How will a mining rally impact small-cap strategies?

With room for the rally in mining stocks to continue, we review the case for UK small-cap trusts.

12th February 2021 15:50

by Callum Stokeld from interactive investor

With room for the rally in mining stocks to continue, a Kepler analyst reviews the case for UK small-cap trusts.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

It is often considered axiomatic in investment markets that smaller companies offer greater pricing inefficiencies, and thus greater opportunities to active managers to generate outperformance. In the UK Small Cap space, we have certainly seen suggestions over the long term that this is true, with the Morningstar UK Small Cap sector producing an average NAV return of circa 173.4% over the 10 years to 5 February 2021, compared to a return of circa 115.2% from the Numis Small Cap including AIM excluding Investment Companies Index.

Yet in more recent months the average active strategy has notably lagged a strong rally in the Numis index, albeit they have produced strong absolute returns themselves. That this has coincided with a strong period of performance in mining companies is, we think, no coincidence.

In the current environment, we think this is relevant, and a pattern that is likely to continue to hold. Shareholders in UK small-cap trusts should, if anything, be reassured if it does. Below, we explain why, and review both the case for mining stocks and UK small caps.

Before we go any further, let us clearly set out our stall: we are positive on the relative prospects for UK small-cap equities, and for mining equities. We do not believe, by any manner of means, that this is an either/or allocation decision, especially when we look at historic correlations (the Numis index has a 10-year median R2 of 0.34 to BRWM). So, we believe investors are well-advised to consider holding exposure to both asset classes at this time. Nonetheless, investors in UK small-cap trusts should accept that a concurrent rally in these assets is likely to prove a headwind to relative returns for actively managed small-cap strategies. Conversely to what may be an instinctive reaction to this, we think shareholders should welcome this if a commodity rally does result in it becoming harder for active managers to outperform.

Rally drivers

As the fortunes of the mining sector as a whole rest somewhat on underlying spot prices, which are themselves a reflection of a balance of supply and demand, there are typically limited opportunities for mass expansion in production while maintaining the value of these commodities. Instead, value is typically created when operational efficiencies, conservatively budgeted new opportunities, and cost discipline meet rising spot prices to create exponential free cash flow growth. As fundamentally cyclical businesses, mining is essentially more ‘value’ focused than general small-cap investing.

In contrast, the majority of small-cap investors tend to focus on ‘growth’ factors, seeking companies that can operationally grow to multiples of their current size. Their stock universe does contain myriad mining companies, but the operational models of these mining companies do not typically chime with what the majority of active small-cap managers are looking for in a stock.

Accordingly, we would commonly expect most managers to be systematically underweight to mining stocks. And, given the smallest mining stocks often rally the most aggressively when the sector is in vogue, we would expect headwinds to emerge for even those managers who are willing to take exposure to high-quality mining names to manage their factor risk, such that they will face relative performance headwinds in a generalised commodity rally.

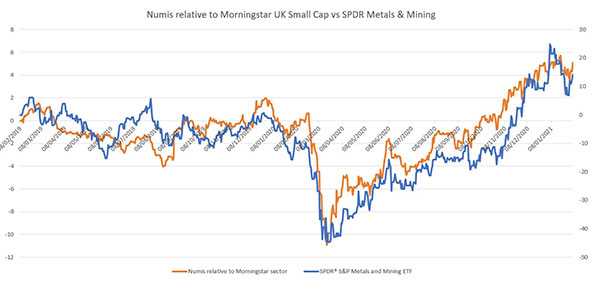

As we set out further below, we think there is room for the rally in mining stocks to continue. We also remain positive on the outlook for actively managed UK small-cap strategies. This is despite the relative headwind that a rally in mining stocks might imply for actively managed strategies; we can see in the graph below the returns of the Numis index relative to the Morningstar UK Small Cap sector, as against the returns from a mining index over the past two years. As we can see, active strategies on average have tended to outperform during periods where mining stocks were weaker, and underperformed when mining stocks rallied.

