ii winter portfolios 2018-19 deliver mega profits

Four months into this six-month strategy and both our winter portfolios are thriving, writes Lee Wild.

8th March 2019 15:55

by Lee Wild from interactive investor

Four months into this six-month strategy and both our winter portfolios are thriving, writes Lee Wild.

Finding a trading strategy that works 100% of the time is the Holy Grail of investing. We're not claiming to have found it here, and seasonal trading is not for everyone, but there is a statistical anomaly backed by decades of data that appears to shift the odds in the investors' favour.

Research shows that buying and selling at two specific dates of the year has historically generated better returns than if you had stayed invested all year round. Indeed, buying a portfolio of shares on 1 November and selling it on 30 April has significantly outperformed over the last 24 years and provides a clear strategy for investors.

Starting with £100 in 1994, investing only in the market between 1 November and 30 April every year would have turned the £100 into £327. By comparison, staying invested continuously would have grown the pot to £261 (excluding dividends), and investing only during the summer months would have left you with just £73 of the original £100.

We adapted the theory to design two portfolios for different risk appetites, made up of liquid FTSE 350 stocks that have regularly outperformed over the winter months. The Consistent Winter Portfolio is a basket of five shares that have risen every winter for at least the past decade. Stocks in the higher-risk Aggressive Winter Portfolio have risen during the same period 90% of the time. Both have now beaten the benchmark and been profitable each time since inception four years ago.

Overcoming the odds

Every year, the corporate, economic and political calendars appear littered with potential banana skins. With Brexit weighing heavily on investment in UK businesses and domestic shares, and a deadline of 29 March set just one month before the strategy ends, this year was no different.

The risk of a US interest rate mistake, rising bond yields, Donald Trump’s trade war with China and another Italian debt crisis featured high up a long list of headwinds. A major market sell-off during the fourth quarter of 2018 appeared to reduce the odds of maintaining our 100% success rate this time. But with just two months to go, an impressive recovery in 2019 so far has put both portfolios in a great position.

February proved a fruitful month for global equities, and receding fears of a no-deal Brexit have given a lift both to shares with a domestic focus and more defensive plays. The FTSE 350 benchmark index added a respectable 1.7%, but both our winter portfolios did better.

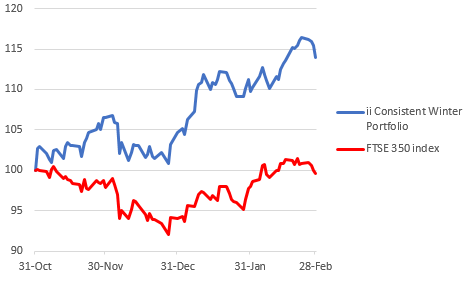

interactive investor Consistent Winter Portfolio

Continuing its impressive form, the Consistent Portfolio jumped by 3.9% in February, taking returns for the first four months of the strategy to 14%. The benchmark is down 0.4%!

Pub chain and brewer Greene King (LSE:GNK) remains the star performer. Still basking in the glow of a strong Christmas trading statement, a 10% gain last month takes total profit since 31 October to 37%. At least matching full-year profit forecasts seems a formality.

Little-known motorway barrier firm Hill & Smith (LSE:HILS) added 7% in February and is up 19% so far this winter. Shares in everyone's favourite blue-chip hotelier InterContinental Hotels Group (LSE:IHG) were up almost 4% for the month and nearly 10% for the strategy to date.

Kitchen supplier Howden Joinery (LSE:HWDN) had risen 26% between 20 December and late February, but full-year results were clearly an excuse to take profits. The numbers were largely in line with expectations, although gross margin and current trading volume trends were disappointing.

Speciality chemicals giant Croda International (LSE:CRDA) is an ever-resent in the consistent portfolios, and has risen every winter for at least the past 14 years. We've just had annual results, and weakness at the personal care division in 2018 is only partially offset by a special dividend. The shares are flat this strategy, but Croda is a class act and there's still time.

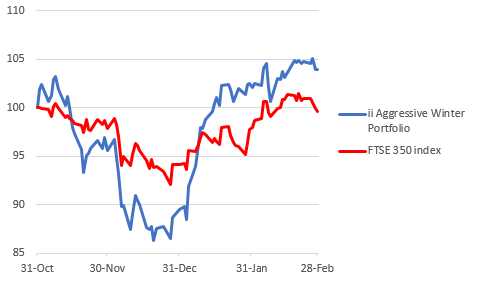

interactive investor Aggressive Winter Portfolio

After a difficult start, our Aggressive Winter Portfolio continues its impressive recovery. JD Sports (LSE:JD.), caught up in the panic around Britain's retail sector, dragged the portfolio down as much as 14% in the run-up to Christmas.

But confidence has returned in spades, and the portfolio, which includes Rightmove (LSE:RMV) and US-focused equipment hire giant Ashtead (LSE:AHT), has added 21% since. Now into positive territory, it returned 1.8% in February and is now up 3.9% for the first four months of the six-month strategy, excluding dividends.

Workspace provider IWG (LSE:IWG) added 2.9% last month and is now flat for the winter period so far. Heat treatment engineer Bodycote (LSE:BOY) has struggled, but prospects are improving.

Results published early March have impressed and the 10% share price rally will show up in next month's portfolio performance data. Numbers were at least in line with expectations, while the automotive business outperformed. A strong balance sheet has also bankrolled a special dividend of 20p a share, which will bump up the portfolio's total return!

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.