Goodwin: Jam yesterday and more jam tomorrow

14th September 2018 15:55

by Richard Beddard from interactive investor

Poised for recovery and confident that it will happen, companies analyst Richard Beddard explains why Goodwin should make a very good long-term investment.

After three of the toughest years in its long history, I think few could be expecting the high level of confidence on display right through Goodwin latest annual report. It is, perhaps, a little too confident, but before I get into one negative, let's address the many positives.

As usual, I am scoring Goodwin to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2 and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

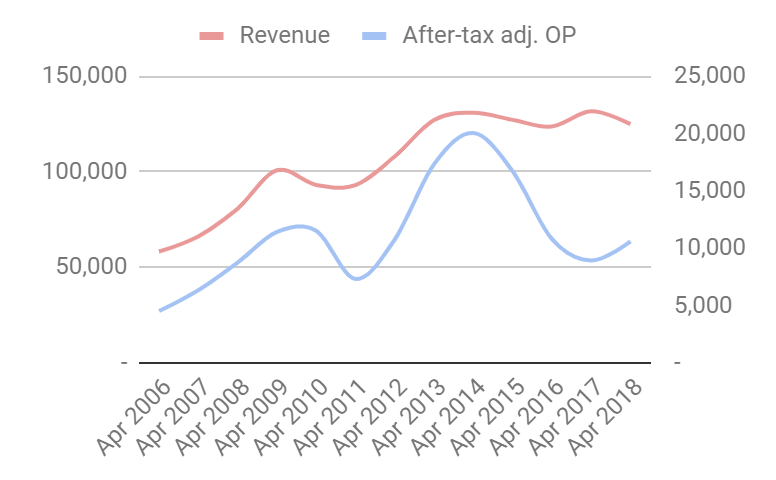

Revenue growth stalled and profit slumped at Goodwin after the oil price crash in 2014 when oil companies froze investment and demand for the company's gigantic patented valves collapsed. The valves control the flow of oil and gas in pipelines and terminals.

Source: interactive investor Past performance is not a guide to future performance

The company remained profitable, though, because it has many other interests. The mechanical engineering division casts giant components used in bridges, for example, as well as radar antennae for airports and air forces.

Its refractory engineering division principally supplies manufacturers of jewellery with investment casting powder, a consumable used up in the manufacturing process. This business is booming in fast growing countries like India and China, and because Kerr, Goodwin's erstwhile biggest competitor, has exited the market. The refractory engineering business also processes minerals used in insulation and fireproofing.

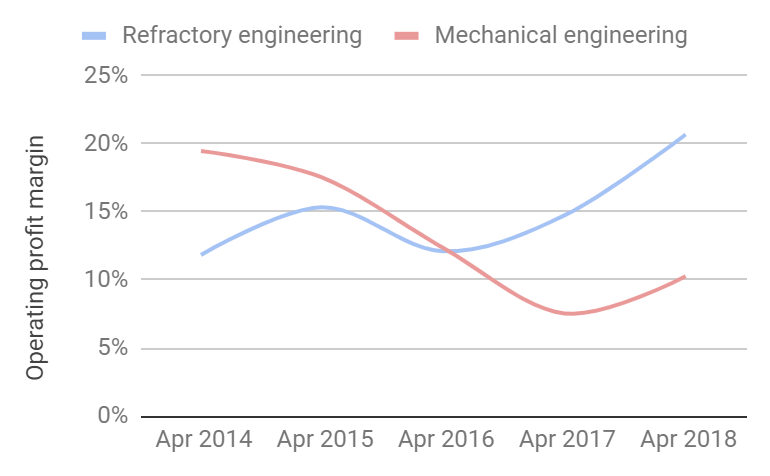

Although mechanical engineering still earns the most revenue, the situation has almost completely reversed in terms of profitability. By a sliver, the refractory engineering businesses earns more profit, and in terms of operating profit margins, it is twice as profitable, when once it was half as profitable:

Source: interactive investor Past performance is not a guide to future performance

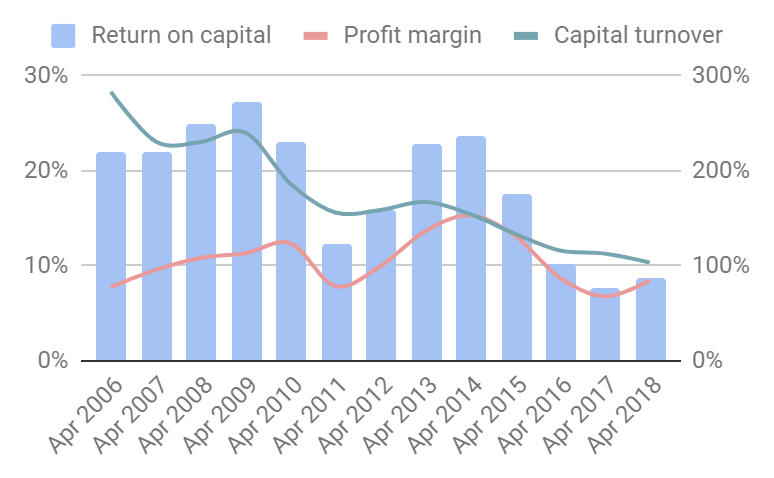

Profitable growth in refractory engineering has saved Goodwin from decisively breaching my 8% lower bound for after tax return on capital. Any lower, even in the hardest of times, and I begin to question the quality of the business.