Numis SC relative to Morningstar vs mining index

Source: Morningstar. Past performance is not a guide to future performance

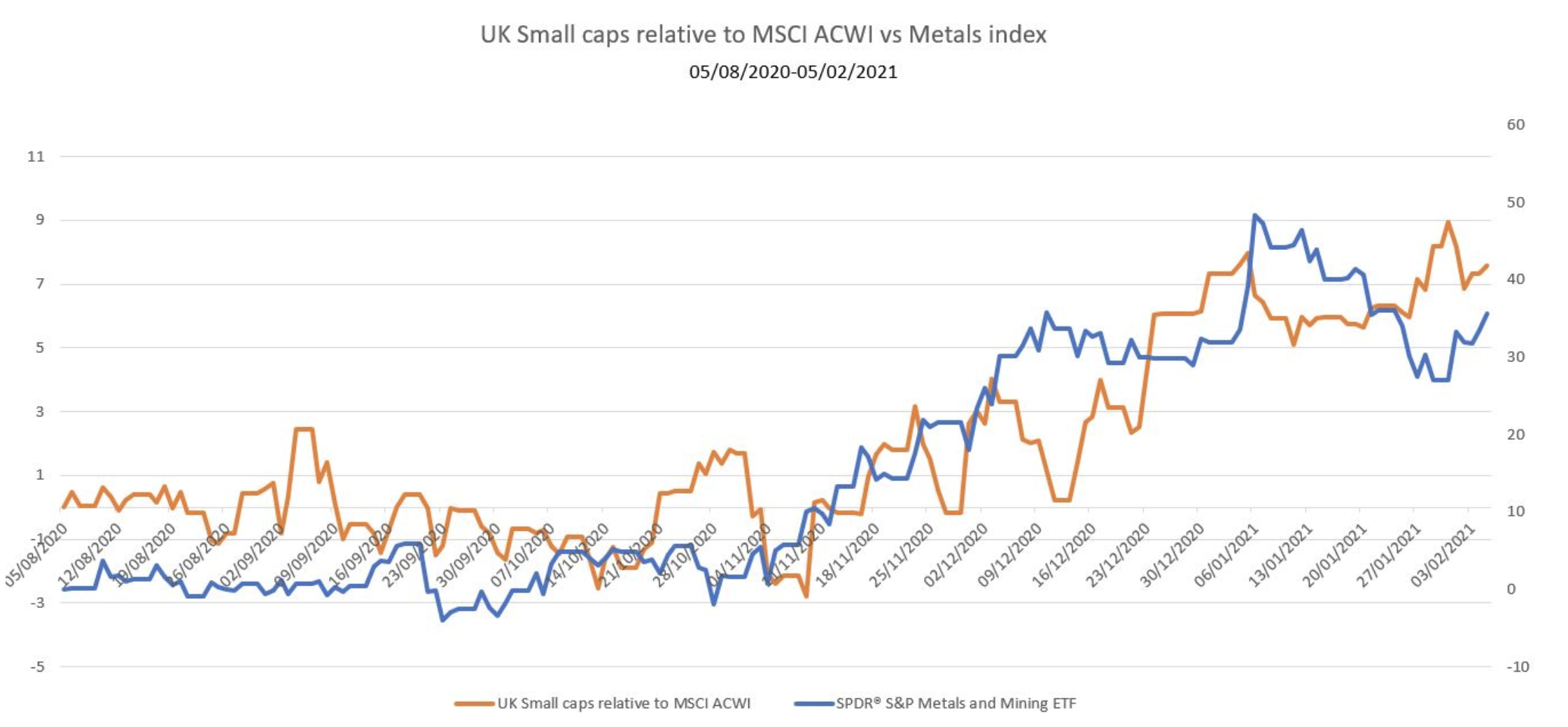

This has also been true over the period since the equity market bottomed out in mid-to-late March 2020. And yet, in absolute terms this has been a great period for the UK Smaller Companies sector, with the average NAV rising by c. 48%. This was also strong relative to broader global markets, with the MSCI ACWI returning circa 42% over the same period. And we can see that the relative fortunes of UK small caps have started to coincide with the absolute performance of mining companies over the past six months. This suggests to us that investors see both of these as beneficiaries of ‘reflation’ trades and global economic recovery.

