Insider: CEO buys after opening for business again

Analysts believe this firm could be an industry consolidator. The boss is optimistic too.

8th June 2020 10:15

by Graeme Evans from interactive investor

Analysts believe this firm could be an industry consolidator. The boss is optimistic too.

With his car showrooms open for the first time in two months, Vertu Motors (LSE:VTU)boss Robert Forrester has wasted no time backing a recovery for the beleaguered sector.

The industry veteran picked up £30,000 of Vertu shares on 3 June at a price of 30p, which, prior to the Covid-19 crisis, would have been the lowest level for the stock since 2012.

The purchase was made on the day that Forrester revealed Vertu incurred losses of £20 million in April and May after being forced to close its 133 sales outlets across the UK.

Sites in England were allowed to re-open on 1 June, but the demand outlook for new and used vehicles is still hugely uncertain, with unemployment set to rise sharply and many new car production lines still closed.

Vertu, however, looks better equipped than most to weather the storm after growing cash balances to a higher-than-expected £44.7 million by mid-May. Its annual results last week also highlighted a number of key strengths, including well located dealerships, supportive banks and a robust digital presence.

The company is seen by analysts as the most likely to lead the consolidation of the sector, with Lookers one potential target following its recent difficulties. Forrester pointed out in the results that the group was well placed to take advantage of opportunities should they arise.

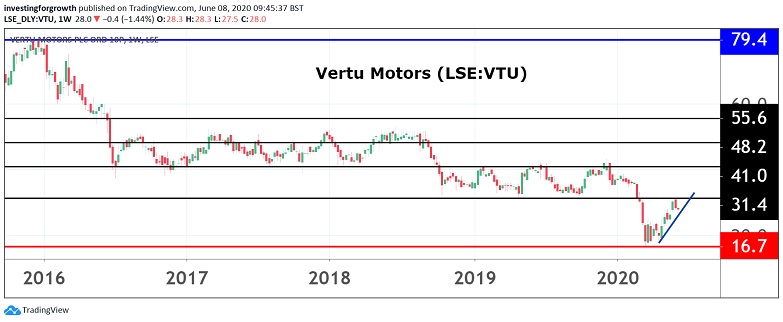

Source: TradingView. Past performance is not a guide to future performance.

Forrester has been with Vertu since it was created in 2006 as an AIM-listed consolidator of UK motor retail businesses, when the first major deal was the acquisition of Bristol Street Motors. It is now the fifth-largest automotive retailer in the UK, with annual revenues of £3 billion and 5,800 staff working across brands including Macklin Motors in Scotland.

Forrester's record - he was a director at Reg Vardy between 2001 and 2006 - means he's no stranger to dealing with industry downturns.

This one, however, has tested him like no other, with the lockdown taking place during the industry's most significant period for activity and profitability: “I have spent the best part of 20 years getting people into motor dealerships and the last two months effectively keeping them out,” he said last week.

- 25 years of AIM: how the junior market has become less risky

- Two fallen star stocks good enough to stage a comeback

- The Week Ahead: three FTSE 100 stocks to watch

Forrester has been a regular buyer of Vertu shares, although last Wednesday's purchase was his biggest since 2014. He also picked up £5,000 worth of shares in the days after the 2016 Brexit referendum threw the car retail industry into turmoil.

That purchase was priced at 44.5p, within the 30p to 50p range the shares have been trading at since 2016 — until the Covid-19 market turmoil sent the stock back to 20p in early March.

House broker Zeus believes that September's new number plate season will be pivotal to determining how Vertu and the rest of the industry performs post lockdown.

Government support in the form of a scrappage scheme could be significant, while Vertu has cited a survey by Auto Trader in which 56% of UK driving licence holders who don't currently own a vehicle said Covid-19 had made them consider buying one.

Forrester wrote on Twitter at the weekend that Saturday's sales were up on last year, with 638 retail deals that day and 2,624 cars sold in total since last Monday.

Zeus said after last week's results:

“While there are no doubt difficult trading months ahead, we believe Vertu has sufficient liquidity and support to come through this and fully reap the opportunities that lie ahead in a sector where significant capacity reduction is expected.”

Its confidence has been boosted by the £20 million losses for April and May being significantly better than the company's forecasts at the start of the crisis, with Zeus originally estimating £12 million to £14 million a month. Cash balances were up from the £30 million disclosed on 7 May, helped by the opening of service operations during some of the lockdown.

This ‘green’ stock just doubled

Vertu shares have fallen 2% since Forrester's purchase, whereas shares of AIM-listed Active Energy Group (LSE:AEG) have soared since its directors bought stock in the wake of the company's full-year results on 1 June.

The renewable energy business more than doubled in value at one point last week, with the results highlighting progress towards the company's goal of becoming a leading provider of next generation biomass fuels.

Its CoalSwitch technology produces biomass pellets that can be manufactured in various formulas as a substitute fuel for coal or traditional white pellets in power stations.

- The Ian Cowie Portfolio: how I’m receiving inflation-busting income

- IPO schedule for 2020 just got interesting

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Michael Rowan, who has been CEO since 2018, bought £9,000 worth of shares at a price of 0.45p, with recently-appointed non-executive directors James Leahy and Jason Zimmermann picking up £5,000 and £6,720 at prices of 0.5p and 0.7p respectively.

The stock started last week at 0.4p and peaked at 0.9p following the director purchases before standing at 0.8p this morning. It had been trading at 4p in 2018.

Analysts at Allenby Capital said:

“Under a new and highly experienced management team we now believe AEG has the potential to generate significant revenues and earnings over the course of the next several years.”

Source: TradingView. Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.