A new electric vehicle boom starts now: back these shares

22nd October 2021 10:16

by John Burford from interactive investor

With the COP26 climate conference almost upon us, our chartist analyses the electric vehicle stocks that are ripe for major advances, and which could change the world for good.

I have been following the ups and down of the budding (second) wave electric vehicle (EV) revolution with great interest, with Tesla being the flagship EV company.

It appears with so many start-up companies in this sector, we are spoiled for choice, just as we were 100 years ago or so with the budding internal combustion engine (ICE) revolution.

Recall back then, there was a great battle between electric vehicles and the new-fangled petrol and diesel-powered vehicles and, at one time, it seemed EVs would win out. In New York City around 1900, more than 50% of the taxis were EVs.

- Invest with ii: Most-traded US Stocks | Sustainable Investing Ideas | Share Tips & Ideas

But the battle was eventually won by the ICEs as they offered major advantages over the EVs of the time - no range anxiety there, with gas stations proliferating across the US. EVs then had a range measured in a few miles. How times change! The boot is now firmly on the other foot.

There is little question that EVs are now here to stay, but only after Tesla was the first to come to market in 2009 and continued to lose money for years. But it turned the corner and is now profitable.

EVs do offer many advantages, such as (hopefully) lower maintenance costs, an easier ride - and that is a key motivation for motorists to go EV.

- Tesla makes record profit, but what do the experts think?

- Tesla and the electric car revolution

- Want to buy and sell international shares? It’s easy to do. Here’s how

We are at the early stages of the Second EV Revolution. Many will be called but few will be chosen. Share selection will be critical. Many start-ups will not make it.

Today, I believe we are at a point where many EV, battery and charging companies are poised for major share advances after much price consolidation. I believe the timing is right to make trades/investments now.

I am covering here just a few of the most promising set-ups. Four out of the five below have made what appear to be complete corrections in three waves and so are ripe for major advances now.

Tesla

I have updated my Tesla (NASDAQ:TSLA) coverage for Chart of the week recently.

Past performance is no guide to future performance

We are in the final wave 5 up to take it above the all-time high at $900.

Chargepoint Holdings

This US company provides charging points across the country. Just as so many in a new sector have found, there are many bumps on the road to riches - and ChargePoint Holdings (NYSE:CHPT) has had a few.

Past performance is no guide to future performance

But the set-up looks compelling, with the a-b-c corrections and the large month-on-month divergence here. I like the lower trendline that should mark major support.

With the September car sale data showing Tesla was the biggest UK seller, and a similar performance in China, confidence in EVs is surely rising and that should benefit this company. Range anxiety is one of the biggest fears for drivers contemplating an EV and charging stations will surely get an installation boost from this data.

A good break above the small upper trendline should confirm the start of a major advance. My first target is $21.50 and then a test of the all-time high at $49.

- Climate change report: the key takeaways for fund investors

- COP26: five top share picks that are climate leaders

- Subscribe to the ii YouTube channel here for all the latest interviews and analysis