Source: interactive investor Past performance is not a guide to future performance

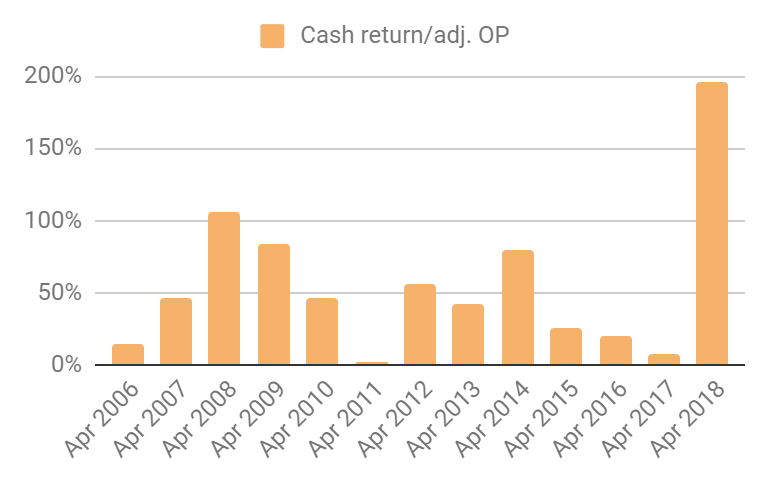

Although revenue declined 5% in the year to April 2018, an increase in adjusted profit of 19% may be an early sign of recovery, in which case there is good news. Goodwin reduced stock, and turned the screws on customers and suppliers, bringing in unprecedented amounts of cash:

Source: interactive investor Past performance is not a guide to future performance

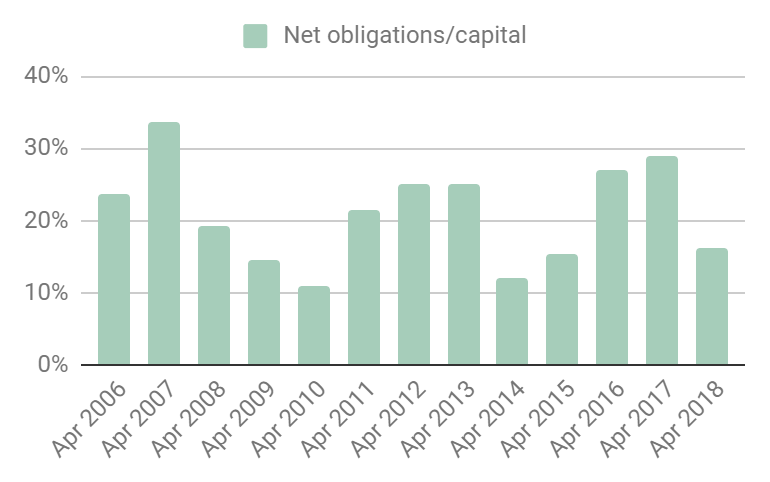

The cash flow improved its already reasonable financial position. Goodwin is more than 80% self-financed:

Source: interactive investor

Adaptable: How will it make more money?

Score: 2

Judging by the numbers alone, it looks as though the business has stabilised. Should conditions improve, Goodwin is well set for growth. By dint of its own enterprise and the natural cyclicality of the oil industry, that is exactly what Goodwin says is happening.

Order intake at the year end was 16% higher, mostly, the company says, because it has spent the last three years reconfiguring its factories to supply US and UK naval submarine and shipbuilding programmes.

Goodwin expects a $19.5 million contract with the US Navy to be "the first of many", and it expects to win orders for a major new military antenna programme in the next 12 months. Other non-oil related "work in progress" includes high integrity castings for nuclear fuel reprocessing and materials to tackle lithium battery fires.

In recent years I have wondered whether Goodwin will be able to bring engineering equipment and skills and sales networks honed in the oil and gas industry to bear in others. It appears that it can, at least to a degree: Goodwin expects profit growth in the engineering division to match the growing refractory engineering division over the next two years.

And, having previously dampened expectations of an imminent recovery in demand from oil explorers and producers, Goodwin has raised them again. Higher oil prices have allowed its customers to pay off debt, and with oil and gas surpluses low, Goodwin believes investment may rise in the current financial year, although it will probably be 2020 before it "really starts to get busy". Then profit growth in mechanical engineering will outstrip refractory engineering and it will once again be the source of most of Goodwin’s profit.

