Pension Awareness Week: the secret to greater engagement

Findings from interactive investor’s Great British Retirement Survey 2025 highlight what could help people save an adequate sum for later life.

19th September 2025 14:57

by Craig Rickman from interactive investor

This year’s Pension Awareness Week, which draws to a close today, has taken place against a backdrop of uncertainty in the retirement space.

The aim of this annual initiative is to promote the value of pensions and highlight the important role they play in achieving financial independence in later life. However, savers currently find themselves grappling with a pension system that’s in a state of flux.

- Invest with ii: Open a SIPP | Best SIPP Investments | SIPP Cashback Offers

In July, the government launched two long-awaited reviews – one focusing on retirement adequacy while the other will examine the state pension age – the policy outcomes of which could have a marked impact on our financial comfort in later life. And as the 2025 Autumn Budget edges into view, with the date set for 26 November, the rumour mill is running wild once again that pension tax reforms are on the agenda.

To be clear, speculation about tax hikes is yet to be substantiated. Unlike the lead up to last year’s final fiscal event, Labour hasn’t been vocal about the matter, however experts believe the country’s precarious financial position may leave Chancellor Rachel Reeves with little option.

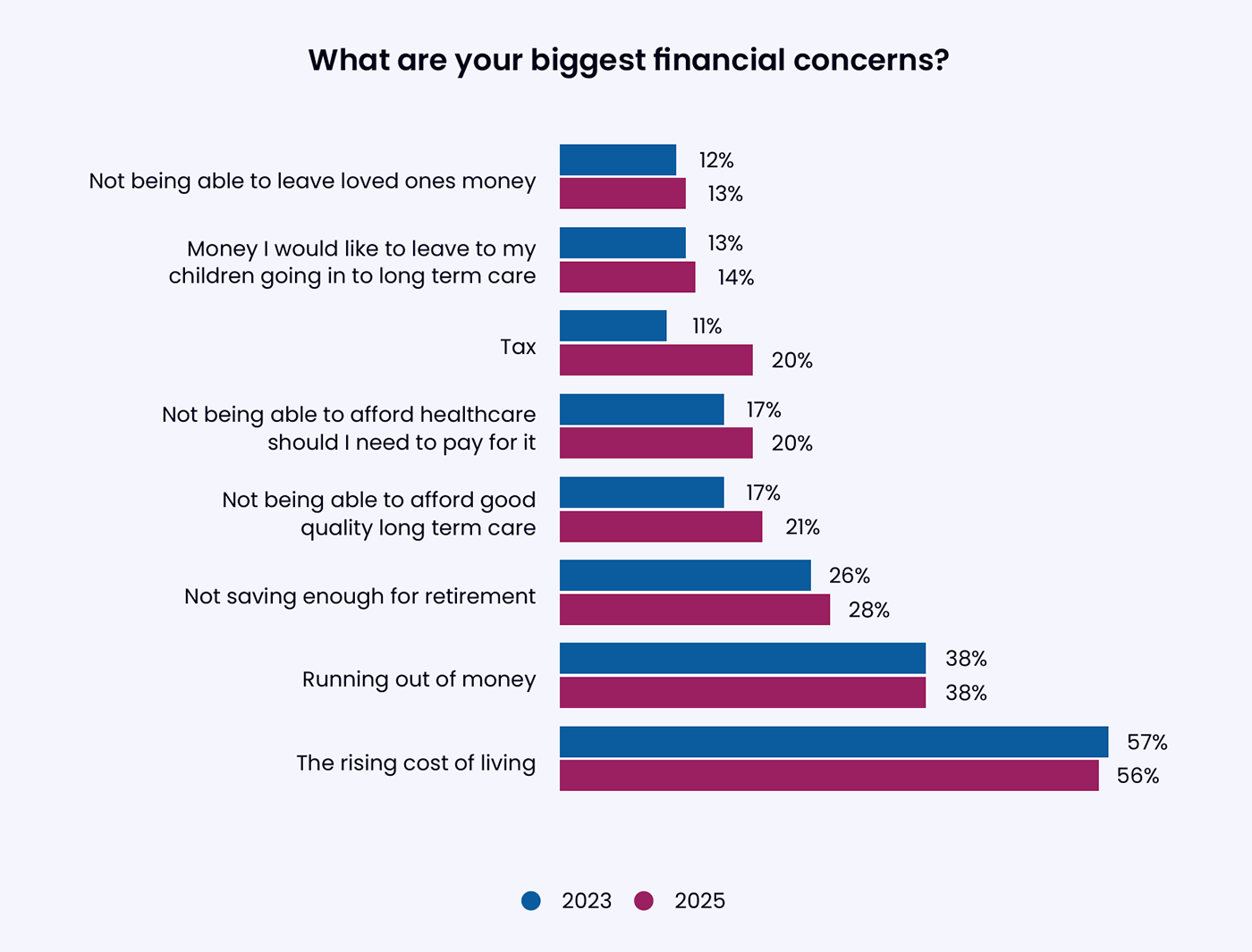

Whatever happens in late November, tax is an increasing worry for consumers, as our Great British Retirement Survey 2025 uncovered (chart below).

