Will this Covid-19 news rock Lloyds Bank’s share price?

The banking group – and the FTSE – seem so far unaffected by the worsening pandemic.

14th January 2021 08:24

by Alistair Strang from Trends and Targets

The banking group – and the FTSE – seem so far unaffected by the worsening pandemic.

Lloyds Banking Group

News of Britain recording its highest-ever daily Covid-19 death count, taking the country to an unenviable second worst in the world. was shocking.

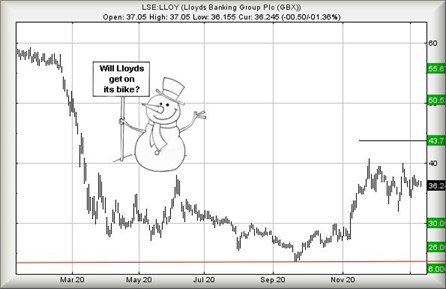

Surprisingly, reports of UK fatalities being over 100,000 did not appear to panic the markets or futures. But we're interested in the share price of Lloyds Banking Group (LSE: LLOY), because it has effectively stopped moving again.

When we last reviewed Lloyds, we had a demand that the price exceed 41.5p to assure our software it was about to move.

Unfortunately, this number has been entirely absent so far in 2020, and we are starting to wonder if it shall prove a forlorn hope. We'd suspected negative news would risk trashing the Lloyds share price, but thus far Boris & Co's successful efforts at producing an almost world-beating mortality rate have failed to shock the FTSE.

- UK bank shares: best opportunities in 2021

- Most-bought FTSE 100 shares of 2020

- Why reading charts can help you become a better investor

In-house, we expect a seasoning of poor income level reports would be required to spook the index.

For Lloyds the immediate situation looks risky, with movement below 34p risking triggering reversal to an initial 30p. If broken, our secondary calculates down at 26p and we'd hope for a bounce, yet again, if such a number makes an appearance.

The other side of the coin is slightly more encouraging, the share price now needing above 40p to trigger a (visually unlikely) movement toward an initial 43.7p. Secondary, if exceeded, would work out at a slightly more encouraging 50p.

The chart confirms Lloyds’ share price is in a sticky situation, but at least our software isn't really projecting a further crash, just a scenario where the share remains trapped between a rock and a hard place.

If it all intends go horribly wrong for Lloyds our 'ultimate bottom', the level we cannot calculate below, comes in at 6p. At present, nothing looks capable of provoking this level.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of interactive investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.