Nine investment trusts on big discounts

Three months in, we check up on our list of discount investment trust opportunities...

3rd May 2019 15:35

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Three months in, we check up on our list of discount investment trust opportunities...

Sweet or sour?

In our February article 'Sweet Treats', we launched our portfolio of discount opportunities - trusts we felt had the potential to see their discounts close significantly and, in turn, supercharge investors' returns. Our portfolio has had a good beginning to its life, with the majority seeing their discounts close slightly in the almost three months since, aided by a good period for the markets.

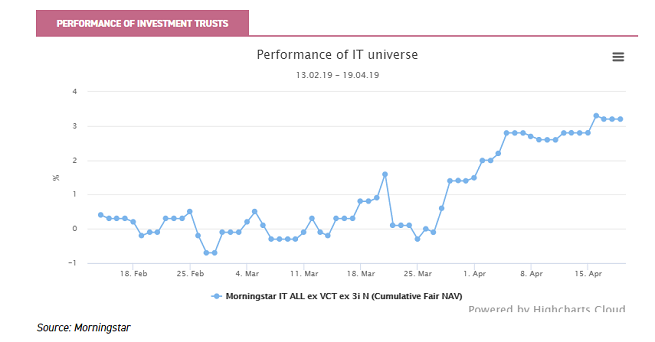

The investment trust universe has seen its average price rise by 3.2% since 13 February, as the below graph shows. We can trace the rally in the market to the meeting of the Federal Reserve's interest rate setting body, the FOMC, on the 20 March. Shortly after that meeting, global equity markets began their rise, as investors lowered their expectations for future interest rates.

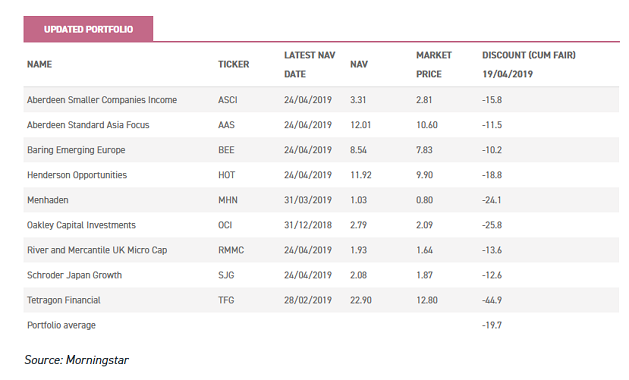

Our eight trusts have outperformed this rising market on average, thanks both to superior NAV returns and the closing discounts. The average share price rose 4.5%, and the average discount narrowed on our portfolio by 0.5%, significantly higher than the 0.2% on the IT universe as a whole. Here we analyse the movements in the trusts' discounts and share prices since our last review, before adding a new opportunity to the list in a new sector.

Portfolio aims

As a reminder, our aim in running this portfolio is to profit from exceptional value opportunities we see in trust's discounts.

The ability to pick up shares trading on a discount to net asset value is one of the distinctive opportunities which closed-ended funds offer.

Of course, trusts can trade on a discount for many reasons and some of them are justified, but the share price movements of investment trusts are subject to the same biases and inefficiencies which the shares of all companies are – they tend to overreact to news and trends tend to be taken further than fundamentals would warrant.

This means that they often throw up opportunities for the value-minded investor who has enough patience to wait for the unjustified discount to close.

The chief benefit to this is accelerating returns: a trust which sees its NAV rise and its discount close at the same time can generate extremely attractive returns, with a similar effect to being geared in a bull market.

But buying on a discount can also give a greater margin of safety on the downside. Once the bad news is priced in, the chance of a discount widening further diminishes and the likelihood of board action to support or close the discount increases.

This portfolio represents the best opportunities we see for relatively short-term gains boosted by discount movements. We view these as "satellite" positions around our core picks for growth, income and growth and annuity income, which we view as being the building blocks of a hypothetical portfolio of investment trusts.

The trusts are, when selected, trading on wide discounts (at least 10% in absolute terms), which we think have the potential to close over the short-to-medium term, but most importantly, have the potential to produce attractive NAV returns (in relative or absolute terms) as well.

Our original eight trusts are an eclectic bunch. This is unsurprising at this current late point in the economic cycle. The average discount on the IT universe has come in from around 16% in 2008 and 8% in 2012 to around 2% at the time of writing.