UK small caps relative to global equities, vs mining index

Source: Morningstar. Past performance is not a guide to future performance

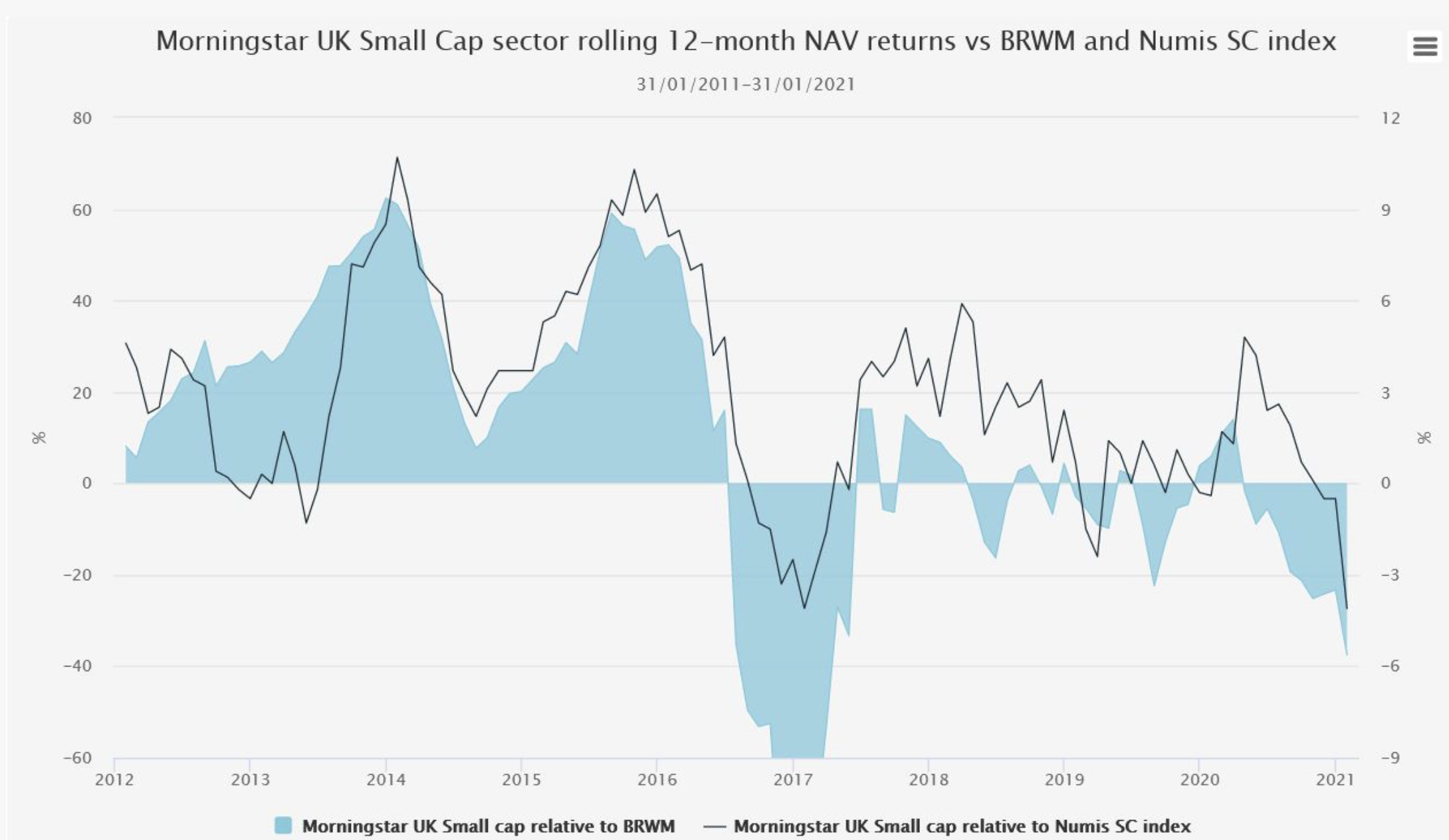

A picture tells a story. La Reve, for example, tells the story of what happens when a celebrated painter goes back to work too soon after a stroke. Far more aesthetically pleasing to our minds is the below chart. It shows the rolling 12-month NAV returns of the average trust in the Morningstar UK Small Cap sector, relative to those of BRWM (standing in as a proxy for mining companies) and the Numis Small Cap Plus AIM Excluding Investment Trusts Index (a common benchmark). We can see that the relative performance of active managers to the Numis index often shows significant directional similarities to their performance relative to mining companies.

