Insider: quick profit for retail sector chiefs

As Britain’s economy hit the buffers, those at the helm of our retail industry snapped up cheap stock.

1st June 2020 10:27

by Graeme Evans from interactive investor

As Britain’s economy hit the buffers, those at the helm of our retail industry snapped up cheap stock.

Retail bosses who bought shares in their own companies during the industry's darkest hour are sitting on sizeable gains now that lockdown restrictions have started to ease.

Greggs (LSE:GRG) CEO Roger Whiteside and the chairmen of Next (LSE:NXT) and McColl's Retail Group (LSE:MCLS) snapped up cheap-looking shares just as the shutters were coming down on the majority of UK shops.

Whiteside's £178,733 worth of Greggs shares bought in the week that the bakery chain closed more than 2,000 outlets are now worth £29,000 more following a 16% surge in value. McColl's chairman Angus Porter has seen the £18,750 of shares he bought on 24 March jump 80%, while Michael Roney is up £24,000 on the £100,000 of Next stock purchased the same day.

The paper profits generated by the trio are reward for their faith at a time when the industry was entering uncharted territory.

Perhaps more importantly, their purchases sent out a powerful message to shareholders, staff and the wider industry about the confidence of management in their respective companies weathering the storm.

The acquisition of £250,000 shares by Pets at Home Group (LSE:PETS) boss Peter Pritchard had just that effect last month after shares had fallen 15% in the wake of full-year results. Having benefited from lockdown sales of essential pet supplies, the company admitted in the results that demand had unwound in the first quarter of the new financial year.

Pritchard responded to the share price slump by buying 121,632 units at about 204p on 21 May, while chairman Michael Burke picked up £100,000 worth priced at 209p. The stock was trading at 241p a week later.

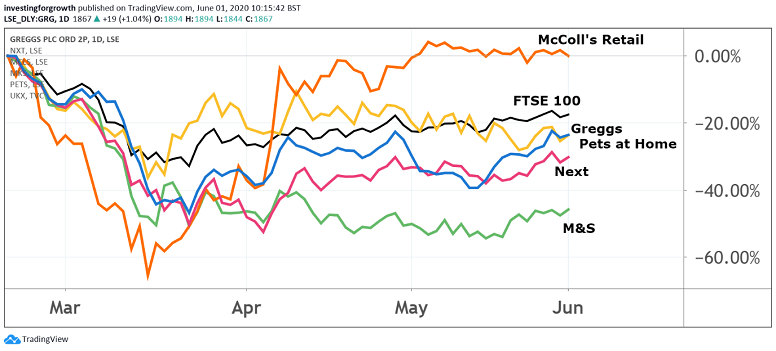

Source: TradingView. Past performance is not a guide to future performance.

Other recent purchases in the retail sector have included at Marks & Spencer (LSE:MKS), where non-executive director Justin King bought 20,000 shares at near to 95p on 16 April. The former Sainsbury's (LSE:SBRY) boss was joined by director Katie Bickerstaffe, who picked up the same number of shares at a price of almost 99p on the same day.

More than a month later, M&S shares are struggling to break clear of the 100p mark after full-year results included hefty write-downs on summer stock. Dividends are also off the table for the foreseeable future, although the ever-present promise of an M&S turnaround means the shares are still rated as a “cautious buy”.

In line with the rest of the retail sector, M&S shares fell 50% during the height of the market's panic over the coronavirus pandemic between 20 February and 23 March, which was the day PM Boris Johnson gave his order for Britons to stay at home.

- Ian Cowie: tomorrow’s big winners in Asia

- Shares for the future: why I’m losing sleep over these stocks

- The Week Ahead: Pennon, Young & Co, Wizz Air

Most stocks have been in recovery mode since then, with the roll-out of government assistance schemes and stimulus measures by central banks triggering an extraordinary rebound for markets worldwide.

The immediate focus for retailers was on conserving cash and shoring up balance sheets in case shops had to be shut for many months.

Greggs closed its 2,050 retail outlets, employing over 25,000 people, from 24 March. Whiteside, though, remained defiant as he told investors in a trading statement:

“Greggs is a resilient business with strong growth credentials and we should be confident of its ability to navigate this event and return to growth when the economy recovers.”

He backed up his words two days later by acquiring 11,251 shares at a price of 1,588p, compared with the near all-time high for the stock of 2,440p in February.

They have risen 16% since then, helped by the prospect of Greggs re-opening at least 800 stores by mid-June.

Two days after Next chairman Michael Roney bought his 2,546 shares at an average price of 3,906p, the fashion and homewares retailer announced it would not be taking online orders due to staff safety fears.

This update sent shares back to 3,390p over the following days, only for them to recover to 4,891p after online capacity was restored and CEO Lord Wolfson went some way to convincing the City that Next was better placed than most to withstand the crisis.

Under the worst-case scenario of Next losing £1.65 billion in annual sales, Wolfson pointed out that cost savings and other measures for generating and retaining cash should mean the company is still able to reduce year-end debt by more than £300 million.

- Global markets: the best and worst recoveries

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

McColl's has been able to keep its 1,400 convenience stores and newsagents open throughout the pandemic, enabling it to provide neighbourhood communities with essential food and toiletries. Over half of its customers live within just 400 metres of its stores.

Serving this local demand has made McColl's one of the best-performing retail stocks during the lockdown, with the share price trebling in value from a low of 15.5p on 16 March.

McColl's chairman Porter bought £18,750 worth of stock at 25p on 24 March, just after the company said in a trading update that its stores remained open. Those shares are now worth more than £34,000.

Even though the McColl's share price is back to where it was at the start of the year, board member Jens Hofma bought £40,950 worth of shares at 45p on 22 May.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.