As such, opportunities tend to be in more idiosyncratic situations, largely to do with governance or management of the company or a highly specific, specialist asset class.

Performance review

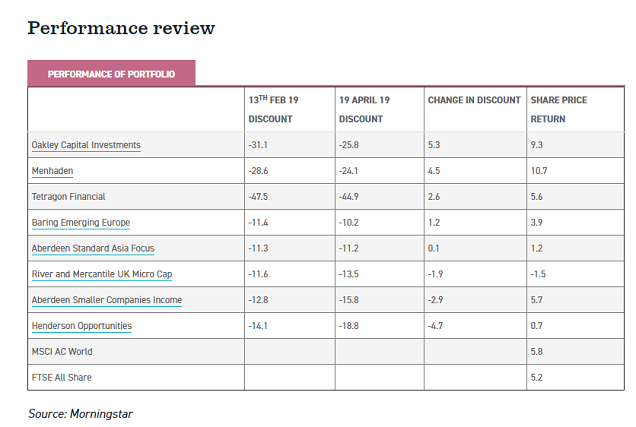

While three of our eight trusts have seen their discounts widen, in two of these cases we believe this is purely a result of share prices having failed to keep pace with a sharp rally in the NAV.

Aberdeen Smaller Companies (LSE:ASCI) and Henderson Opportunities (LSE:HOT) have seen share price rises of 5.7% and 0.7% respectively, but the discounts have widened by 2.9% and 4.7% making these discount opportunities even more of an opportunity!

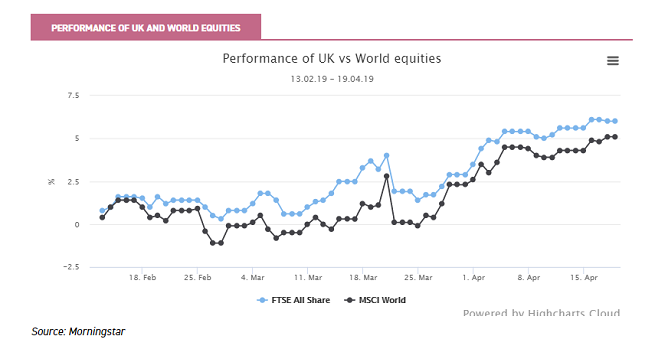

It seems that the cloud of uncertainty around the Brexit process has meant that investment trust investors remain sceptical of the sharp rally in the UK equity market.

In fact, UK equities have outperformed the global market since 13 February, with returns of 6% for the FTSE All Share compared to 3.5% for the MSCI World.

We would interpret the results from ASCI and HOT as highly favourable so far, with the managers of both trusts generating market beating returns, but investors not yet giving them the benefit of the doubt. As such, both trusts have become even more attractive in our view.

In the case of Aberdeen Smaller Companies Income, we continue to believe that the change in management last year could lead to a re-rating. Since September 2018, the trust has been run by Abby Glennie, one of the two UK small cap managers in the Standard Life Smaller Companies team, which has an outstanding track record of generating strong total returns with a quality growth style.

Abby works alongside Harry Nimmo, whose Standard Life Smaller Companies Trust trades on an 8% discount, but has frequently traded on a premium when UK small caps are more in favour. ASCI's process has moved toward alignment with Harry's, with the only differences coming from the income skew of the mandate.

Henderson Opportunities Trust, on the other hand, we view as more of a Brexit rebound play or at least one to hold until the next cyclical rally in the UK. The trust, managed by James Henderson and Laura Foll, has a tendency to be significantly geared, run high levels of small and mid-cap exposure and has cyclical and value tilts.

The shares and the discount have been highly volatile in the past, and we think this is one that could trade at par when investors next seek geared exposure to a bull market.

The other trust which has seen a widening discount, River and Mercantile UK Micro Cap (LSE:RMMC), has also seen a slight rise in NAV but a share price fall of 1.9%. Whether this widening discount is thanks to a lack of investor appetite down to Brexit related fears, or thanks to dissatisfaction from existing holders (at the AGM held on 27 February, two resolutions passed with substantial dissenters (around 21% of shareholder voted against the two resolutions)) it is hard to tell.

In our view, neither is a particularly relevant factor, and does nothing to alter our view that the investment thesis remains intact. Competitors Miton UK Microcap (LSE:MINI) and Downing Strategic Micro-Cap Investment Trust (LSE:DSM) both trade on discounts of around 1000bps narrower, despite significantly worse performance over all time periods.