Morningstar UK small cap sector: rolling 12-month NAV returns vs BRWM and Numis SC index

Source: Morningstar. Past performance is not a guide to future performance

When the Four Horseman Find Their Horses Clamped

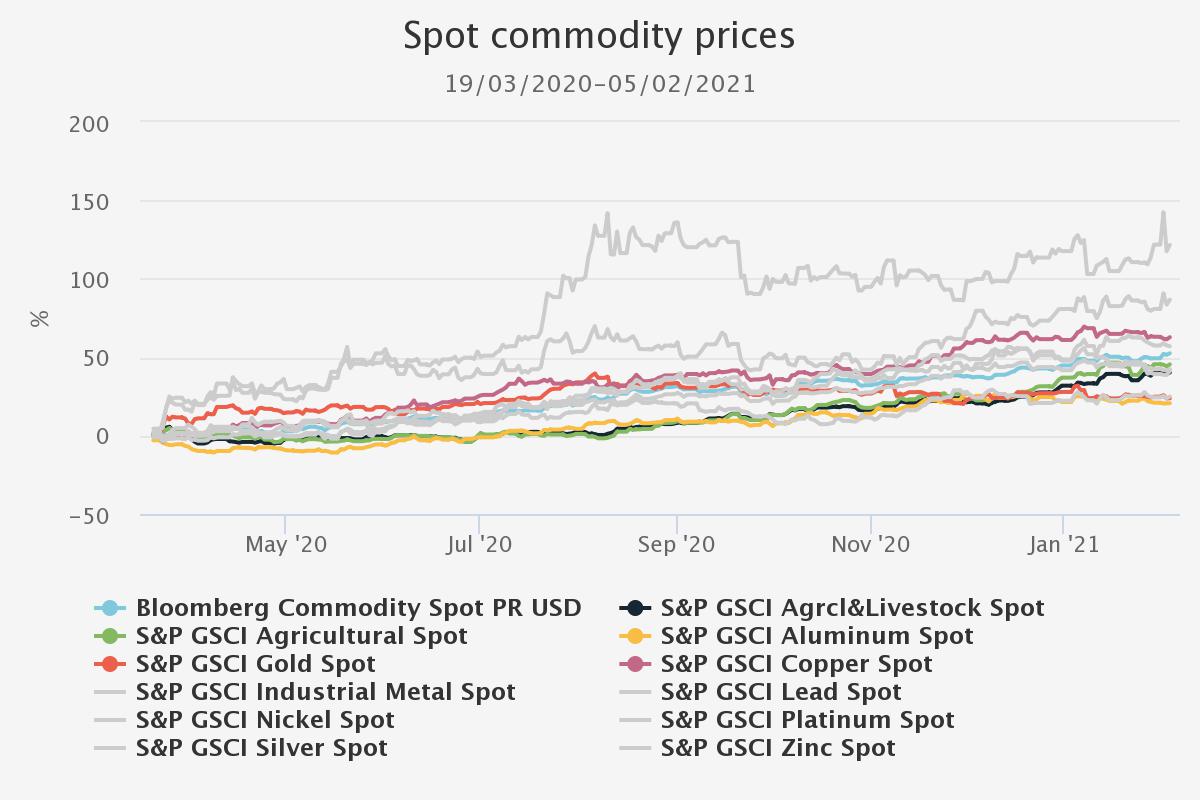

Spot commodity prices have nearly universally performed strongly since the denouement of the USD liquidity panic in March 2020 (your attention may have been diverted by Covid-19 at the time). With the extension and expansion of swap-lines by the US Federal Reserve to multiple foreign central banks in mid-March 2020, an incipient USD squeeze (and tangential tightening of global monetary conditions) was headed off. Asset liquidations, net, reversed. Future contract settlement fears were abated. And, the economic Armageddon averted, confidence returned to producers and the buyers of spot commodities which had hitherto been decimated.

Spot commodity prices 19/03/2020-04/02/2021

Source: Morningstar. Past performance is not a guide to future performance

The story driving this was not just a sudden return to confidence about the world. Instead, as was recently highlighted yet again in our conversations with the managers of BRWM, supply discipline has remained across the mining industry in recent years even as spot prices have risen. Specific examples include the policy of Barrick Gold to only greenlight copper projects when they forecast at least a 15% IRR at a spot copper price of $275, for example (current spot copper is circa $356). Despite sharply higher spot metals prices, Morgan Stanley has highlighted that mining sector capex is expected to continue to fall in the coming years, while inventories in key metals such as copper have fallen significantly.

