ii view: DS Smith stays confident

Paper and packaging group DS Smith is benefitting from e-commerce trends, but Germany remains weak.

3rd September 2019 11:01

by Keith Bowman from interactive investor

Paper and packaging group DS Smith is benefitting from e-commerce trends, but Germany remains weak.

First-quarter trading update

Chief executive Miles Roberts said:

"The underlying drivers of demand for sustainable corrugated packaging remain strong and our leading offerings for highly resilient FMCG (Fast Moving Consumer Goods) and e-commerce customers give us confidence of volume and market share growth.

"While volatility in the macro-economic environment and input costs remains, our focus on pricing discipline, margin progression, enhanced cost and efficiency improvements, and cash generation, support our expectation of further good progress in the year."

ii round-up:

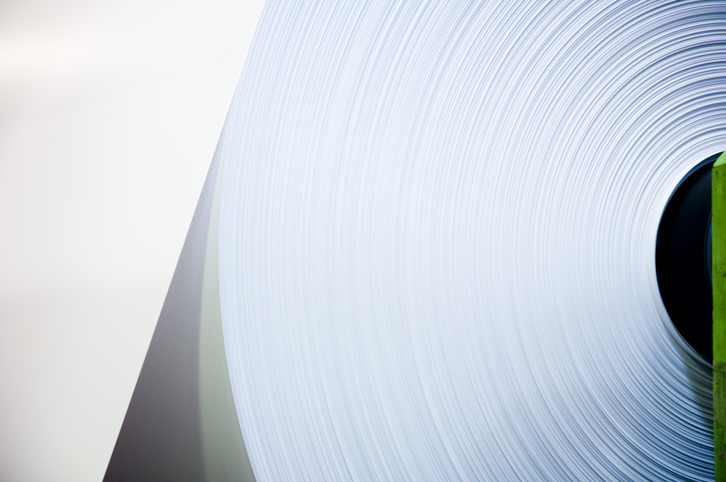

A maker of corrugated packaging, containerboard and a full-service packaging provider, Smith (DS) (LSE:SMDS) operates from more than 200 manufacturing sites. It also makes recycled paper and runs a recycling business - over 80% of all corrugated packaging sold is sent back to its paper mills for recycling.

Customers include Tesco (LSE:TSCO), Pets at Home (LSE:PETS) and Furniture Village.

In a typically brief trading update, DS Smith reported ongoing progress in its first quarter.

Customer pricing had remained strong, with management expectations for overall financial performance unchanged.

The integration of its previous Spanish acquisition Europac is progressing well, further underlining Smith's prior upgrading of estimated cost savings from €50 million to €70 million per annum.

The FTSE 100 company reiterated confidence in its resilient business model despite ongoing subdued volumes in some markets such as Germany.

The share price retreated by over 1% in early UK stock market trading.

ii view:

DS Smith offers investors exposure to the European and North American paper and packaging industry. Recent acquisitions have improved its network of paper mills both geographically and from a product perspective. Paper assets are managed to support its packaging operations, and the rapidly expanding online consumer market requires massive amounts of cardboard packaging.

For investors, management outlook comments pointing to volatility in both the macro-economic environment and input costs offer some caution, although management confidence in both volume and market share growth is reassuring. A prospective dividend yield in the region of 5% and covered twice by earnings is also attractive. So is a forward price/earnings (PE) ratio below the three and 10-year averages.

Positives:

- Exposure to e-commerce trends

- Expanding both its European and North American operations

Negatives:

- Volume weakness seen in some export-led markets such as Germany

- Group input costs are volatile

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.