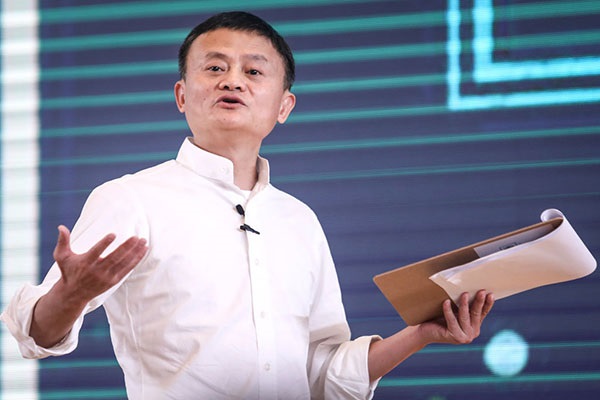

Jack Ma’s Ant Group IPO will smash records

Demand is high for the world's most popular digital payment platform and UK investors will benefit.

27th October 2020 15:33

by Graeme Evans from interactive investor

Demand is high for the world's most popular digital payment platform and UK investors will benefit.

A record-breaking IPO that should value China's Ant Group at an eye-watering US$313 billion will have more than just passing interest for UK investors next week.

The digital payments company, which was spun out of e-commerce giant Alibaba in 2011, is due to make its debut on the Hong Kong and Shanghai stock exchanges on Thursday, 5 November.

While accessing these markets may present challenges, FTSE 100-listed Scottish Mortgage Investment Trust (LSE:SMT) and New York-traded Alibaba (NYSE:BABA) are among the indirect options UK investors may want to consider for exposure to the Alipay owner.

Tech-focused Scottish Mortgage counts Ant as one of its biggest unlisted holdings - and the 15th largest overall - amounting to 1.9% of the £15.5 billion fund at the end of September. In addition, the Baillie Gifford flagship investment trust has Alibaba as its third biggest holding at 6.1%, behind just Amazon (NASDAQ:AMZN)at 7.9% and electric car maker Tesla (NASDAQ:TSLA) at 12%.

The Jack Ma-founded Alibaba is likely to retain a 33% stake in Ant, given that it is expected to buy shares in next week's stock market flotation.

Ant is poised to raise about $17.2 billion in Shanghai and roughly the same in Hong Kong, making the IPO much bigger than the $29.4 billion secured by Saudi Aramco last December. It is also bigger than the $25 billion raised by Alibaba in its own flotation in 2014.

- Ant Group: how to access this massive IPO

- McAfee IPO to take advantage of tech boom

- IPO boom: Airbnb, The Hut Group, Snowflake, Bumble, Ant Group

- Find out more about IPOs on interactive investor here

According to Reuters, the price tag for the Shanghai leg of the Ant listing has been set at 68.8 yuan ($10.27) a share and HK$80 ($10.32) per share for the Hong Kong tranche. That would be a multiple of 31.4 times Ant’s 2021 earnings and 24.2 times its 2022 earnings forecast, whereas Alibaba is trading at 34.3 times trailing 12-month earnings in Hong Kong.

There are now one billion monthly users of Ant's Alipay app, making it the world's most popular digital payment platform. It has also grown into other areas of financial services, such as wealth management and insurance.

The $313 billion valuation is $80 billion more than the current market cap of Nasdaq-listed PayPal Holdings and marginally ahead of Wall Street banking giant JPMorgan Chase & Co (NYSE:JPM). HSBC (LSE:HSBA), the nearest equivalent in London, is worth $65 billion.

Alibaba, which is China’s equivalent to US online retailing giant Amazon, has a market cap of about $830 billion. It generates revenues mainly by selling advertising and promotional services to third-party merchants that list products on its e-commerce sites.

There are several other UK-listed investment trusts where Alibaba represents a substantial part of their portfolios. They include JPMorgan Emerging Markets (LSE:JMG), whose 8% Alibaba weighting was its second biggest holding at the end of September.

And like Scottish Mortgage, Fidelity China Special (LSE:FCSS) has backed Alibaba since before its IPO in 2014 and today still has 9.2% of its assets in the e-commerce giant.

Ant's debut should provide another confidence boost for the new listings market after decent starts to life for Warren Buffett-backed data warehouse company Snowflake in New York and for London-listed THG Holdings, which trades as The Hut Group.

Investor appetite should be further tested in the coming weeks by potential Wall Street IPOs for cybersecurity firm McAfee and home rental company Airbnb.

- Baillie Gifford American: owning Tesla and more top stocks

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

James Anderson, joint manager of Scottish Mortgage, wrote earlier this month that the Covid-19 pandemic had failed to diminish the lure of the IPO.

In an article looking back on a year of coronavirus disruption, he told clients: “In the early days of the pandemic there was a general presumption that life would be very hard for unquoted companies. Yet by June the shift in mood was palpable.

“So many of our venture investments are digital first, often tugging at new frontiers from virtual medicine to financial system reinvention, that their businesses leapt forward in often dramatic fashion.

“Pandemic notwithstanding, higher not lower valuations proliferated in funding rounds. From the mighty, such as Ant Group, to the apparently troubled, such as Airbnb, the lure of the IPO returned.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.