ii’s view on the top-performing FTSE All-Share companies

Several blockbusting performances with two investment trusts in the top 15.

14th December 2020 15:16

by Myron Jobson from interactive investor

Several blockbusting performances with two investment trusts in the top 15.

Despite the fact that the FTSE All-Share is down by 12% in the year to date (to the morning of 14 December 2020), there have been some blockbusting performances among some companies, although that is absolutely no guide to the future: one year’s winners can have a very different experience the following year.

A fifth of the top 15 FTSE All-Share companies were investment trusts with high US and/or Asian international exposure.

Richard Hunter, Head of Markets, interactive investor, says: “The pandemic has generally been an economic thorn in the side for UK investments yet, as is often the case, such periods of crisis can also throw out some winners.

“The best performing stock in the All-Share is AO World (LSE:AO.), the electrical products retailer, which is up by 296% (and 630% since its March low). Quite apart from its sales of major domestic appliances (such as fridges), smaller products have also enjoyed significant sales growth, as the enforced working from home environment has led to a spike in the purchases of small appliances, audio visual, computing and gaming products.

“In addition, the company is firmly of the belief that the growth in online purchases, particularly for its major domestic appliances, represents a permanent shift in consumer habits.

“Speciality drug company Indivior (LSE:INDV) is second, with the shares having spiked by 166% in 2020, although the move is relative. Currently embroiled in a £1 billion law claim from former parent Reckitt Benckiser (LSE:RB.) which has hung over the company for some time, the shares are currently trading at 104p, which represents a decline of 79% from the high of 490p which the shares reached in June 2018.

“In third place is Premier Foods (LSE:PFD), up 146% year to date. The company, whose brands include Mr Kipling, Sharwood’s, Bisto and Batchelors, has seen the benefit of stockpiling and stay-at-home cooking trends during lockdown. In addition, changes to its pension fund earlier in the year resulted in a surplus of £1.2 billion. Premier has enjoyed several consecutive quarters of UK growth, helped in part by a relaunch of Mr Kipling in 2018.”

Investment trusts

Asian focussed investment trusts accounted for two of the top performing FTSE All Share companies over the year to date, with Pacific Horizon in sixth place (up 135% over the year to date to 11 December), and JPMorgan China Growth & Income (LSE:JCGI) in thirteenth place, up 78%.

Baillie Gifford US Growth (LSE:USA) was in 8th place (up 115%), Scottish Mortgage (LSE:SMT) was in ninth place (up 98%), boosted by high US, Chinese and Asian exposure.

Allianz Technology Trust (LSE:ATT), in fifteenth place, is up 75% over the year to date and has around 84% in US stocks.

Dzmitry Lipski, Head of Fund Research, interactive investor, says: “These investment trusts have done staggeringly well, but we would remind investors how important it is to avoid chasing past performance.

“For example, we are huge fans of Scottish Mortgage and it has a place on our Super 60 rated list as an adventurous option. But with staggering returns over both short- and long-term, investors need to think about the risks, as well as the potential rewards.

“Its incredible track record was built on exceptional stock selection and preference for innovative and disruptive businesses – and many of these have been in the technology sector. However, that comes at the price of increased volatility, and strategies such as this could be best utilised as a satellite-growth engine within a well-diversified portfolio.”

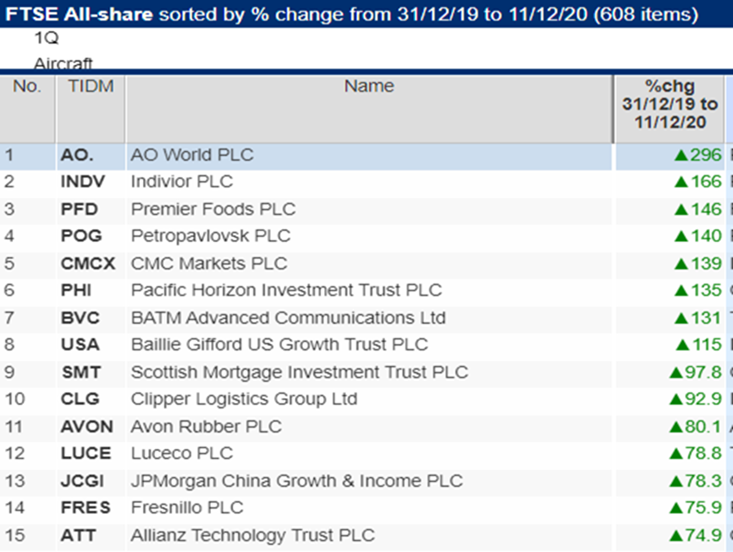

Top performing FTSE All Share companies over year to date to 11 December 2020

Source: SharePad to 11 December 2020.

Past performance is no guide to the future and the value of investments can go down as well as up and you may not get back the full amount invested.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.