As readers may recall, RMMC saw its discount widen out following the dismissal of former manager Philip Rodrigs in December 2017. However, his replacement, George Ensor, has worked on the trust since it launched, and the investment process is relatively well defined, being based on a number of screens which River & Mercantile use across their funds.

We continue to believe it makes little sense for the trust to trade on a wider discount than the micro-cap (as well as the UK Small Companies) peer group.

RMMC specialises in an area with few options, and there is scope for a much higher rating when appetite towards UK small caps recovers.

Turning to those trusts which have seen their discounts close, the three biggest movers were those trusts originally on the three widest discounts – albeit not in that order.

The most significant has been Oakley Capital (LSE:OCI), which has seen its discount close by 530 basis points. Since we highlighted the trust it has posted strong results for 2018, with NAV total return up 9.4% from the previous 30th June 2018 NAV.

In our recent note, we highlighted that the trust has generated strong long-term NAV total returns, and has outperformed the FTSE All Share over three years. Being a directly invested private equity fund, the portfolio is highly concentrated and subject to single stock shocks (both positive and negative).

However, recognising the persistent discount, the board has implemented a number of reforms to attempt to tackle it, including a commitment to never issue shares at a discount to NAV, greater disclosure of underlying portfolio companies, investor meetings and capital markets days, and a renewed commitment to buy back shares. In addition, the manager tells us that the AIM listing is also being reviewed.

The most recent buyback was on 15 March, when 404,100 shares were repurchased, or 0.2% of share capital. We think the discount move so far is a validation of our original thesis, and with the average discount on the listed private equity sector 800bps narrower than OCI's current discount, there is plenty more potential to aim for.

Menhaden's discount has narrowed by 4.5% since Valentine's day, thanks to a sharp share price rally in the second week of April. When we covered the trust in early February, we noted press rumours of a potential sale of the trust's largest investment, X-Elio, worth 19.1% of the portfolio. As we understand it, the holding has been the subject of a bidding contest, with the announcement of the winner expected in this post-Easter period.

Part of the discount narrowing could be a result of investors anticipating a successful conclusion of this process, and (possibly) an uplift to the valuation on the sale. As we highlighted in our February update, we believe the trust has undergone a significant evolution, and is no longer simply a "green" fund, but rather a value fund with a strong sustainability tilt to its investment process.

Performance has significantly improved, with the trust up 14.5% in NAV total return terms over a year, compared to an AIC Global sector average of 10.2%.

The share price has risen by 18.2% over one year, reflecting the narrowing discount. Having a highly concentrated portfolio does present NAV risks, and there is potential discount / share price risk if we receive any adverse news on the potential X-Elio sale.

However, over the medium term, we see further discount tightening as likely, particularly given the continuation vote due in May 2020.

Tetragon (LSE:TFG) is the third trust to have seen substantial discount tightening already, of 2.6%. As we have previously highlighted, it is a complex vehicle, which may have contributed to investors steering clear in the past.

The portfolio includes a diverse number of "alternative" strategies, such as those investing in convertible bonds, event driven equity strategies, and bank loans. It also owns stakes in a number of asset management companies (30% of NAV), many of which manage the company's capital.

The variety and the types of strategies should mean that NAV is uncorrelated to equity markets, we believe, which together with the historic return profile (consistent double-digit NAV total returns), if repeated, make this a highly attractive investment.

The complications with Tetragon include the corporate governance angle – Tetragon's principals Reade Griffith and Paddy Dear have a controlling shareholding, as well as relatively high fees. In our view, although there are complications, there is a price for everything, and the discount of 47% on a portfolio of uncorrelated assets which have delivered solid returns in the past is too wide.

Baring Emerging Europe (LSE:BEE) has seen its discount come in by 1.2%. It now sits at 10.2% but was as low as 8% at the end of February after a sharp rally in the NAV.

We still think the likely continuation vote provides comfort on the downside. By our calculations, the shares need to trade on an average discount of 7% or less until 30 September to avoid a tender offer early next year, which should mean the discount doesn't widen much further in the interim. We also think there is huge potential in this portfolio purely on an NAV basis.

The Emerging Europe market is deeply out of favour, with the MSCI benchmark trading on a forward PE of just 6.8 times. Meanwhile, manager Matthias Siller has generated more alpha against the benchmark over three and five year periods than all but one trust in the global emerging markets sector.

