ii investment review: full-year 2020

In one of the most tumultuous years in history, here are the assets that generated the best returns.

12th January 2021 12:44

by Dzmitry Lipski from interactive investor

In one of the most tumultuous years in history, here are the assets that generated the best returns.

Market round-up

Investors had the most traumatic 12 months in living memory in 2020, a collapse in global economies triggered by lockdowns to battle the Covid-19 pandemic. Not only was there financial pain, but massive social repercussions made the year one to forget.

Most economies had made a start getting back to normal once lockdowns were lifted, but further waves of the virus brought more restrictions. Despite this, vaccine news lifted hopes for a global economic recovery in 2021. A Brexit trade deal between Britain and the European Union also shifted a cloud that’s overhung UK shares since the EU referendum four-and-a-half years ago.

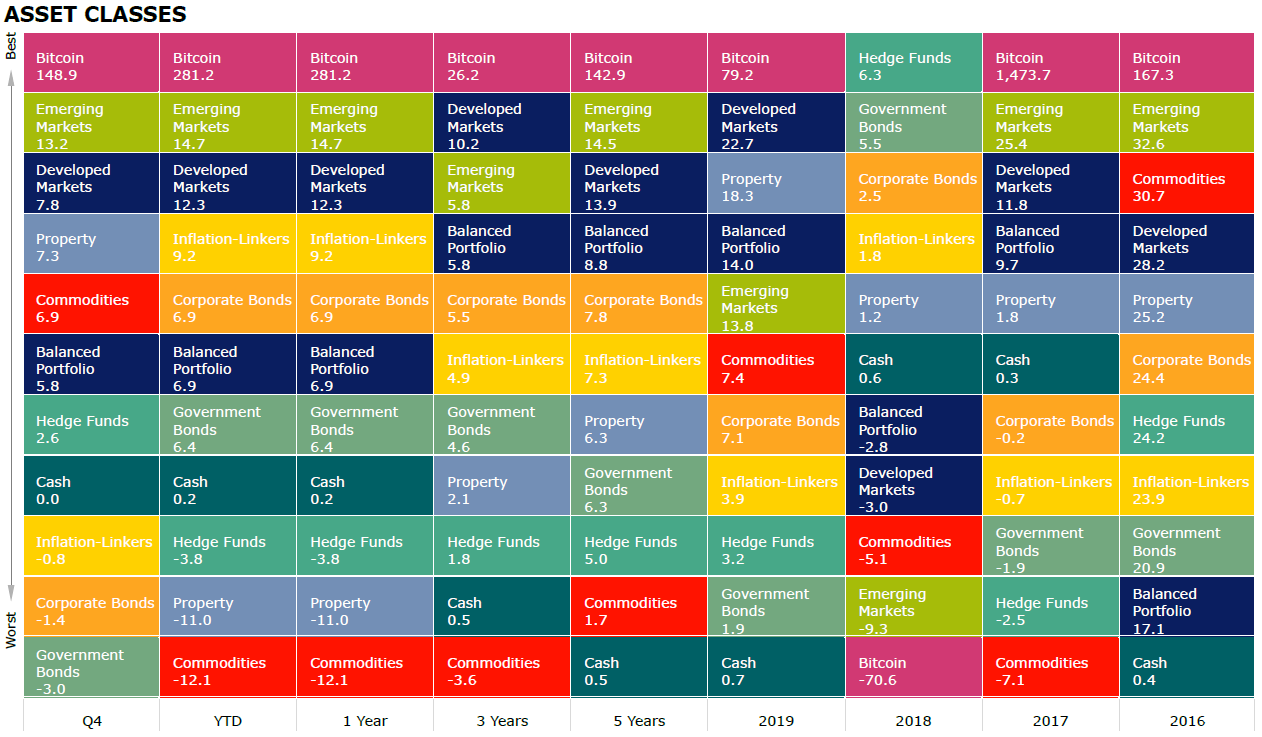

Markets experienced unprecedented volatility during the height of the pandemic in March, but have managed to recover their losses, and many staged strong performances in sterling terms: global equities returned 12.3% , while bonds – 5.8%. Emerging markets have outperformed their developed counterparts, with a return of almost 15% underpinned by US dollar weakness. Commodities and property delivered negative returns for the year.

An upsurge in demand towards the end of the year had Bitcoin up 281%. The cryptocurrency outperformed every mainstream asset class in 2020 as its growing adoption as a payment method and alternative asset class.

Source: Morningstar Total returns in sterling

Shares

The UK continued to lag other developed markets, with FTSE All Share down almost 10% for the year. The UK experienced a bigger fall in economic activity, and 2020 ended with a Brexit trade deal finally being agreed. That helped sterling and domestically focused areas of the market which enabled strong gains.

European equities delivered a positive return of 7.5% for the year, despite the Covid lockdowns. EU leaders approved the €1.8 trillion budget package, including the €750 billion recovery fund to tackle the pandemic and make European economies more sustainable and digital.

US equities returned almost 15% for the year, boosted by Joe Biden’s win in the presidential election, as well as a $900 billion stimulus package announced in late December. There are expectations that more money will be found to prop up the US economy.

