Housebuilder shares boom, but why?

We explain what’s driving homebuilder shares, and what’s behind price moves elsewhere today.

23rd April 2020 15:50

by Graeme Evans from interactive investor

We explain what’s driving homebuilder shares, and what’s behind price moves elsewhere today.

Dividend cuts that would have been unthinkable at the start of 2020 failed to rattle followers of popular stocks Compass (LSE:CPG) and Computacenter (LSE:CCC) today.

With more than half of its business out of action due to various country lockdowns, catering giant Compass told investors it would not be paying an interim or final dividend for the year to September 30. Computacenter has also sacrificed the award from 2019 trading, even though its cash position is strong and trading has been in line with expectations.

In better coronavirus-related news, ii Winter Portfolio stock Croda International (LSE:CRDA) said it will still pay its 2019 dividend worth £65 million. DFS Furniture (LSE:DFS) and restaurants business Loungers also boosted their finances with the completion of share placings last night.

The fundraisings were followed by more warnings today about the devastating economic impact of the pandemic in the UK. Today's IHS Markit/CIPS Flash composite purchasing managers' index showed a reading of just 12.9 for April, down from 36 last month and a much bigger slide than at the height of the global financial crisis.

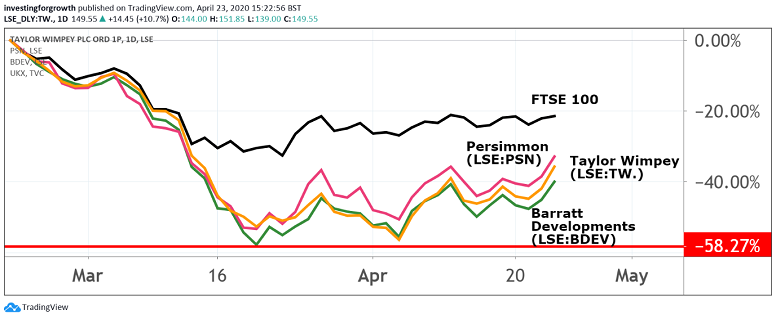

IHS Markit said the figure was consistent with GDP falling at a quarterly rate of approximately 7 percent. With the re-opening of shops, factories and building sites now crucial for the economic recovery, Taylor Wimpey (LSE:TW.) announced the resumption of work at its construction sites from May. Its shares jumped 12%, with Persimmon (LSE:PSN) and Barratt Developments (LSE:BDEV) not far behind.

Source: TradingView Past performance is not a guide to future performance

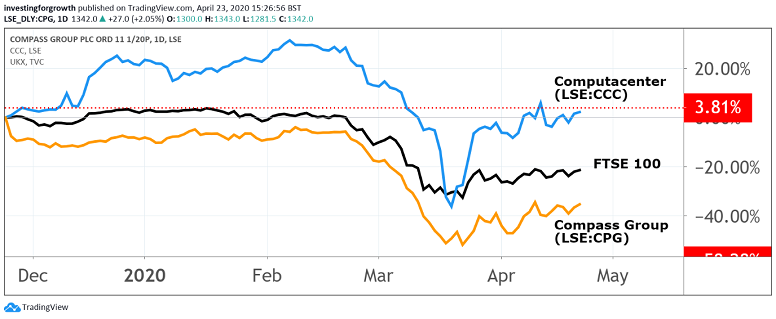

Compass shares, meanwhile, were unmoved at 1,320p after today's dividend blow was offset by evidence of robust trading before the crisis and from the defence and healthcare operations still able to trade over recent weeks.

Half-year revenues for the six months to March 31 were 1.6% higher, which was within previous guidance of between zero and 2% and points to a fall of 2% in the second quarter. As well as cost savings of £450 million a month, the company has put in place additional credit facilities of £800 million for total committed facilities of £2.8 billion.

Analysts at UBS think Compass has at least 20 months of liquidity against the current trading backdrop. They have a price target of 1,705p, which compares with the low of 1,100p seen in mid-March and February's record high of 1,900p.

Like Compass, Computacenter shares had been trading at all-time highs earlier in the year. They plunged from 1,900p to less than 900p last month, only to rally to 1,500p since then.

There was some encouragement today as the technology partner for large corporate and public sector organisations said trading had been more robust than it had expected at the start of the crisis. It also reported a surge in demand from customers looking for business continuity, particularly around homeworking and network resilience.

This has been offset by the industrial sector, where a large number of customers have had to stop production. Explaining the “prudent” decision not to pay the 2019 dividend, the company pointed out it had received and approved a number of requests for extended payment terms.

The company added:

“The second half of the year is more difficult to predict but currently our full year expectations remain unchanged.”

Source: TradingView Past performance is not a guide to future performance

FTSE 100-listed speciality chemicals firm Croda International (LSE:CRDA) also reported poor trading visibility, although the value of its order book remains strong. All 19 of its manufacturing sites are still operating due to the company being a critical supplier to a number of industries during the Covid-19 crisis, including healthcare, crop care, cleaning and sanitisers.

Having completed its debt refinancing last year, Croda said it will still pay the dividend of 50.5p a share it announced with February's annual results. Shares were 13p higher at 4,775p, compared with 4,070p in March and 5,185p in February.

Meanwhile, the latest round of City fundraisings generated proceeds of £64 million for DFS Furniture and more than £8 million for Loungers. The new shares were priced with institutions at a 16% premium, with both stocks trading above their respective placing levels this afternoon.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.