How I rate these three well-known stocks

9th November 2022 07:59

by Rodney Hobson from interactive investor

This is meant to be a lucrative time of year for these companies, but should they be in your Christmas stocking? Our overseas investing expert Rodney Hobson also gives an update on Peloton.

Beauty, it is said, is in the eye of the beholder. During lockdowns there was little reason to wear eyeliner and blush if users were not going into offices or to social occasions. It is very disappointing, therefore, to see luxury cosmetics supplier The Estee Lauder Companies Inc Class A (NYSE:EL) taking a downbeat view ahead of Christmas just when sales ought to be rising.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

Instead, they fell 11% to $3.93 billion in the three months to the end of September and profits slumped 29% to $489 million, as margins were squeezed from 16% to 12%. This is the first quarter of Lauder’s financial year, which runs to June.

Source: interactive investor Past performance is not a guide to future performance

The rather dire figures were caused mainly because lockdown restrictions in China, caused by continuing sporadic outbreaks of Covid-19, hit sales in Asia more than expected. Inflation in the United States has also led to retailers reducing stock levels for more expensive products.

It means Lauder now expects sales to shrink 6-8% during the year to next June rather than grow by 5-7%, which is a rather unpleasant setback by any reckoning. It puts doubt over the company’s claim that sales growth will accelerate after Christmas.

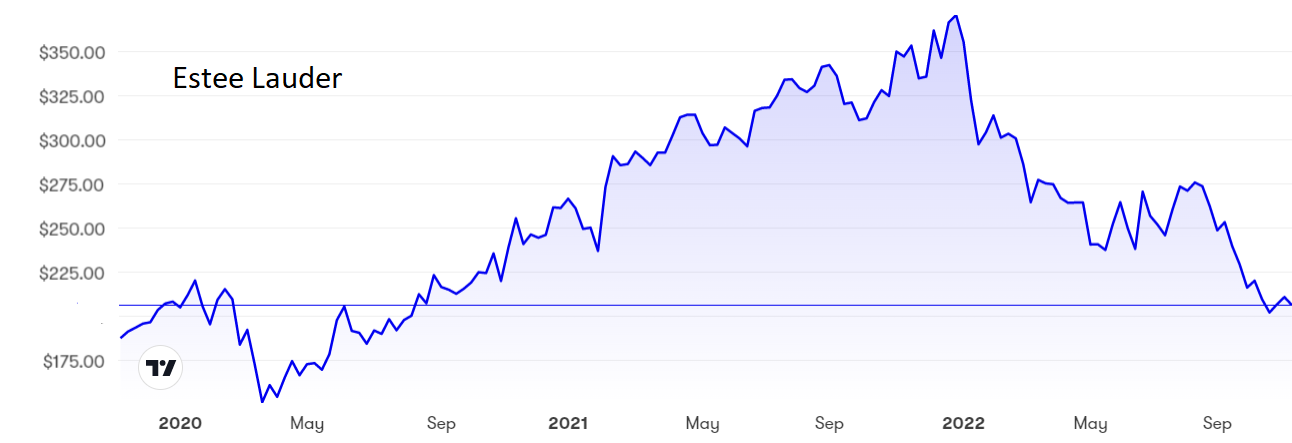

The shares raced to a peak of $370 at the end of last December but have been falling back since and are looking to find a floor at around $200, where the price/earnings (PE) ratio is still a demanding 34 and the yield, despite an increase in the quarterly dividend to 66 cents, is a meagre 1.2%. However, that is pretty much in line with rivals in the beauty business and it is well covered by earnings per share of $1.37.

- This US midterm election investing trick has worked 100% of the time

- Five shares doing their bit to save the world from climate change

In contrast, L'Oreal SA (EURONEXT:OR) coped with similar problems much better, outperforming the global beauty market with total sales up 20% to €9.58 billion and like-for-like sales 9.1% ahead. North America, Lauder’s home turf, led the way for L’Oreal while Latin America was another success region. Sales also shot ahead in South Asia, the Pacific, the Middle East and Africa.

The share price chart has followed a similar pattern to Lauder’s, with a peak at 425p and a current price of €327, where the PE is more demanding at 32.3 but the yield is a little better at 1.5%.

Source: interactive investor Past performance is not a guide to future performance

Hobson’s choice: I said to buy Estee Lauder up to $195 in 2020 and, as I expected, the company staged a great recovery from the pandemic. Well done to anyone who took profits while they had the chance. Given that the shares could slip further, the rating for the time being has to be only a hold. Look for a chance to buy in below $195 again.

Currently, L’Oreal looks the better buy.

Update: Sometimes a new boss with new ideas can turn round a failing company. It is not happening yet at fitness equipment group Peloton Interactive Inc (NASDAQ:PTON), where Barry McCarthy, who took over as chief executive at the turn of the year, has failed to produce an immediate improvement from drastic measures he took three months ago.

- Investors stunned as Federal Reserve issues threat in war on inflation

- A share to buy, another to sell and one to hold

- Time to buy one of Warren Buffett’s favourite stocks now?

Revenue slumped 23% to $616.5 million in the three months to 30 September, once again falling short of analysts’ expectations, and well short of the $805.2 million achieved a year earlier. Projected sales have been scaled back. The net loss widened from $376 million to $408.5 million.

Source: interactive investor Past performance is not a guide to future performance

On the positive side, the number of members increased 6% to 6.7 million and Peloton claims it is ahead of schedule in its turnaround programme.

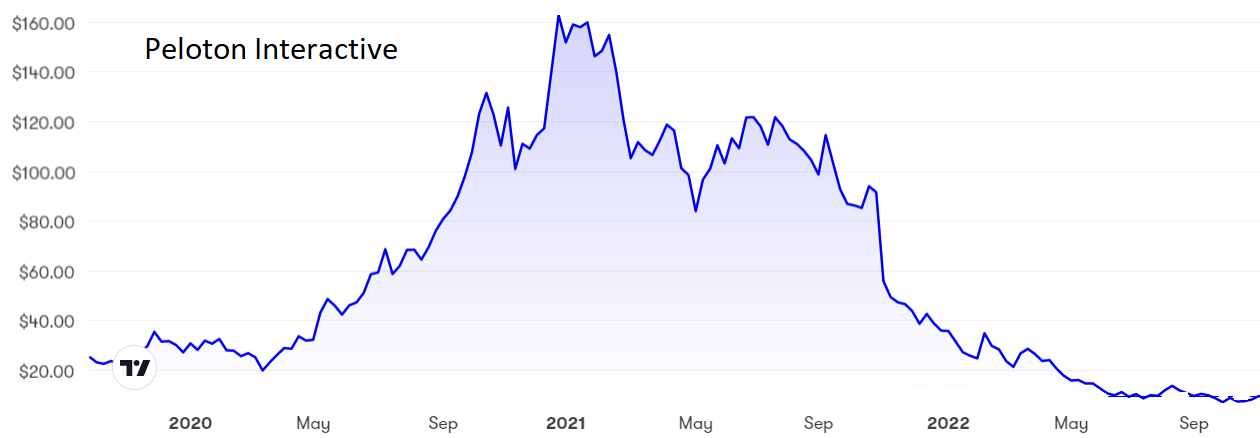

The shares are bumping along just below $10, less than half the price they floated at just over three years ago. At the height of the pandemic, they briefly topped $160.

It is hard to reconcile the optimism of Peloton management with the dire figures. I have already warned investors three times this year to stay well clear, initially at $25. It is not too late to sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.