Gone are the days of retirement certainty. This makes it harder for pension savers to plan, and erodes public trust in the pensions system.

The report delves into some of the core challenges for pension savers, and the impact of the complex pensions landscape, from people’s retirement expectations versus their reality, pension education, wealth gaps, changes to inheritance tax, and much more.

And it outlines what interactive investor would like to see in terms of reform, as we continue to champion individual savers all across the UK.

You can read the highlights on this page, or download the full report via the link below.

Our market-leading retirement survey finds that rising costs have eroded the financial security of many families across the UK.

More people are in debt than two years ago, and older workers are responding by working harder for longer.

Against this uncertain backdrop, many have little spare to bolster their long-term retirement savings.

Many pension savers are on track for financial insecurity in retirement and they are increasingly worried.

We hope the data in this survey – though a sober read – gives our industry and the government some food for thought, and actionable next steps. - Richard Wilson, Chief Executive

More people in retirement have unsecured debt than in our 2023 report. This includes credit card debt and Buy Now Pay Later.

The average unsecured debt is £1,750.

This is an increase from the 50% two years ago.

Also, only 10% describe themselves as “retired” in their late 50s – down from 15% in 2023.

The biggest barrier for savers to consolidate their pension was that they simply didn’t know how to.

One in five didn’t see the need, and one in five found it too overwhelming.

Six in ten pension savers expect to fall short of a moderately comfortable retirement, expecting retirement pension wealth of less than £300,000.

The Pensions UK’s retirement living standards estimates that people need at least £330,000 in their pension by retirement to achieve a moderate standard of living.

Expectations begin to dwindle as people approach retirement. Among those in their early sixties, over two thirds (68%) expect pension wealth of less than £300,000, compared with 53% in their twenties.

Read more: How much pension do I need to retire?

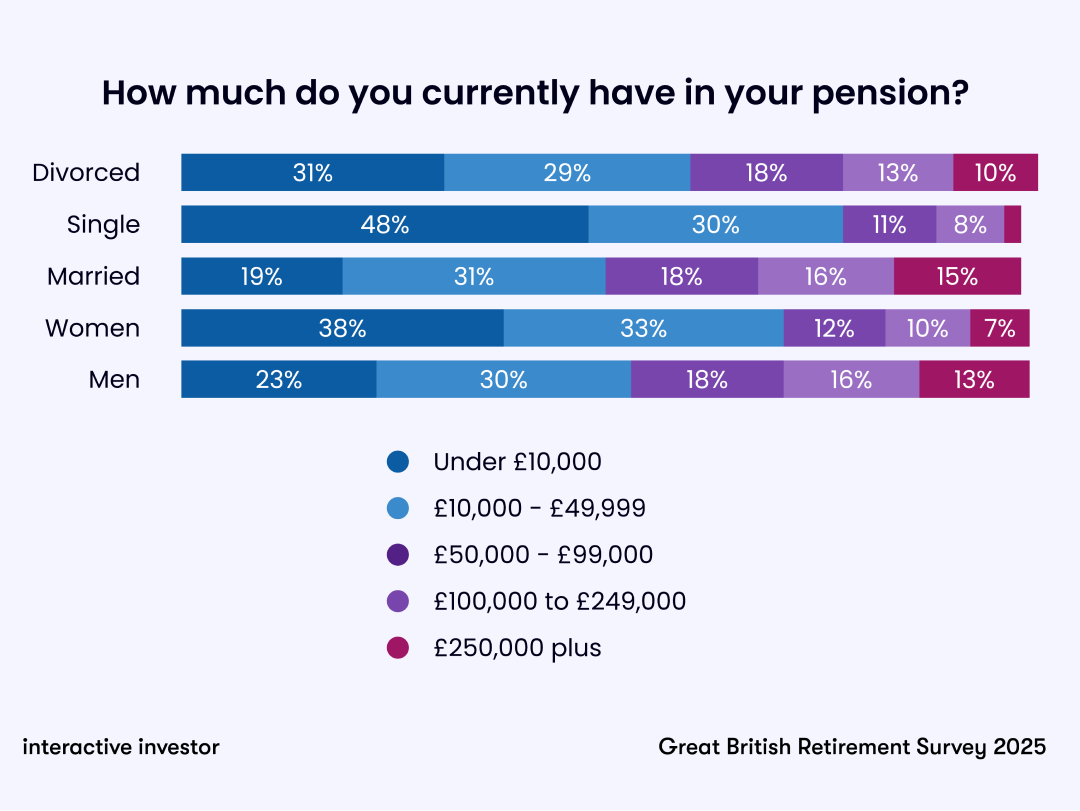

Despite years of progress on the gender pay gap, many women are still struggling to build pension wealth.

