Lloyds Bank shares could rally – but does more pain come first?

The bank’s share price could recover to 50p, according to this analyst, but might fall before it does.

1st February 2021 08:44

by Alistair Strang from Trends and Targets

The bank’s share price could recover to 50p, according to this analyst, but might fall before it does.

Lloyds Bank

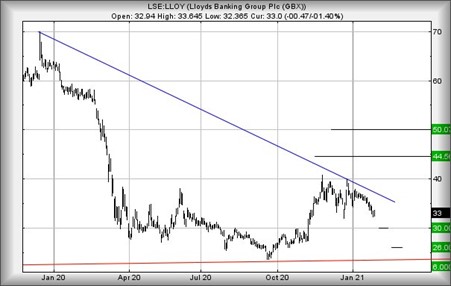

When we last reviewed Lloyds Bank (LSE: LLOY) three weeks ago we were pretty confident a break of 34p would drive reversal to an initial 30p, with secondary, when (or if) broken, at an eventual bottom of 26p. The share price broke below our trigger level five days ago and is grudgingly moving down to our target level. It needs to exceed 38p simply to escape the immediate reversal cycle, something we're not inclined to hold our breath for.

Visually, it's still the case that an eventual 26p makes quite an attractive entry point, if the price ever gets there! The pace of reversal, so far this year, has been steady but very, very, slow.

It's probably important to remember things risk speeding up fairly soon. US earnings season reports risk causing trouble. Companies have been issuing repeated profit warnings due to earnings being squeezed during 2020.

- UK bank shares: best opportunities in 2021

- Will this Covid-19 news rock Lloyds Bank’s share price?-

- Why reading charts can help you become a better investor

The coming week has results from BP (LSE:BP.), Exxon Mobil (NYSE:XOM), Otis and ScottsMiracleGro (NYSE:SMG), alongside a bunch of scientific and online retailers. The obvious question is: will negative reports be balanced by positive reports from eBay Inc (NASDAQ:EBAY), Pfizer (NYSE:PFE) and Alphabet's (NASDAQ:GOOGL) positive earnings?

For Lloyds to exceed 38p it would break the immediate blue downtrend, meaning the share could recover to an initial 44.5p with secondary, if bettered, a fairly cheerful 50p. As mentioned previously, moves this year tend to suggest 26p shall prove irresistible.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of interactive investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.