Goldman doesn’t see an AI bubble, but the pattern does look…familiar

The boom’s been backed by real profits and record earnings, so far. But with a few worrying patterns developing, you may want to start watching the cracks – not just the charts.

24th October 2025 09:21

- Today’s AI-driven tech rally isn’t a rerun of the dot-com era. This boom’s buzziest names are delivering real earnings, funding growth with cash, and trading at valuations that are high but defensible

- The big risk lies in concentration and execution. A few giants dominate global markets and are spending heavily on AI infrastructure – if those returns disappoint, their valuations could cool fast

- The best AI opportunities may lie beyond Big Tech. The $7 trillion (£5.3 trillion) data centre build-out is creating long-term tailwinds for energy, industrial, and construction players.

I’ve been watching the AI boom this year with excitement – and a bit of trepidation. Every other headline seems to shout about another multibillion-dollar deal, and tech’s heavyweights keep swelling. So yeah, bubble talk is back.

Now, Goldman Sachs says we’re not there yet – and the rally’s still rooted in fundamentals. But a few things have me raising an eyebrow – like vendor financing. NVIDIA and others are financially fronting their own customers (ahem, OpenAI) while selling them chips. And that kind of loop looks powerful…right up until it starts collapsing.

Let’s be clear: I’m not hitting the panic button. But I do see the cracks forming, and in a market this pumped, they’re worth watching.

Bubbles: the pattern that keeps repeating

Before looking at today’s market, it helps to understand the typical rhythm of financial bubbles – the sequence that plays out again and again whenever innovation meets easy capital.

It generally starts with a breakthrough. A new technology or structural shift captures attention and alters everyone’s expectations for the future. Then, investment pours in. Valuations climb faster than the underlying cash flows that can justify them. And eventually, optimism hardens into overconfidence, and when reality catches up, prices reset.

That’s been the arc for every tech bubble: innovation, acceleration, euphoria, correction.

AI appears to be in the early stages of that curve. Like the internet in the 1990s, it represents a genuine technological revolution. And just like back then, no one knows how big the market will eventually be, how long it will take to scale, or who will emerge as winners. Investors are effectively buying options on dozens of names, and when the excitement compounds, the value of the whole can start to outrun the actual economics underneath.

And in that light, the AI rally is more nuanced than “bubble or not”. The heavyweights that survive corrections often emerge stronger. That’s how Amazon.com Inc (NASDAQ:AMZN) and Google (Alphabet Inc Class A (NASDAQ:GOOGL)) came out of the dot-com crash a quarter-century ago – by consolidating power and turning early speculation into durable business models. The question now is which AI titans will do the same when this cycle inevitably cools.

Tech’s rise, and the fundamentals

The rally so far has not required a blind leap of faith: it’s been solidly backed by earnings power and financial strength.

The major players – Microsoft Corp (NASDAQ:MSFT), Apple Inc (NASDAQ:AAPL), NVIDIA Corp (NASDAQ:NVDA), Alphabet – sit at the very core of the modern economy: cloud computing, chipmaking, and digital platforms. They generate huge piles of cash and have generally used it to reinvest, defend their territory, and scale. What’s more, their growth is self-funded and disciplined, supported by consistent profitability, rather than debt.