Women currently have lower pension wealth than men (£17,500 on average, compared to £37,500 for men) and just 17% of women have more than £100,000 in their workplace pension, compared with 31% of men.

Women also have lower financial expectations for retirement, expecting £150,000 pension wealth on average by retirement, compared to £250,000 for men.

There are also big financial gaps for single people and divorcees. Divorced respondents expect pension wealth of just £75,000 on average by retirement, compared to £350,000 for married respondents.

They have similar current pension values but are older and closer to retirement on average than married respondents, so have less time build pension wealth.

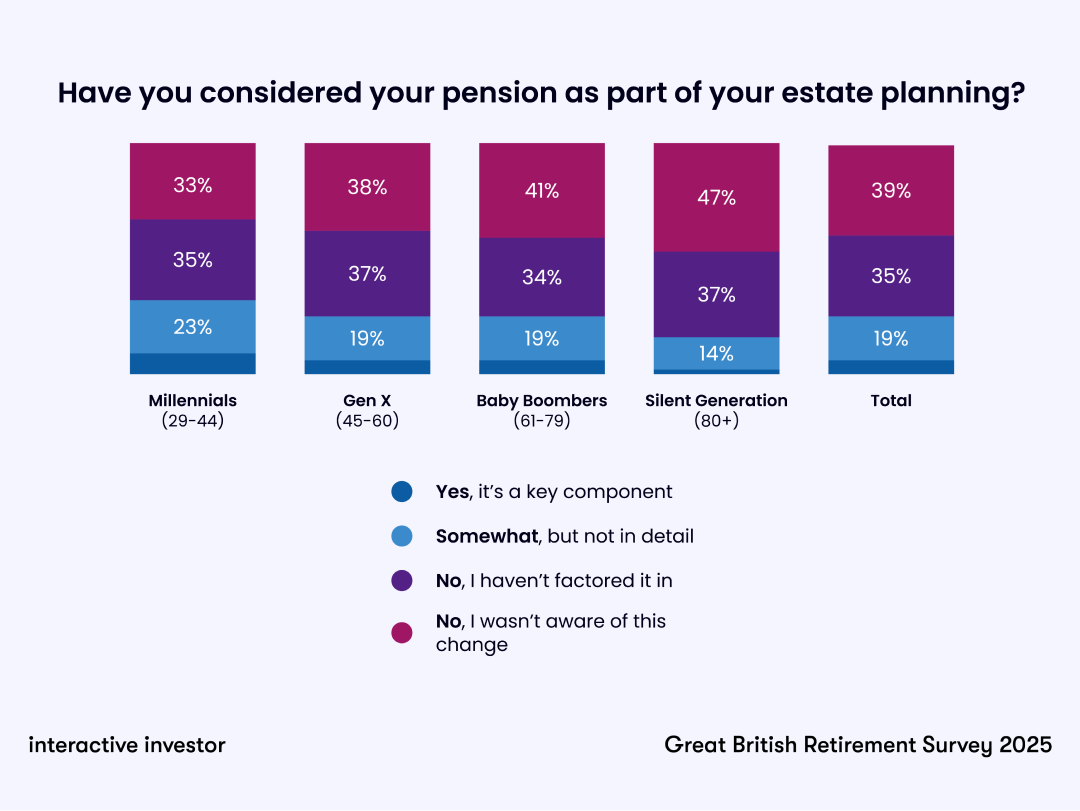

Changes to inheritance tax and how it relates to pensions has been hot on the political agenda and never far from the national headlines over the last year.

We wanted to find out how much pension savers understand about the Government’s plans to introduce IHT to pensions in April 2027, and how this impacts their pension planning. Three-quarters (74%) of pension savers either don’t know about the rule change or haven’t factored it into their estate planning.