Tight supply discipline is meeting incipient demand. Governments across the world believe they have discovered that they can borrow unlimited sums without repercussions from the once-feared bond vigilantes. Stephanie Kelton, doyen of modern monetary theory, is an economic adviser to new US President Joe Biden. Here, and elsewhere, plans for infrastructure projects are being put together around the world. There is probably plenty of hype in headline numbers, but there is strong evidence that the Chinese government has fallen back on old habits and is already stimulating growth through infrastructure investment and property building (once again, the ‘rising consumer class’ narrative has fallen flat, as economist Michael Pettis has highlighted).

Despite this (and a substantial rally in mining company shares over the past 10 months or so), we note that valuations remain relatively low in a mining sector which has seen substantial deleveraging and capex discipline. Even on flat spot prices, we think the sector should be attractive, with companies able to generate attractive returns on capital. Any rise in spot prices increases the attractions exponentially (and it is possibly this consideration that has attracted the attentions of Monks (LSE:MNKS)investment trust in recent months, which has initiated positions in major mining companies Rio Tinto (LSE:RIO) and BHP (LSE:BHP)).

Canterbury uber Alles

Three of our investment trust research team picked UK Smaller Companies trusts for 2021. Each rationale varied slightly, but in common they observed the attractions of the UK market in any global recovery from the Covid-19 pandemic. The political turmoil of recent years, with uncertainties over UK politics and over the resolution or otherwise of Brexit negotiations had deterred many from allocating to the UK. Bank of America Merrill Lynch fund manager surveys amongst institutional and professional investors have consistently highlighted institutional allocations to the UK are severely underweight relative to history.

For a brief time it appeared the decisive victory of the Conservative Party at the 2019 general election would catalyse a return to favour, offering the UK market the comfort of a significant government majority to push through a conclusion to Brexit negotiations. Managers and market commentators all anticipated that clarity on future arrangements, whatever they may be, would catalyse a resurgence of interest in the UK market. And this was initially borne out, before the sceptre of Covid-19 raised its head.

Yet, with vaccine programmes being rolled out across the world, and with the UK at the forefront amongst major economies, there would seem grounds for renewed optimism. We note that multi-asset managers such as Peter Hewitt of BMO Managed Portfolio (BMPG/BMPI) have highlighted UK trusts as potential beneficiaries to any local or global ‘return to normality’.

Certainly, more uncertainty seems to have been priced into UK markets than many global peers, with the FTSE All-Share at a significant valuation discount to European or US markets and small cap indices lowly valued relative to their large-cap peers relative to history. This has been extended vicariously to small cap trusts, as noted by Nick Greenwood and Charlotte Cuthbertson of Miton Global Opportunities (LSE:MIGO), who see a sectoral opportunity in the small-cap space driven by a confluence of factors.

Such are the relatively exceptional economic circumstances of the current environment that a recovery in share prices need not be style confined either. Equity markets in the UK have bifurcated sharply between perceived lockdown ‘winners’ vs lockdown ‘losers’. A purely quantitative value approach would undoubtedly favour the latter category heavily at this time, yet, as we saw on the announcement of successful vaccine developments in November 2020, there is plenty of capital willing to buy these companies on the promise of a return to more normal operating conditions.

Essentially, we would contend that many of these companies are not being priced off of changing perceptions of future cash flows, except in so far as changes have reflected the perception of the likelihood of the existence of cash flows at all. In other words, as insolvency risks are repriced and diminished, they have enjoyed strong tailwinds. Undoubtedly many smaller companies will fall victim to the economic backdrop, and identifying the survivors remains key. Yet it seems highly likely that many companies previously assumed by the market to be obsolete will prove otherwise. If this perception reverses, it could help drive returns.

Just such a dynamic helped drive sharp outperformance in Aberforth Smaller Companies (LSE:ASL)towards the end of 2020, for example. The managers of ASL look to identify where cheap valuations are based on incorrect market assumptions of decline or failure, which left them with a strong framework to filter the often-indiscriminate sell-off in many ‘old-world’ companies during 2020. Over the past six months to 06/02/2021, ASL has delivered NAV returns of circa 43.7%, comfortably outperforming the peer group average NAV return of circa 22.2% over the same period. During this same period, the SPDR Mining & Metals Index has rallied by circa 35.6%.