Lithium Americas

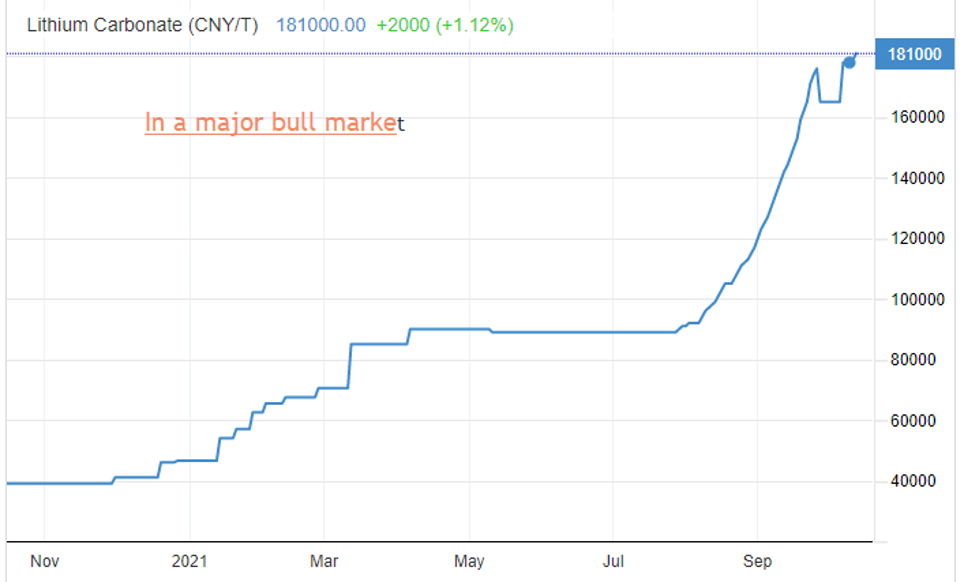

Lithium Americas (NYSE:LAC) is a small Canadian lithium miner with operations in Argentina and the US. Just to give some idea of the scale of operations in today's world of lithium mining, the company has just announced an expansion of the capacity of its Nevada play of 14 million tons of lithium carbonate grading at a minuscule 2 parts per million. You literally need a microscope to see it! But with lithium prices zooming - see below - it is likely to be very profitable.

Past performance is no guide to future performance

The market has already responded to the bullish fundamentals but there should be plenty of room for more. But keep in mind mining companies are notorious for the huge price swings as surveys come in either a dud or a Home Run

The sceptical should note Mark Twain's definition of a mine - a large hole in the ground where investors pour money, and his quote: “A gold mine is a hole in the ground with a liar on top.”

Of course, successful lithium mines are already producing profits and should continue to do so.

Past performance is no guide to future performance

With the caveat that huge swings are possible, this share appears to be poised for major advances to new highs.

NIO

This Chinese auto maker aims to be the first really smart EV (whatever this means!) and is appealing to the trendy set - just as Tesla is currently doing. But NIO (NYSE:NIO) is not really an auto maker - it partners up with the manufacturers using its designs with high-tech spec. It is the 'Apple' of the EVs.

With its first profit seemingly a little distance away, an investment here is a punt on its ability to do a 'Tesla', who laid the ground for high tech EV companies to lose money for years before turning the corner.

Past performance is no guide to future performance

Yet despite the problems of a near bankruptcy and others, the shares have held up remarkably well and points to major advances ahead when the good news starts rolling in, such as expanding sales.

My first major target is the $55 region.

- Volvo IPO: everything you need to know

- The great investment strategies: growth investing

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Blink Charging Co

This is another US EV charging operation, smaller than Chargepoint, but because the US is such a very large country, there is plenty of room for several operators taking on different sectors.

Past performance is no guide to future performance

A glance at Blink Charging Co (NASDAQ:BLNK)’s chart above reveals a down-sloping wedge formation and a clear a-b-c wave pattern, similar to Chargepoint’s. This should not be surprising as they have both encountered the same hurdles such as the prospect of running out of cash. Not to mention the technical difficulties inherent in designing a very fast charge unit that would help allay anxieties over re-charging times on long journeys.

My first major target is $40 region.

Toyota Motor Corp

This venerable Japanese car maker is heavily involved in the EV revolution and is a major battery designer and producer. Toyota Motor Corp (NYSE:TM) has ambitious plans to expand battery operations in the US.

Note how the shares were stuck in a five-year range until the Corona Crash of last year, which seemed to signal a wake-up call to investors that the ICE era is transforming into the EV era.

Past performance is no guide to future performance

This company is famed for producing best-selling vehicles over the years and odds are they will continue to do so. Of course, it is no rocket-ship Tesla, but more of a ‘steady as she goes’ share. Oh, and it produces a dividend (unusual for this sector).

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.