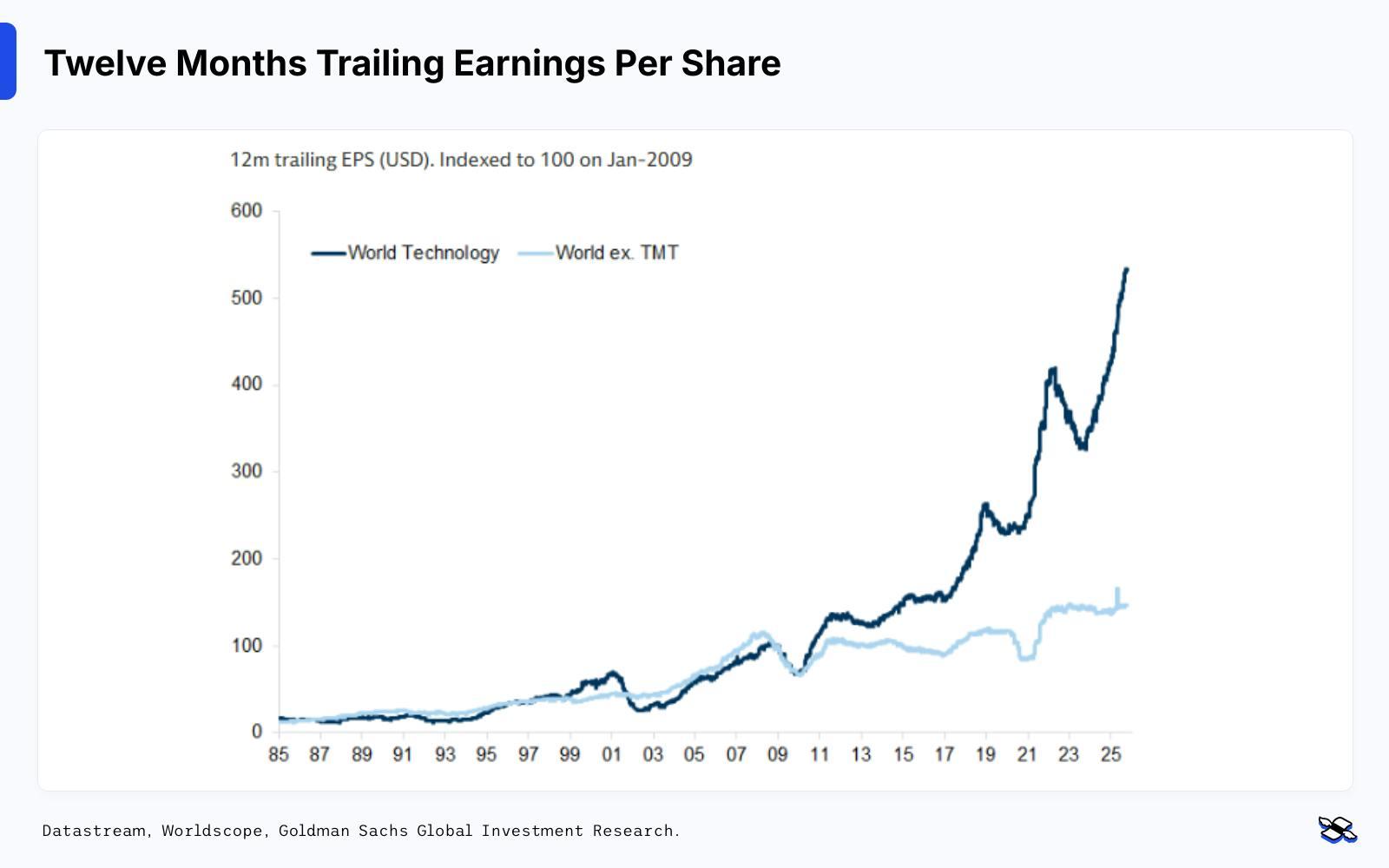

And, as Goldman points out, tech-sector earnings per share have accelerated since the 2008-09 financial crisis, driven by real operating leverage.

Tech earnings (dark blue) have outstripped those of the global market (light blue). *TMT=Technology, Media, and Telecommunications. Sources: Datastream, Worldscope, Goldman Sachs Global Investment Research.

In other words, Big Tech’s balance sheets are healthy. And, let’s be clear, that’s a critical distinction. In past bubbles, the promises came first, and in many cases, the earnings never arrived.

This time around, there are already profits, and plenty of investors are taking that as a sign that the rally has substance. But that doesn’t mean prices will rise forever.

And that brings us to valuation…

Valuations, and where they stand now

It’s one thing for companies to deliver on growth; it’s another for investors to pay the right price for that growth. This is where the rubber meets the road – because even great businesses can be overvalued.