In our view, it may not even take further equity market reappraisal of the viability of the underlying companies, to drive returns in this sector. In an efficiently operating capital market, cheap assets will attract buyers. If the public markets are not interested, competing companies likely will be interested in exploring M&A opportunities. With access to capital cheap and abundant, and many companies in any event displaying strong balance sheets, expect buyers to emerge from the corporate sector if they do not in equity markets. As the managers of ASL have highlighted, market valuations remain low by historic levels in the UK small cap space; even recent outperformance has not changed this yet. Tentative signs of rising M&A suggest corporates recognise value in this space, and for viable businesses could offer some price support.

To us, this also highlights the potential opportunities for growth and quality growth companies and strategies. Strong, well-capitalised businesses looking to expand their market share are being presented with a variety of opportunities to do so, as the managers of JPMorgan Smaller Companies (LSE:JMI)have previously highlighted. The opportunities for disruption and advantages to small caps may also grow if a deregulatory approach is adopted by the government. While this remains hypothetical at this time, support for such an approach has been voiced by certain elements of the Conservative party; as we have previously highlighted, academic evidence suggests regulations in recent years have increasingly served as barriers to entry and hindered small cap returns.

More pertinently to us, as the manager of MINI, Gervais Williams, has highlighted, the UK market and industrial commodities are likely to enjoy similar macroeconomic drivers. Both are comparatively short-duration assets at the present time; mining companies may command more beta, but the UK market as a whole should be well placed for upside capture relative to other risk allocations in such a scenario.

Conclusion

In the short term, the relative fortunes of UK small cap strategies to global equities seem increasingly likely, to us, to coincide with the fortunes of the mining sector. This is not because there is significant exposure in these strategies to mining companies. Generally, where it is held, the proportions are small. Instead, it is because both sectors are likely to be perceived as beneficiaries of economic normalisation globally.

Given the positive sensitivity of both value strategies and commodities to a perceived macroeconomic acceleration, it is plausible to us that the impact could be felt less in trusts such as Aberforth Smaller Companies (LSE:ASL)and Miton UK Microcap (LSE:MINI). Both trusts tilt notably more towards ‘value’ style factors than many of their peers, and this perhaps accounts for their stronger relative performance profiles in recent months as mining stocks have accelerated to the upside.

Furthermore, conditions of global economic normalisation would likely suggest strong absolute performance conditions for UK small cap strategies. And yet, we are warning investors now that we expect ‘relative’ performance to the benchmark to be more challenging in such an environment. Rather than being a cause for concern, we think this should in fact be regarded as likely evidence of managers sticking to their investment process, and should be welcomed by long-term shareholders. Investing in smaller companies involves a focus on the developing strategy of a company, and how it can leverage present assets (tangible or intangible) into top-line growth. Investing into commodities requires a different focus, onto acquiring high quality assets at the right price and at the right time. We think commodities exposure is better taken through specialists in the sector, such as BlackRock World Mining Trust (LSE:BRWM)or Golden Prospect Precious Metal (LSE:GPM).

Some small-cap managers seek to mitigate the potential impact of commodity and/or value rallies. Roland Arnold, manager of BlackRock Smaller Companies (LSE:BRSC), for example, primarily builds BRSC’s portfolio based upon bottom-up stock selection. Yet he is cognisant of the potential headwinds to relative returns from sector exposures, and will include high-quality mining names at points in the cycle he deems it prudent to do so. This, we note, has mitigated periodic headwinds to the trust, but we also observe that BRSC’s strongest returns relative to the benchmark have tended to coincide with weaker performance from commodities.

Other trusts, such as BlackRock Throgmorton (LSE:THRG), deliberately eschew the mining sector, with the manager believing he is better placed focussing on industries where he and the team have a better oversight of the industry drivers and which are not dependent on external factors to drive returns. The strong outperformance of THRG clearly shows that the impact to relative performance of mining company rallies is a generalised consideration, and not a complete impediment to outperformance.

There is no ‘correct’ approach for UK small-cap managers to deal with the impact of a mining rally. We think merely that relative returns going forward should be viewed with one eye on the potential impact of such a rally.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.