Investing in this sector now gets you in pretty near the bottom

Our overseas investing expert spots an opportunity for investors as the US economy gets back to normal.

22nd April 2020 10:51

by Rodney Hobson from interactive investor

Our overseas investing expert spots an opportunity for investors as the US economy gets back to normal.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The American housing market took centre stage in the last stock market crash; this time it is a bit player and it should recovery faster and more steadily than it did last time.

The housing market debacle in the United States in 2007-8 was not directly the fault of the housebuilders, rather it was because banks with more money than sense were lending recklessly to home buyers who had no prospect of repaying the loans. The outcome was a glut of empty properties caused by high levels of repossessions and evictions.

It took five years to get back to normal, but then followed five solid years of growth. Rising prosperity during the second period of President Obama and financial stimuli from President Trump did the trick.

Some UK investors enjoyed the benefits indirectly: plant hire group Ashtead (LSE:AHT) reported continued strong growth for its Sunbelt US arm and proposed to seek bolt-on acquisitions, while building supplies provider Ferguson (LSE:FERG) consider switching its listing to New York to reflect better prospects across the Atlantic.

Now the coronavirus crisis has set everything back. Although Trump is trying to minimise the lockdowns, there is bound to be an economic impact that will reduce Americans’ ability to buy houses. New York, the most important financial centre, has been particularly badly hit.

However, The United States is a big country and large swathes have escaped relatively untouched by the pandemic, at least so far, and several companies quoted on the New York Stock Exchange offer the opportunity for investors to benefit as the US economy, and the housing market, get back to normal.

Investors should prefer companies with operations in a wide spread of states, as the sector can vary enormously in different parts of such a large country.

Also of concern is the collapse of the crude oil price. Lower oil prices are generally good for economies because they make the cost of producing and distributing goods less onerous.

In this case, though, the price has fallen so far that fracking has become seriously uneconomic. A key advantage that the US had, effectively reaching the point where it was self-sufficient in oil at prices below much of the rest of the world, has turned into a catastrophe in many oil producing states.

The US economy has held up better than most in recent years. It was the first major developed nation to come out of the last crisis and could well be the first out of this one.

If so, the housing market there will recover within a reasonable time frame, certainly much less than the five years it took after the last financial crash. Ultra-low interest rates will help the process. Investing now gets you in pretty near the bottom.

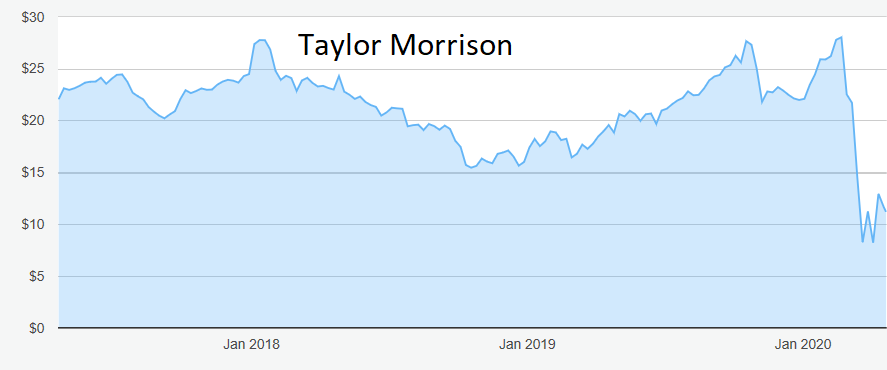

Taylor Morrison Home Corporation (NYSE:TMHC) is based in Arizona and operates under two well-respected brands, Taylor Morrison and Darling Homes, building a good mix of developments from first-time to luxury homes in eight states stretching from California to Florida. The shares slipped from $28 in Mid-February to just $7 a month later and still stand below $11.