Over half (52%) said they don't intend to make any changes to their retirement and estate planning based on the upcoming rule change, with one quarter (25%) saying they did not know.

Among interactive investor customers, nearly half (45%) said their pension is a key part of their estate planning. Over one-third (36%) plan to withdraw more from their pension and spend it as a result of the changes, while 35% plan to withdraw more than planned from their pension and gift it.

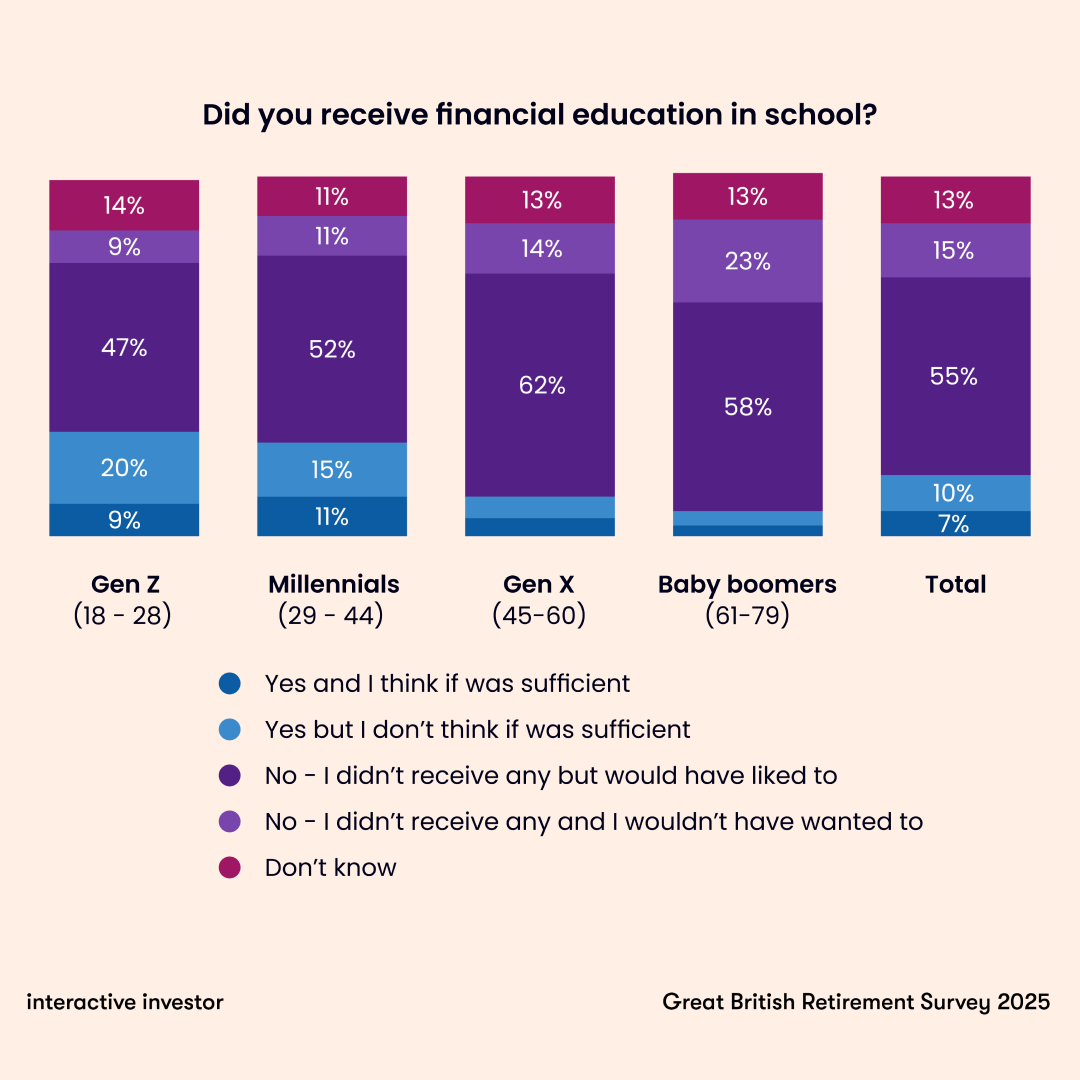

All generations told us their financial education was insufficient.