This year's annual report contains a useful summary of what makes it special. Twenty-five years ago the majority of Goodwin's output was manufactured under license, which limited profitability because much of the profit was taken by the licensors, and because the licenses limited Goodwin's sales territory to Europe.

In search of profitability, the company developed its own products, valves, slurry pumps, radar antenna systems, alloy castings, casting powders and other minerals. The valves and some other products are patented, all these products are “top three in the world” and most are number one. Its commitment to developing its own products and selling them through subsidiaries in fast growing developing economies means today it does not manufacture under license and it makes less than 10% of sales in Europe.

Product development, building a worldwide sales network, and acquiring complementary companies took most of the company’s resources, which is why Goodwin only paid a modest dividend of 20% of post-tax profit plus depreciation and amortisation. Now it believes it can afford to pay 38%, and so it has doubled the dividend for 2018, compared to 2017.

I think it is fair to say that, despite the dramatic reduction in profitability over the last three years, Goodwin has demonstrated that by developing specialist materials and products and selling them globally it has become a much stronger business. Even though it plans to restrict investment to 55% of post-tax profit (plus depreciation and amortisation), on average in future, that should be more than enough to enable it to build on these strengths.

Resilient: What could go wrong?

Score: 1

There are some long-term risks. Goodwin says world energy demand is forecast to increase by 28% between 2015 and 2040 but neglects to comment on how the balance of energy supply may shift, probably towards wind and solar, as, for example, electric vehicles become commonplace. The company's nuclear ambitions are one indication of how it may be hedging its bets.

The refractory engineering businesses also faces a potential long-term threat. While casting remains the dominant method of mass-producing jewellery, 3D printing is used for very higher value and intricate pieces. As the technology improves it will probably become more versatile, but here too Goodwin is moving with the times. It supplies 3D printing machines that print resin patterns used as moulds in the casting process (Goodwin supplies the resin and casting powder). It is finding other applications and customers for its minerals..

Equitable: Will we all benefit?

Score: 1

Until 2016, I trusted Goodwin fully. It had a long track record of delighting customers and although it has automated, it also has a big government supported apprenticeship programme. By most anecdotal accounts it is a good place to work. The Goodwin family own more than 50% of the shares in the company so it has by far the most to gain by securing its long-term future.

That's all still true, but in 2016 the board introduced a convoluted long-term incentive plan (LTIP) that will give each of its eight directors, most of them family members, shares worth 1% of the firm’s equity should the company achieve a Total Shareholder Return target requiring the share price to rise about 60% to £35 in the three year period to April 2019 (currently it is £26.50). Shareholders will have earned £12.40 per share, but we will have given up 8% of the firm at a cost, in terms of dilution, of about £2.60 per share. If the shares do not reach the target the directors get a proportion of the shares.

I am not going to explain in depth why I hate LTIPs, I have done it too many times. Suffice it to say I believe they obscure payouts that would otherwise look extreme compared to employees. If the size of the award depends on shareholder return, they incentivise management to inflate the share price.

Should Goodwin's share price reach the target by next April, the market value of the firm will be about £250 million, the total value of the LTIP will be over £20 million, and the shares awarded to each director would be worth £2.5 million. The company has always been helpful and open with me, it supplied me with the LTIP illustration I have reported here, so I hope and expect the supremely confident tone of Goodwin's annual report is justified by the facts on the ground. But I also wonder if it is informed by the board’s desire to secure a large payout in six months time.

What I hate most about LTIPs, you see, is they make a cynic of me.

Cheap: Is the firm's valuation modest?

Score: 1

On a debt adjusted basis the market value of Goodwin is about 20 times adjusted profit, but it is likely that profit is well below what we can expect from Goodwin in the future. The shares are probably undervalued.

A total score of 7/10 means I think Goodwin is a good, but slightly tarnished, long-term investment.

Here are some of Richard's recent articles:

- Colefax: Does old faithful hit the magic number?

- Games Workshop: Verdict on this stunning performer

- System1: Testing its powers of recovery

- MS International: Can the rebound last?

- Castings: Between a rock and a hard place

- Trifast: Continuous improvement adds up

- Vp: An acquisition too far

- Air Partner: Talks a good business

- Sprue Aegis: Do this and they'll be 'dirt cheap'

- 16 conviction shares to consider

- Walker Greenbank: Cheap but fearful

- Hollywood Bowl close to joining exclusive club

- Anpario: Gearing up for growth

- Are Next shares a buy for the long term?

- 16 shares for the future

- Is Portmeirion in the 'buy' zone?

- XP Power shares: They're electrifying!

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard owns shares in Goodwin.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.