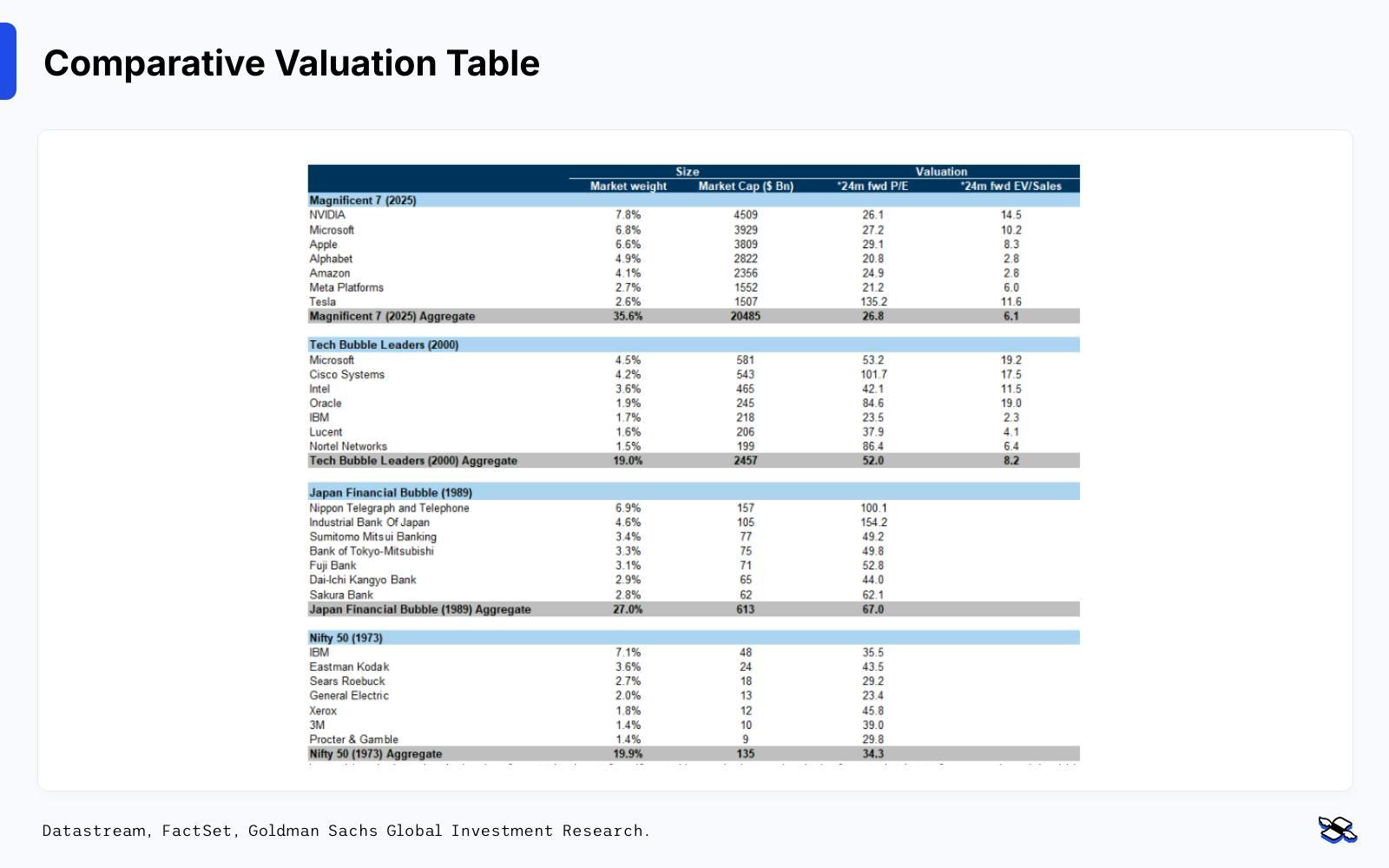

It’s true: tech stocks are expensive. But they’re not wildly out of line with history. Goldman’s analysis shows that the Magnificent Seven are trading around 27x forward earnings. That’s high, but it’s nowhere near dot-com territory, where similar stocks hit 50x earnings and, in some cases, just kept rising. Consider today’s price-to-earnings-growth ratios and return on equity, and the story becomes even clearer: stock prices are high, yeah, but they’re supported by growth and profitability.

The dividend discount model is another important gauge. Right now, it suggests the market is pricing in about 8% nominal growth over the long term. That’s not low, but it’s also not outrageous. During the tech bubble, that figure shot above 10%. What we’re seeing today is more restrained – though I’ll admit, there’s not a lot of room for error.

Today’s dominant companies aren’t as expensive as those in previous “bubble” periods. *Actual last twelve months (LTM) price-to earnings (P/E) and enterprise-value-to-sales (EV/sales) data from January 2nd, 1973, for the Nifty 50. **LTM P/E data and EV/sales from December 12th, 1989, for the Japan financial bubble. ***24m forward P/E and EV/sales data from March 24th, 2000, for the dot-com bubble. Sources: Datastream, FactSet, Goldman Sachs Global Investment Research.

Bubble or no bubble, expectations are certainly high. And in markets, when expectations are this high, even small disappointments can have an outsized, downward impact.

And the other risks

Valuations aren’t the only warning signal – it’s just the first one most people consider.

But equally concerning is the market’s concentration risk. Just a handful of mega-companies have been doing most of the heavy lifting – and investing huge sums to stay ahead. The 10 biggest US stocks now make up almost a quarter of the global stock market. That’s tricky, to say the least. When market leadership is this narrow, any stumble from the top can ripple across everything else.