Source: interactive investor Past performance is not a guide to future performance

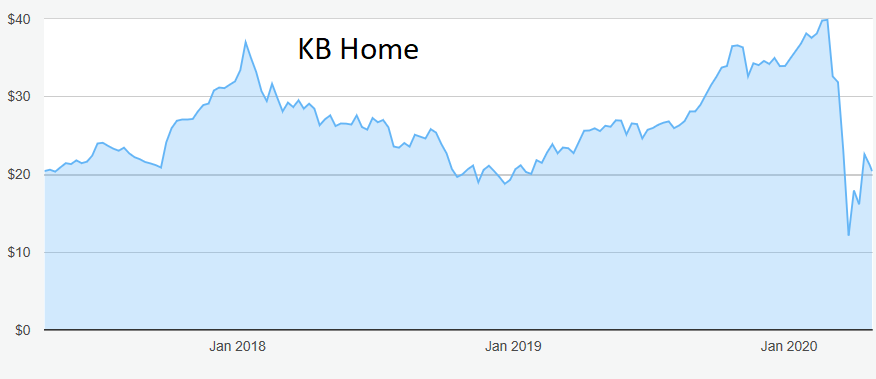

At around $20, KB Home (NYSE:KBH) stands at only half its mid-February level and it does pay a dividend, although the yield is only about 1.45% and the payout could be suspended if the coronavirus disruption persists. Like Taylor Morrison, it operates in eight states ranging from east to west coasts.

Source: interactive investor Past performance is not a guide to future performance

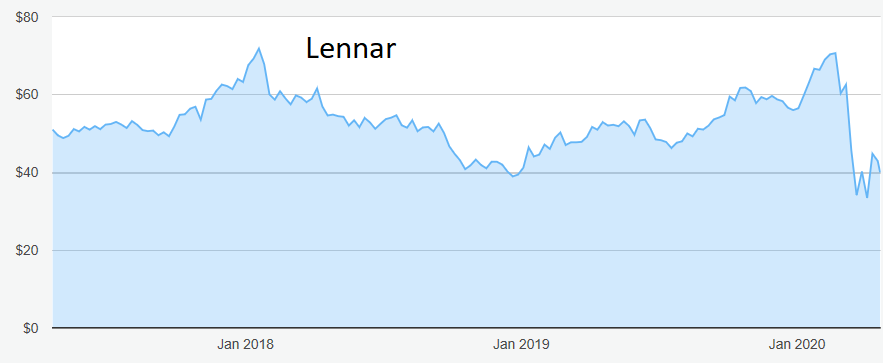

By merging with CalATlantic in February 2018, Lennar (NYSE:LEN) became the largest homebuilder in the US in terms of revenue. Its shares have so far recovered further than most in the sector, from $30 to $40, even though its yield now stands below 1%.

Source: interactive investor Past performance is not a guide to future performance

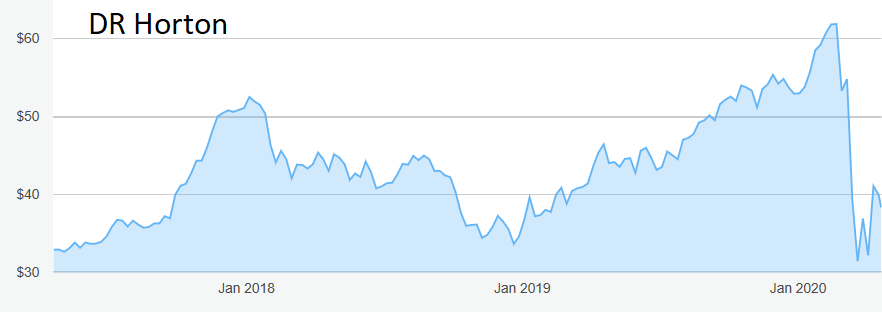

Dallas-based D.R. Horton (NYSE:DHI) offers the best yield at 1.7%.

Source: interactive investor Past performance is not a guide to future performance

Hobson’s Choice: Buy Taylor Morrison at up to $15.50, where the stock could run into resistance on the road to recovery. The equivalent figure for Lennar is $45. I wouldn’t be inclined to chase KB Home past $22.50 at this stage. I wrote in March last year that Horton looked the best in the sector and, at $38, the stock is down less than 10%. My advice from 13 months ago to buy up to $42 is unchanged. The shares have been as high as $62 but don’t expect to see that level again any time soon.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.