Greene King and Stagecoach bounce back after early dive

28th June 2018 12:51

by Lee Wild from interactive investor

Greene King

Big football matches and boxing events drew in the punters at Greene King pubs over Easter, and they're back at the bar in droves for the football World Cup in Russia.

With a mixture of football and an early summer heatwave, Greene King couldn't have written the script any better. Down 1.2% in the year to April, pub like-for-like sales are up 2.2% in the last eight weeks.

That's in marked contrast to previous updates where snow has kept drinkers at home, which partly explains a weaker full-year performance. Revenue fell 1.8% over the 12 months to £2.18 billion and underlying pre-tax profit of £243 million, while in line with expectations, was 11% lower than the year before.

It's not just bad weather that shrivelled Greene King profits. Pubs are still closing down at a rate of knots, competition is fierce, costs are rising and consumer confidence remains low.

While consumer confidence remains fragile and real wages growth only modest, quality consumer stocks like high street retailer Next, Howden Joinery Group and Greene King have been in demand.

Greene King shares began a recovery from last September's profits warning in April, rallying more than 40% in just a few months from 450p to 650p.

There's still more to do, certainly in terms of efficiency, but management has made a good start to this turnaround programme and is currently backed to do better. The shares aren't expensive by any stretch, and the dividend yield is attractive, which suggests the 14% crash first thing Thursday was clearly overdone.

Source: interactive investor Past performance is not a guide to future performance

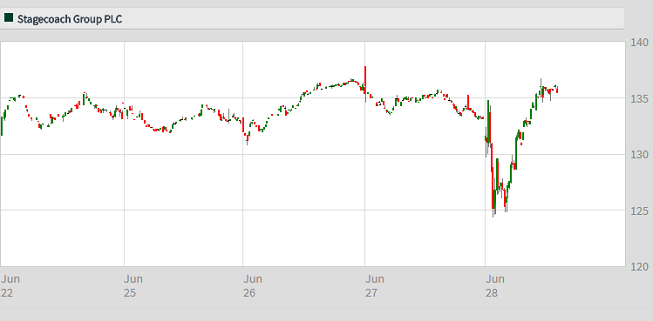

Stagecoach

It's been a terrible few years for Stagecoach Group, and there's very little to revive optimism in these full-year results, scarred by a huge cut to the dividend.

The end of its South West Trains franchise last August caused an 18% drop in revenue to £3.2 billion, and the bus division contributed to weaker year-on-year profits.

Stagecoach's reputation took a big dent this year when the government renationalised the East Coast franchise which Stagecoach ran with Virgin Trains. Forecast passenger numbers proved well wide of the mark, resulting in big losses.

Further cash outflows during the handover of East Coast and difficult trading elsewhere make the generous dividend unsustainable. The final dividend is more than halved to 3.9p, which slashes the total payout by over a third.

The shares may trade on just single-digit earnings multiples, and the dividend yield remains in excess of 5%, but predicting no improvement in profit this year will not bring investors back in sufficient numbers.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.