We asked savers, ‘What are your biggest financial concerns?’ and one in five (20%) said tax. While other challenges such as the rising cost of living, running out of money in retirement and affording long-term care ranked as bigger concerns, what’s striking is the percentage of people worried about tax almost doubled from the 11% figure registered in 2023.

This trend is eye-catching but doesn’t draw huge surprise. Long before the government unleashed a £40 billion package of tax measures at last year’s Autumn Budget, our HMRC bills were on the climb thanks to fiscal drag – a stealthy tactic of raising taxes without pushing up the headline rates. Income tax thresholds have been frozen since 2021 and will remain at current levels until 2028-29, shunting more of us into higher rates.

- When will you get your state pension?

- Retirement case study: how I manage a £2.5m SIPP and ISA portfolio

People not only have a better understanding of fiscal drag but are nervous about being hit with another round of tax increases in November, particularly on pensions, evidenced by the surge in people drawing their tax-free lump sum. Financial Conduct Authority (FCA) data published earlier this week found that tax-free pension withdrawals have doubled in the past two years.

Given the range of generous tax breaks on offer, pensions may appear a soft target should the government need to raise revenue, but it’s a delicate area.

For starters, the maximum tax-free lump sum has been frozen at £268,275, so with every passing year its value will erode in ‘real terms’ – a further example of fiscal drag in action. Unless the government decides to uprate the figure annually to match inflation, many future retirees who save particularly hard for later life will face higher tax bills in retirement no matter whether the cap is reduced.

As our new retirement survey also found, frequent changes to pension rules and taxes are undermining trust in the pension system. One in four respondents (24%) said they would feel empowered to save more in their pension if the rules stopped changing, with one in three Millennials (29%) flagging this as a key concern.

Reforms to the pension tax system have arrived thick and fast in the past decade alone. The lifetime allowance (LTA) has been scrapped, new annual allowances have been introduced, namely restrictions for high earners and those already drawing pension income, and pensions will no longer be inheritance tax (IHT) exempt from April 2027. In addition, the minimum age you can access private pensions is rising from 55 to 57 in 2028, and the state pension age is increasing to age 67 the same year.

Such frequent and significant shifting of the goalposts is not sitting well with savers. The tax advantages within pensions act as a key incentive to tuck money away for later life. If these are gradually eroded, it could dampen rather than foster a strong savings culture in the UK.

- What to consider before gifting your pension to swerve IHT

- Is it possible to give away my pension savings to avoid IHT?

Given the panic and alarm that ensued 12 months ago, and the risks of people making knee-jerk decisions with their long-term finances, savers desperately need reassurance about the future of pension taxation.

Potential changes to the private pension landscape aren’t the sole concern. Around one in five (22%) young people (age 18 to 28) think the state pension won’t exist by the time they retire, while another one in five don’t know, plus more than one-third (36%) of Generation X (age 45 to 60) believe the state pension won’t exist for today’s young people.

These worries may be overblown but equally are a natural response to the growing uncertainty surrounding the state pension’s future. As I mentioned higher up, the government is reviewing the state pension age, with the legitimate prospect we’ll have to work longer before claiming it. Elsewhere, the affordability of the triple lock - the mechanism that uprates the state pension annually by the highest of inflation, wage growth or 2.5% - is under constant scrutiny.

On a more positive note, in the two decades I’ve worked in the financial sector – either giving money advice or writing about money – I’ve noticed a gradual uptick in terms of pension awareness and appetite among friends and family.

Whether that’s younger to middle-aged people taking a keener interest in their workplace schemes to older generations playing a more active role in how their retirement savings are invested, many want to learn more about how pensions work and understand the ways to make the most of them.

Improving pension comprehension and awareness will become even more important as time moves on. The workplace pivot from “gold-plated” defined benefit (DB) schemes, which secure a guaranteed income for life, to defined contribution (DC) pensions – in essence, a savings pot - means people must pay closer attention to their retirement savings.

- How minimum pension age rise to 57 might affect you

- How DB to DC pension shift is impacting workers’ retirements

Savers must make sure they accrue sufficient wealth to last as long as they do and invest in things that offer the best opportunity for their money to grow. And given that retirees tend to keep their pension invested in retirement and draw a flexible income, the need to engage typically no longer stops once we hit our golden years.

The government’s consultation into pension adequacy could offer some solutions. Jacking up minimum contributions under auto enrolment – currently 5% for employees and 3% for employers based on qualifying income - seems an obvious outcome, but timing here is important.

On one hand, businesses are facing steeper tax bills due to April’s employer national insurance (NI) hike and workers are still grappling with the higher cost of living; the latter was voted as the biggest challenge people face when saving for retirement, in our new survey.

As such, neither group may welcome higher statutory pension contributions right now. It could heap more pressure on businesses and run the risk of workers opting out of their workplace pensions altogether – missing out on valuable employer contributions and tax relief in the process.

But on the other hand, every year savers contribute less to their pensions, their long-term financial security will suffer.

These are obstacles that the current government and any future ones must seek to hurdle, but this won’t happen overnight. In the meantime, bringing some calm and consistency to the pension framework, notably the tax rules, can start the process of rebuilding – or in some cases building – greater trust among savers and retirees.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.