Just 7% said they received sufficient financial education, rising to 14% among Gen Z – so, at least we can see that maybe things are beginning to shift for younger people.

Those approaching retirement today are the least likely to say they received sufficient financial education. With recent pension changes and the onus increasingly on the individual to manage their pension wealth, this is a worrying reality.

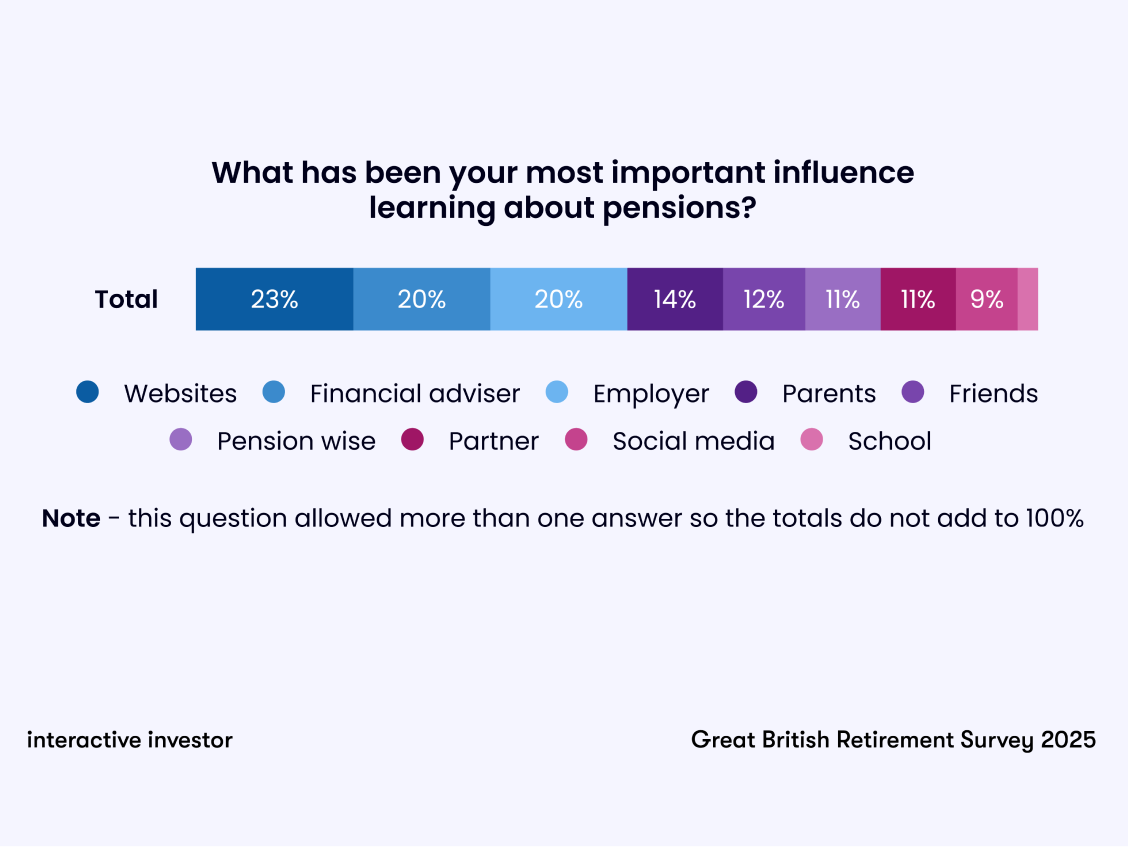

We can see that the internet is becoming the go-to source of financial education, with nearly one-quarter saying it is their key source of information on pensions – by contrast, just 3% said school was their most important influence.

Respondents said their most important influences when learning were websites (23%), financial advisers (20%), employers (20%) and parents (14%). Among young people, parents (27%) and social media (21%) were the biggest influences, whereas Millennials and Gen X were more likely to say websites, employers and financial advisers were a big influence.

If you would like to speak to one of our spokespeople or if you would like bespoke content from our expert writers, please contact:

Saffron Wainwright

PR Manager

Email: saffron.wainwright@ii.co.uk