Investing globally: where bargain hunters can find ‘sweet spot’

Research highlights an overlooked part of the global stock market that is trading at a 15-year low on a popular valuation measure.

14th May 2025 10:35

by Kyle Caldwell from interactive investor

For investors on the lookout for opportunities, an area of the global stock market that may pique interest among bargain hunters is medium-sized businesses, according to new research.

This area of the market, along with smaller companies, has been out of favour over the past couple of years. The big driver has been interest rate rises, which has led to higher bond yields. Given investors can pocket an attractive level of income from cash and the safest parts of the bond market – money market funds and UK gilts – there is less incentive for investors to take on greater levels of risk.

Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

However, with UK interest rates on the decline, last week dropping to 4.25%, the case for looking for higher growth opportunities within equity markets has strengthened. While only those with a crystal ball can predict what the new normal will be for borrowing costs, the outlook for cash in the years ahead looks less appealing than today.

Moreover, investors may be eyeing up potential valuation opportunities that have emerged following the recent pick-up in stock market volatility as markets react to US President Donald Trump’s tariff policies.

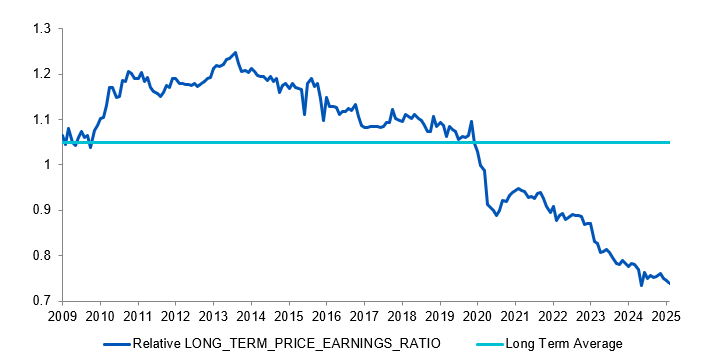

For those attempting to ‘buy low’, data from Aberdeen highlights that a potential ‘sweet spot’ in global equity markets is medium-sized business, known as mid-caps. The chart below shows that on the popular price/earnings (PE) measure mid-cap stocks are trading at the lowest valuations versus large-cap stocks since 2009. Moreover, this part of the market is trading well below its long-term averages. The comparison is based on the MSCI World Mid-Cap Index and MSCI World Index.

Source: Aberdeen, Bloomberg, to 31 March 2025

Global mid-caps, as defined by the MSCI World Mid-Cap Index, are also less exposed to the US stock market than large caps. The MSCI World Mid-Cap Index has a 62% weighting towards the US, compared with 72% for the MSCI World Index.

Anjli Shah, fund manager of abrdn Global Mid-Cap Equity, points out that this part of the market also carries less risk than smaller companies. This played out in the recent uptick in stock market volatility. Aberdeen’s analysis of Morningstar’s data shows that up to 27 April, the return year-to-date for the MSCI World Mid-Cap Index was -0.47%. This was a smaller sell-off than experienced by the MSCI World Index (-1.94%) and by the MSCI World Small-Cap Index (-4.10%).

Shahnotes: “For companies to have made it from small to mid-cap, they tend to have established and resilient business models while remaining nimble. Thus, mid-caps can potentially offer lower levels of risk than small-caps.”

'Elephants don't gallop'

Active fund managers face better odds of outperforming a passive fund when they invest in mid-cap or small-caps. These areas of the market are less covered by analysts, meaning there is more chance of an active manager gaining an edge by finding underpriced shares.

In contrast, larger companies are widely researched and followed by analysts, so it is harder for active fund managers to find hidden treasures among their investment universe, meaning they are less likely to get ahead of an index fund or exchange-traded fund (ETF) investing in larger companies.

To borrow a quote from the late Jim Slater, ‘elephants don’t gallop’. In other words, smaller-sized companies have more room to grow and greater ability to potentially produce higher returns for shareholders.

The trade-off is that smaller companies can be more volatile than their blue-chip counterparts.

For those looking for global smaller company exposure, abrdn Global Smaller Companies and Vanguard Glb Small-Cap Index are two of interactive investor’s Super 60 investment ideas. Other options outside of the Super 60 list include The Global Smaller Companies Trust (LSE:GSCT) and Smithson Investment Trust.

While a global approach would outsource the country decision-making, some investors may also want to take matters into their own hands by considering the opportunities in individual markets. In interactive investor’s Super 60 list, WS Amati UK Listed Smaller Companies is highlighted. Investment trust duo Fidelity Special Values (LSE:FSV) and Diverse Income Trust (LSE:DIVI), which invests across the UK market, have a bias to UK mid-caps and small-caps.

Other options often flagged by external experts include BlackRock Smaller Companies (LSE:BRSC), JPMorgan UK Small Cap Growth & Income (LSE:JUGI) and Aberforth UK Small Companies, with latter investing in ‘deep value stocks’.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.