Nuclear energy funds to power portfolios

Governments are supporting nuclear again and investors should pay attention, argues Saltydog Investor.

17th June 2025 11:12

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

For some time, we have argued that nuclear power should play a key role in the UK’s green energy strategy. Successive governments have agreed in principle but have been slow to act. However, that may be about to change.

This month, energy secretary Ed Miliband has committed £14.2 billion to the construction of Sizewell C, a new nuclear power station in Suffolk. Once operational, it is expected to deliver 3.2GW of clean, baseload electricity, enough to meet 7% of UK demand and power six million homes.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Alongside that, an additional £2.5 billion has been allocated to launch the UK’s first Small Modular Reactor (SMR) programme over the next four years. Rolls-Royce Holdings (LSE:RR.) has been chosen to build the first three units in partnership with Great British Energy. Factory-based modular construction should cut costs and speed up delivery compared to traditional nuclear builds.

It's not just the UK pressing ahead. China has approved 10 new reactors this year, with targets of 200GW by 2030 and 500GW by 2050. Europe is also ramping up. The EU wants to increase capacity to 109GW by 2050, supported by €241 billion (£205 billion) of investment. France already generates 65% of its electricity from nuclear and plans to grow that further.

Elsewhere, India, Japan and South Korea are reactivating or expanding their reactor fleets. Turkey expects its first unit at the Akkuyu Nuclear Power Plant to enter trial operations in 2025. Its goal is 20GW of nuclear capacity by 2050. Emerging markets including Indonesia, Malaysia, Kazakhstan, Ghana and Yemen are also progressing their own nuclear programmes.

At the end of May, President Donald Trump signed a series of executive orders aimed at quadrupling US nuclear capacity from 100GW to 400GW by 2050. The measures include making federal land available for new plants, prioritising funding, accelerating the disposal and recycling of nuclear waste, fast-tracking SMR development and reactor upgrades, and expanding the nuclear workforce through new apprenticeships.

- Top-performing fund, investment trust and ETF data: June 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

According to the International Energy Agency (IEA), more than 40 countries have plans to expand their nuclear energy capacity.

The shift towards nuclear power aligns with the world's growing energy demands. Industries of the future, such as data centres, chip manufacturing, desalination, hydrogen production, and next-generation farming systems, require huge amounts of energy. Nuclear power could help meet these needs in a sustainable way.

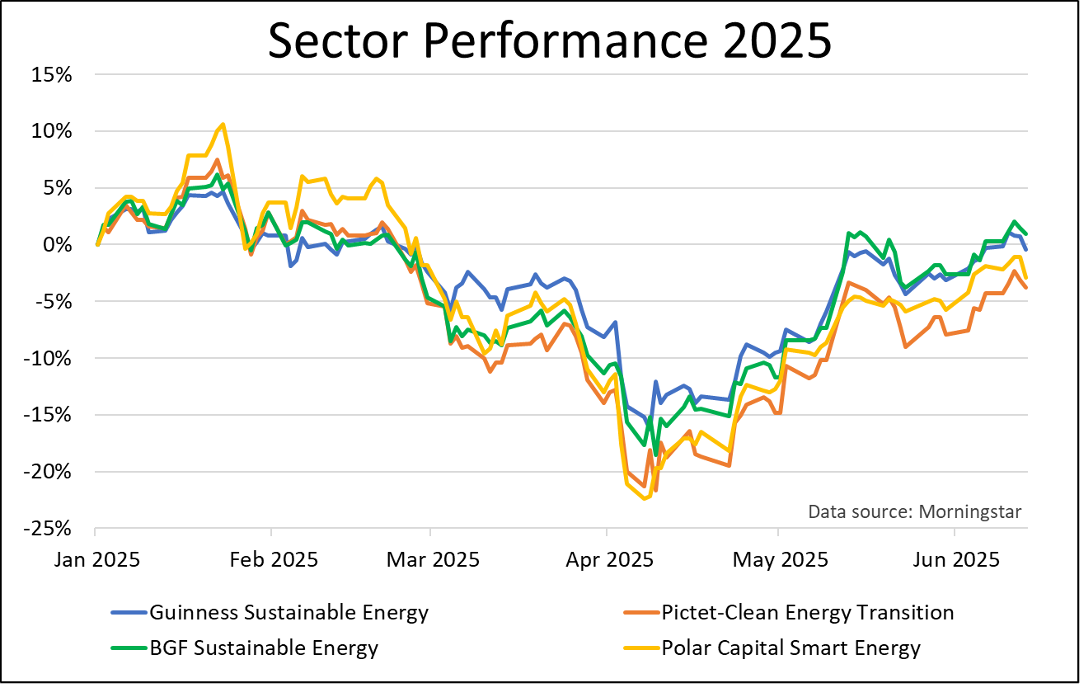

There must be an investment opportunity here, but it's not particularly well covered in the fund universe. However, after a disappointing start to the year, some of the more general “green energy” funds such as Pictet-Clean Energy Transition, Guinness Sustainable Energy, BGF Sustainable Energy, and Polar Capital Smart Energy have started to recover. If they jump aboard, they could be well placed to benefit from this latest development.

Past performance is not a guide to future performance.

There is also Geiger Counter Ord (LSE:GCL), an investment trust that focuses on uranium exploration and production stocks. It targets companies critical to the nuclear fuel supply chain.

Additionally, there are several exchange-traded funds (ETFs) targeting uranium and nuclear technologies. These include HANetf Sprott Uranium Miners ETF Acc GBP (LSE:URNP); HANetf Sprott Junior Uranium Miners ETF USD Acc GBP (LSE:URJP); Global X Uranium ETF USD Acc GBP (LSE:URNG); VanEck Uranium and Nuclear Technologies ETF A $ Acc GBP (LSE:NUCG), and WisdomTree Uranium & Nucler Energy ETF $ Acc GBP (LSE:NCLP).

We will be keeping a close eye on developments and watching to see if more funds emerge to capture this growing global trend.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.