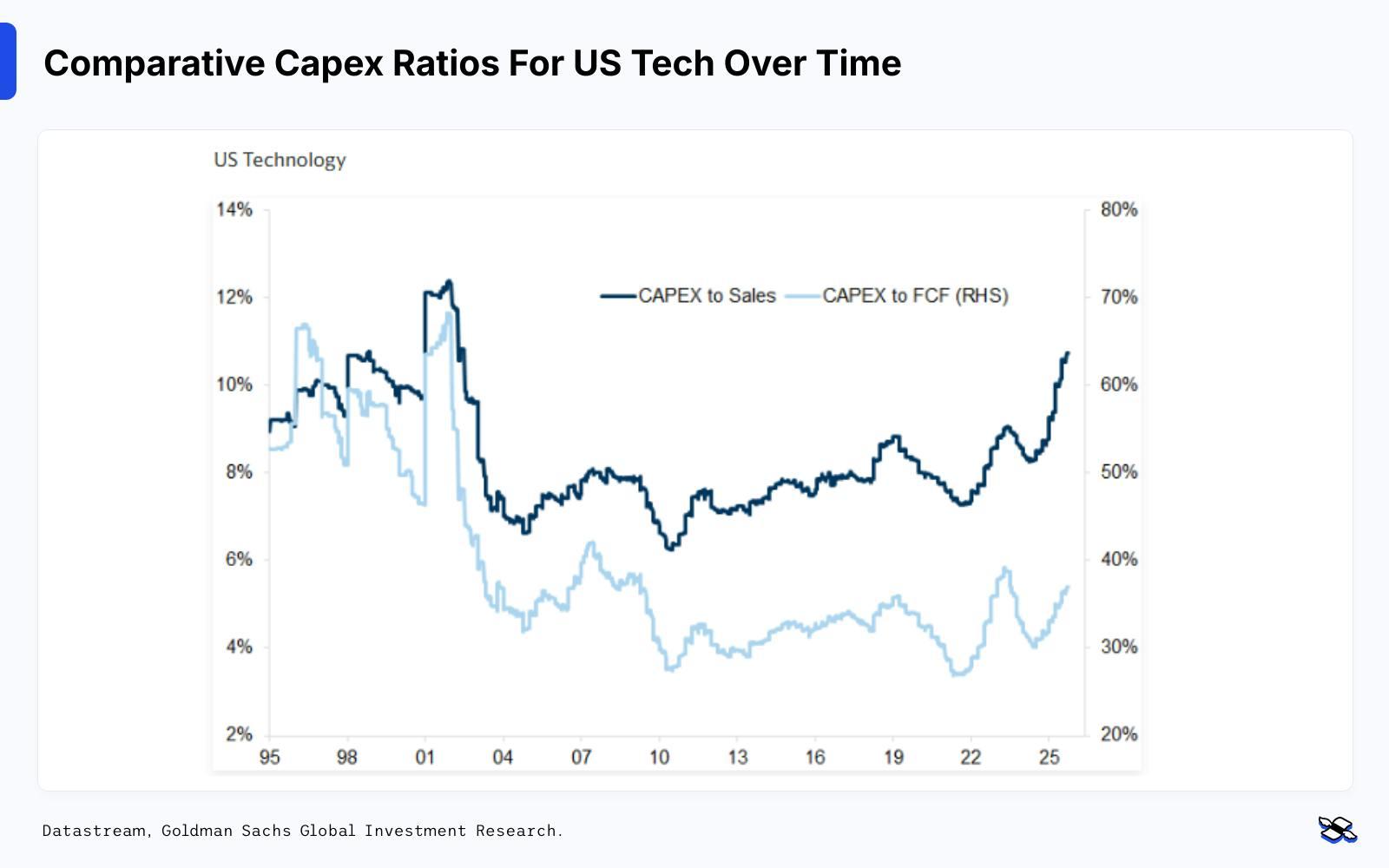

There’s also been a massive jump in spending since generative AI first burst onto the scene. Meta Platforms Inc Class A (NASDAQ:META), Microsoft, Amazon – they’re all pouring billions into the technology’s infrastructure to keep up with demand. And, yeah, the capex-to-sales ratio for US tech has rocketed, the capex-to-free-cash-flow ratio has held steady – going nowhere near the spending extremes of the late ’90s. And although most of the company outlays have been funded with cash (not debt), Goldman points out there’s been a pickup in vendor financing and bond issuance, especially around data centers. So those numbers might not be quite as pristine as they seem.

But the real risk isn’t leverage – it’s returns. If these vast investments don’t pay off as quickly as markets expect, valuations could swiftly compress.

Capex-to-sales ratios have risen for US tech – but they’re still relatively low compared to capex-to-free-cash-flow. Sources: Datastream, Goldman Sachs Global Investment Research.

That said, the result is unlikely to be catastrophic – at least, for Big Tech. Most of the mega-companies have strong enough balance sheets to absorb the pressure of a broad stock valuation rethink.

Zoom out a bit, and the bigger picture is unusually balanced. Unlike past bubbles, today’s AI-driven surge is building tangible assets – data centers, power networks, logistics systems – that could lift productivity across entire industries. And the opportunity set is broadening: stock markets in Europe and Asia have kept pace with the US this year, and rising demand for electricity, equipment, and construction means the beneficiaries of the latest innovation wave aren’t just software firms.

For investors, the opportunities may be hiding in plain sight: the “picks and shovels” of the $7 trillion data-center buildout.

Theodora Lee Jospeh is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.