then table a motion of no-confidence in the government in the hope of triggering a general election.

This hideous muddle has pushed price/earnings ratios on UK stocks down to about 12 times, and the likelihood is that things will get a lot worse before they get better. However, this will present investors with opportunities to buy stocks in some quite deep market dips. Investors could certainly do worse than buy some sound dividend-paying stocks, as UK dividend yields are averaging just over 4% – especially given the growth potential they offer.

And, at the start of the new year, many investors will also be thinking about investment themes for the medium term. Hardly a week goes by without another incident involving cybersecurity hitting the headlines. British Airways and Ticketmaster were just two high-profile companies successfully targeted by hackers in 2018.

Kenneth Lamont, an analyst at Morningstar, suggests playing this theme via the iShares Digital Security ETF which invests in about 100 firms in the global cybersecurity market – it has an ongoing charge of just 0.4%. iShares uses data provider Stoxx to select firms based on the revenue they generate from digital security activities.

The fund gives equal weighting to global heavyweights such as Cisco Systems and smaller players such as the FTSE 250-listed security software specialist Sophos Group. This gives the fund a pronounced and counter-cyclical mid- and small-cap growth tilt.

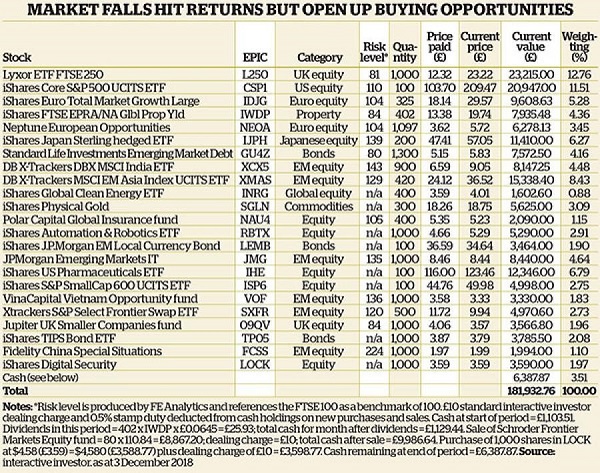

Cash for the purchase has been raised by taking profits from our holding in the Schroder Frontier Markets Equity fund, where progress is too slow for this portfolio.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.