Asian market equities were the best performing region overall, with China gaining 25% in sterling terms. Although Covid-19 originated in China, authorities there were able to get a grip and contain the outbreak much quicker than governments in the West. That gave investors greater confidence in the local economy and that domestic companies could continue to benefit from economic growth.

| Performance | ||||

|---|---|---|---|---|

| Q4 (%) | 1 year | 3 years | 5 years | |

| China | 5.17 | 25.5 | 8.67 | 16.8 |

| Asia Pacific Ex Japan | 12.69 | 18.66 | 7.52 | 14.64 |

| S&P 500 | 6.07 | 14.74 | 13.78 | 16.97 |

| Emerging Markets | 13.2 | 14.65 | 5.81 | 14.52 |

| World | 7.78 | 12.32 | 10.16 | 13.9 |

| India | 14.48 | 11.99 | 4.47 | 11.19 |

| TOPIX Japan | 7.49 | 9.55 | 4.79 | 10.42 |

| Europe Ex UK | 9 | 7.49 | 5.15 | 9.82 |

| FTSE Small Cap | 24.2 | 7.15 | 4.83 | 9.24 |

| FTSE 250 | 18.85 | -4.55 | 2.19 | 6.04 |

| FTSE All Share | 12.62 | -9.82 | -0.91 | 5.14 |

| FTSE 100 | 10.86 | -11.55 | -1.8 | 4.77 |

| Russia | 15.01 | -15.18 | 9.19 | 18.23 |

| Brazil | 29.57 | -21.52 | 0.24 | 17.76 |

Source: Morningstar. *MSCI. Total returns in sterling

Sectors

For equity markets, the vaccine announcement in the final quarter of 2020 led to greater momentum in sector rotation. Industries that had previously suffered most severely from the pandemic, such as energy and financials, were the top gainers. However, over the year they still ended up in negative territory. Technology, healthcare, and consumer discretionary, which includes online retailers, delivered a strong performance. These sectors have been big beneficiaries of the surge in demand for tools that help home working, and for purchasing goods online as lockdowns keep high street stores shut.

| Performance | ||||

|---|---|---|---|---|

| Q4 (%) | 1 year | 3 years | 5 years | |

| Information Technology | 6.77 | 39.34 | 26.93 | 27.97 |

| Consumer Discretionary | 9.9 | 32.41 | 17.37 | 17.58 |

| Communication Services | 9.32 | 19.18 | 11.74 | 11.19 |

| Materials | 9.5 | 16.23 | 6.74 | 15.91 |

| Health Care | 1.04 | 10.01 | 12.38 | 11.54 |

| Industrials | 9.07 | 8.23 | 6.46 | 13.2 |

| Consumer Staples | 0.63 | 4.46 | 5.6 | 8.82 |

| Utilities | 3.34 | 1.52 | 9.01 | 11.19 |

| Financials | 17.27 | -5.83 | 0.07 | 8.55 |

| Real Estate | 2.75 | -7.92 | 2.68 | 6.82 |

| Energy | 19.86 | -33.58 | -13.99 | -1.63 |

Source: Morningstar. Total returns in sterling

Bonds

Corporate bonds outperformed government bonds in 2020, with both investment grade and high yield delivering positive returns. Investors expect yields will likely remain low for even longer due to central bank intervention.

| Performance | ||||

|---|---|---|---|---|

| Q4 (%) | 1 year | 3 years | 5 years | |

| UK Inflation Linked | 1.17 | 11.34 | 5.65 | 8.67 |

| Global Inflation Linked | -0.81 | 9.19 | 4.92 | 7.28 |

| EURO Corporate | 0.63 | 8.52 | 2.81 | 7.01 |

| UK Gilts | 0.63 | 8.27 | 5.19 | 5.47 |

| Sterling Corporate | 3.22 | 7.96 | 5.17 | 6.07 |

| Global Corporate | -1.45 | 6.92 | 5.51 | 7.83 |

| Global Government | -3.02 | 6.38 | 4.56 | 6.28 |

| Global Aggregate | -2.32 | 5.83 | 4.49 | 6.38 |

| Global High Yield | 1.69 | 4.7 | 5.53 | 10.12 |

Source: Morningstar. Total returns in sterling

Commodities and Alternative Investments

Gold gained 20% for the year as investors remained concerned about the impact of the pandemic on the global economy. In August, the yellow metal - seen as a safer asset when other, more risky investment markets, are volatile - broke above $2,000 an ounce for the first time.

The global economic slowdown had a significant impact on sentiment toward the oil sector. Brent Crude recovered from below $17 a barrel in April to trade above $50 by year-end. Production cuts will help address the supply-demand imbalance.

| Performance | ||||

|---|---|---|---|---|

| Q4 (%) | 1 year | 3 years | 5 years | |

| CBOE Market Volatility (VIX) | -18.41 | 76.81 | 26.81 | 6.14 |

| Gold | -5.04 | 20.34 | 13.02 | 13.93 |

| Cash | 0.01 | 0.21 | 0.52 | 0.45 |

| Global Natural Resources | 15.31 | -2.42 | 0.69 | 12.54 |

| Hedge Funds | 2.56 | -3.77 | 1.82 | 5.03 |

| Global Infrastructure | 8.79 | -8.67 | 2.34 | 9.54 |

| Commodity | 6.89 | -12.13 | -3.6 | 1.69 |

| UK REITs | 13.76 | -15.92 | -1.52 | -0.31 |

| Brent Crude Oil | 19.64 | -23.94 | -8.48 | 8.42 |

Source: Morningstar. Total returns in sterling

Most-traded shares on the ii platform in 2020

Most-bought |

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.