Aberdeen Standard Asia Focus (LSE:AAS) has seen the smallest discount movement since February, with a marginal 0.1% movement. The share price has also been relatively dull, with a 1.2% gain.

This is unsurprising given the return of risk appetite to markets which has seen the MSCI AC Asia Pacific Index rally 4.7%. AAS has a quality tilt which is more in demand in struggling or sideways markets and means it is relatively light on cyclicals and economically sensitive stocks which are the quickest to move in rallies.

We still believe that the next few years in Asian markets are likely to be more favourable to the trust than the last few, which saw growth and momentum styles dominate.

Furthermore, the main reasons for expecting a re-rating remain intact. Hugh Young, one of the most experienced fund managers in the market, was named lead manager in November as part of an overhaul requested by the board.

The number of holdings has been cut and the concentration in the highest-conviction names raised, and we believe these changes increase the chance of significant outperformance in the future. As such, the discount of 11.2% looks unwarranted relative to the sector weighted average discount of 4.9%.

A new pick

While we are pleased with the results so far from our picks, none of the discount movements have been close to what we believe is their full upside potential. In the case of the three biggest movers, Oakley, Menhaden and Tetragon, they remain on exceptionally wide discounts relative to peers which we think are unwarranted and have significant potential to close further.

As we have explained above, in the case of the three laggards, widening discounts have occurred despite rising NAVs, and we would expect the share prices of the trusts to catch up with the market eventually.

However, we recognise the possibility that in the short term the ongoing uncertainty around Brexit may lead to these discounts being more volatile. We are comfortable with all three picks, nonetheless.

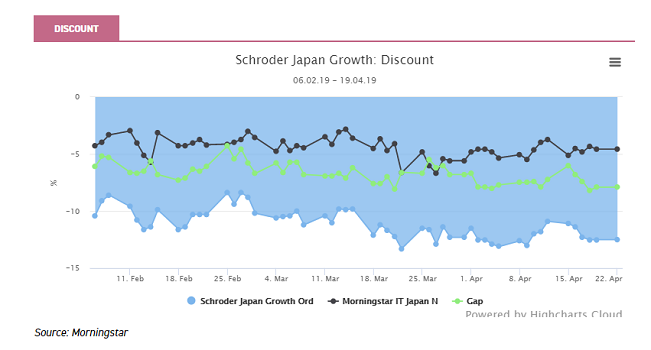

We have decided to add Schroder Japan Growth (LSE:SJG) to the Discount Opportunities Portfolio. It has been managed by Andrew Rose since November 2007, but in February 2019 he announced he would be leaving the industry this June. This has led to the discount widening significantly.

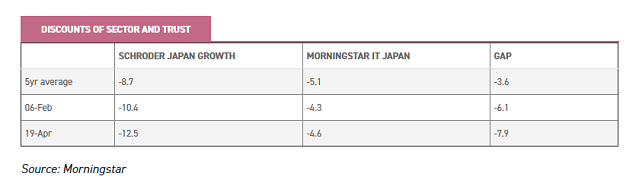

According to Morningstar data, since the 7 February, the trust's discount has widened from 10.4% out to 12.5%. Over this period of rising risk appetite, the gap between the trust and the sector’s discount has widened from 600 basis points to 800.

Even prior to this announcement, the gap between the trust's discount and that of the peer group was at the wider end of its range, which we attribute to the value style being out of favour.

Over five years the trust has traded on an average discount to its sector of 3.6%; the figure is now 7.9%.

We would expect the stylistic disadvantage to swing round in the trust's favour over the medium to long term too, so this is an interesting entry point in our view.

As for Andre's departure, management will pass to his deputy, Masaki Taketsume. This is a planned transition, which is one reason we have confidence in picking up this trust now.

Masaki Taketsume has worked on Schroder's Japanese equity desk since 2007, and moved over to London in 2014 to work closely with Andrew in anticipation of his retirement.

He has therefore had ten years' experience in the team and three years working closely with Andrew on this trust.

The fact the new manager has worked so closely with the departing manager gives us some confidence there will not be a sudden drop-off in performance.

Certainly, there will be a period of adjustment whilst investors get to grips with the new manager, but over the medium to long term we think there is significant potential for the discount to narrow.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons.

The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.