James Halstead: Why this investor favourite must try harder

16th November 2018 16:42

by Richard Beddard from interactive investor

James Halstead is highly profitable, cash rich, pays a big dividend and is barely growing profit. Analyst Richard Beddard worries It may be a sheep in wolf's clothing.

Just writing this article feels treasonous. As a dedicated fan of AIM royalty, established family firms listed on the Alternative Investment Market like Churchill China, Dewhurst and FW Thorpe, it feels like there’s a company missing from the lineup. Arguably, it is the king: James Halstead.

As usual I am scoring James Halstead to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

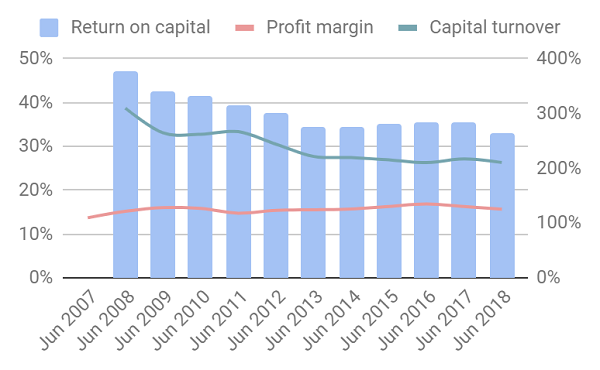

James Halstead has made good money for a long time. Last decade, when construction was booming, it made a return on capital of 40% or more. Since 2012, it has settled down to average 35%. Profit margins average 16%.

Source: interactive investor Past performance is not a guide to future performance

These are remarkable figures, even among the remarkable companies I follow, and especially considering James Halstead makes a product as prosaic as vinyl flooring, basically a combination of oil (ethylene, 43%) and chlorine (salt 57%) - among the most abundant raw materials on the planet.

The profit is real. Cash flow after capital expenditure averaged about 88% of adjusted operating profit, the company has £50 million in cash on its balance sheet and no debt. James Halstead's annual report contains this reassuring phrase:

"Prudence is less regarded by the accounting profession in the preparation of published accounts than it was even a decade ago but to us caution remains important."

So how does it do it?

Adaptable: How will it make more money?

Score: 1

It improves the product and the way it makes it. In the year to January 2018 Polyflor, James Halstead's principal commercial brand, launched what it claims is the largest new range by any manufacturer for many years.

It's called Palettone and comes in 50 colours. Polyflor also introduced Polysafe Verona, which is slip resistant and pure in colour so it doesn’t confuse people with dementia, and Polyflor Wovon, interwoven tiles that are a low maintenance alternative to textiles.

James Halstead introduced new ranges for its other brands too: Karndean (aimed at the wholesale market) and Expona Domestic (aimed at the residential market).

Although Polyflor addresses many requirements, some of them quite specialist, in most cases one company's vinyl is much like another's. If James Halstead has a superpower, it probably resides in the sales department. The company deals with end users and specifiers (architects and designers), who it supports with a full design service. Going direct to the end user means it can drive a harder bargain with the distributor, treating it effectively like a delivery service rather than a sales agent.

James Halstead exports all over the world and In Western Europe, Australia, New Zealand, Canada and India it controls the distribution network in this way. It is planning to extend its Hong Kong sales operation into China and other Asian markets.

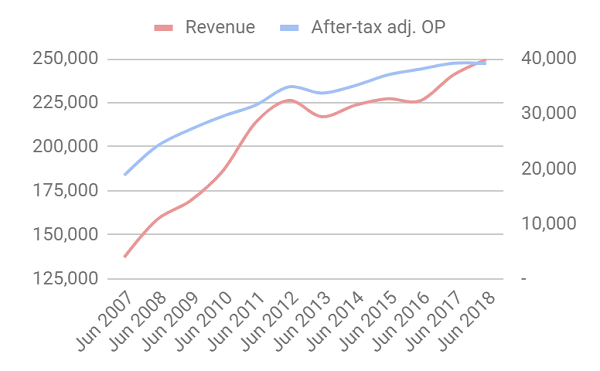

I wonder, though, if it is doing enough to grow. Profit growth has slowed in recent years and flat-lined in 2018:

Source: interactive investor Past performance is not a guide to future performance

The company says increased raw material costs nullified the benefit of a weak pound, and the £2 million cost of trials, samples, and marketing materials to launch Palletone dragged on profit.

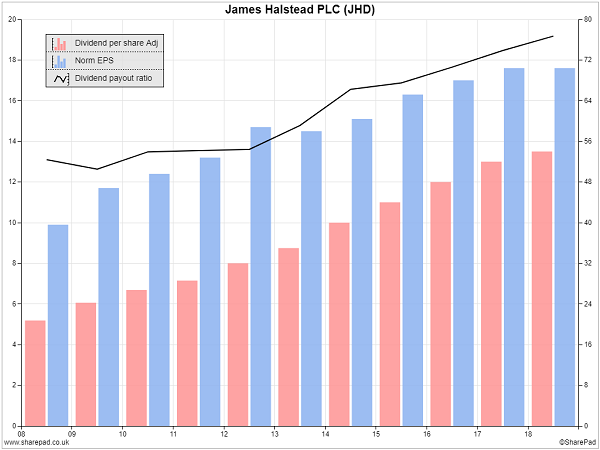

But I think James Halstead has become quite conservative. In 2018 it paid out almost 80% of its profit in dividends, a ratio that has risen steadily (black line):

Past performance is not a guide to future performance

Money paid out, cannot of course be invested to grow the business.

That said, James Halstead has £50 million sitting on the balance sheet so it has money it could invest and it has shown ambition this year. As well as a major product launch, it bid for Airea, a listed carpet tile manufacturer, which, the company says, was the most public of a number of acquisition opportunities, none of them fulfilled.

Resilient: What could go wrong?

Score: 1

The company's direct relationships with end users and specifiers probably gives it an advantage, but I wonder about trends in the flooring business.

James Halstead has shown an interest in diversifying into carpet tile and in this year’s annual report, chief executive Mark Halstead says:

"In recent years a lot of competitor focus has been in the area of luxury vinyl tile but vinyl sheet continues to be a large sector of the market."

According to market researchers the luxury vinyl tile market is growing faster than luxury vinyl sheet, although sheet is more water and slip resistant, and easier to clean, so it will always have a market in places like hospitals, laboratories and schools, for example.

James Halstead sells luxury vinyl tile, but unlike Palletone and the other sheet ranges, it does not manufacture tiles. I do not know whether that makes the company less competitive in the faster growing market, but it could be that James Halstead is at a delicate point in its lifecycle.

To grow it must diversify, but if it diversifies it becomes more like its competitors, which tend to supply a wide range of flooring products. As a specialist, Halstead has thrived.

I hold my hands up when it comes to Brexit. The closer we get, the more unfathomable it becomes. James Halstead earns about 44% of revenue to Europe and Scandinavia, and a further 33% of revenue in the UK. It also imports raw materials from Europe. Obviously it would be affected if trading conditions deteriorate.

Equitable: Will we all benefit?

Score: 2

I think James Halstead is a customer-focused firm. Its commitment to prudent accounting and paying a big dividend make it something of an investor favourite too.

It is also probably a good place to work. The company says it places great emphasis on attaining a knowledgeable and experienced workforce, it has operated an employee share scheme since 1980, and Polyflor boasts two clubs, one for employees who have served more than 25 years and one for employees with more than 40 years service.

Mark Halstead has been chief executive since 2002 and Gordon Oliver joined as financial controller in 1987, becoming finance director in 1999. The two men are very well paid, but at least the share option scheme spares shareholders the worst excesses of modern Long-Term Incentive Plans!

Cheap: Is the firm's valuation modest?

Score: 0

Nope. The shares cost about 21 times adjusted profit. To my mind that's a growth rating for an income stock (the dividend yield is 3.5%).

I feel I ought to like James Halstead more than I do, but a score of 6/10 means I don't think it is a compelling long-term investment even though it is a very strong business.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.