This powerful investment phenomenon could last decades

There are three sensible rules for investment success, but Kyle Caldwell has another smart tactic.

7th June 2019 12:15

by Kyle Caldwell from interactive investor

There are three sensible rules for investment success, but Kyle Caldwell has another smart tactic.

There are various ways whereby self-directed investors can tilt the odds of stock market success in their favour. Three sensible rules as a starting point are to invest for the long term, drip-feed money into the market to benefit from pound-cost averaging, and keep a close eye on charges for both the funds held and the broker fee that is also levied.

Another smart tactic is to take advantage of a powerful investment phenomenon likely to continue to play out in the decades to come: the significant outperformance of smaller companies over large ones. For more seasoned investors, the so-called small cap premium has long been a staple of equity investing, particularly in regard to the UK market.

The numbers speak for themselves: research in 2016 by professors Elroy Dimson and Paul Marsh at the London Business School found that £1 invested in 1955 in the Numis 1000 index, composed of the 1,000 smallest UK-listed companies, would have grown to £12,144 by the end of 2015. In contrast, £1 invested in the FTSE All-Share index over that 60-year period would have grown to just £829.

This tendency for smaller companies to achieve superior growth is something various fund management firms have been seeking to take advantage of for some time. However, although a decade ago there were 53 UK smaller company funds, there was a distinct lack of opportunities to tap into up-and-coming businesses listed overseas.

At that time there were question marks over whether the smaller companies effect extended to overseas shares, but the answer has now become clear following an academic paper in 2017, also by Dimson and Marsh. The professors found that from the start of 2000 to the end of 2016, the smaller company premium on a global basis was 5.5% per year.

Indeed, in 18 of the 20 non-UK countries looked at, smaller company shares outperformed larger firms in their respective stock markets. The only two countries where the smaller-company effect was not evident over the period were Taiwan and Hong Kong.

Prior to this paper being published, fund management firms had begun to recognise the implications of the phenomenon, and there is now a small but growing number of dedicated smaller company funds focused on the US, Europe, Japan, Asia and emerging markets, as well as those investing more broadly through a global approach. While fund marketing literature always labours the point that "past performance is no guide to the future", it was no doubt the record of strong performance by smaller companies in overseas markets that caught managers’ attention.

Structural drivers remain in place

Although investors are regularly warned to not blindly buy on past performance, the advantages that smaller companies have over large firms are structural and will remain intact, so in theory they should continue to reward investors – but only those who adopt a long-term approach (on which more later).

The London Business School research pointed out that among the main drivers behind outperformance for smaller companies is the fact that they are both under-owned and under-researched. This is despite the fact that there are far more smaller companies – 6,000 listed globally compared to 2,500 large firms. Of these 6,000 names, around 20% to 25% are "uninvestable" because they are too small for private investors to trade, says Alan Rowsell, manager of the Standard Life Global Smaller Companies fund. Nevertheless, he adds, those who choose to ignore smaller-company shares are missing out on 70% of the businesses listed globally.

On the whole smaller companies are largely neglected. There are various reasons why this is the case and it is unlikely to change. For a start, most institutional investors, as well some fund managers, tend to shy away from smaller companies on the grounds that the shares are too illiquid, while most analysts stick to the larger companies as they are easier to research and more widely owned.

Moreover, Dimson and Marsh also note that the sheer number of stocks in the universe means it is "notoriously difficult" to track smaller companies passively. They conclude that "these factors contribute to the ongoing systematic neglect of the smaller companies sector, despite the strong returns it can offer."

Short-termism is also to blame, according to Peter Elston, chief investment officer at Seneca Investment Managers. "The reason why the outperformance of smaller companies over the long term is an anomaly is because investors as a whole are short-sighted and are only looking three or four years ahead, despite all the authoritative data showing that over the very long term smaller companies have the upper hand."

Fund managers who specialise in buying overseas smaller companies point to other structural advantages. The most commonly cited, to borrow a quote from the late Jim Slater, is the fact that "elephants don't gallop". In other words, smaller companies have more room to grow and therefore greater ability to produce higher returns for shareholders.

Peter Ewins, manager of the BMO Global Smaller Companies (LSE:BGSC), which has grown its dividend for 48 years, adds: "As well as it being easier to grow as a small entity, from a management perspective it is much easier to change strategy and go in a different direction, whereas for changes to happen in a large company there would be about 25 different committees where approval would need to be sought."

Moreover, the management team of a smaller company tends to be more aligned with shareholders' interests by personally having higher equity holdings, points out Nick Mustoe, manager of the Invesco Perpetual UK Smaller Companies (LSE:IPU). He adds:

"Smaller companies are repeatedly overlooked, but from small acorns these businesses can turn into big oak trees."

On the whole, smaller-sized business are more domestically focused than their larger-company peers and are therefore more in tune with the health of the economy they operate in. Rowsell adds:

"Typically a smaller company will have around 60% to 70% of its revenue tied to the local economy, whereas a large company has more like 40% to 50%."

Therefore, during times when a country's economic growth is sluggish or contracting (which in turn makes investors become more cautious), smaller companies fall out of favour. This is the trade-off that investors have to accept in pursuit of the potentially higher returns on offer – smaller companies are riskier than larger businesses and in turn more vulnerable to investor sentiment quickly turning sour. The past year has been a case in point, as smaller companies have underperformed, and that has been pretty consistent across all markets. To take advantage of the smaller company effect, therefore, it is essential investors adopt a long-term approach.

Where the smaller company premium works

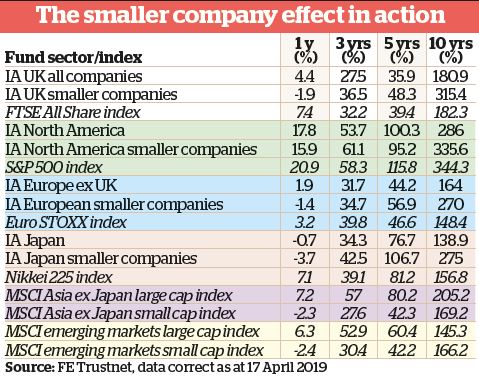

But there is no disputing that in developed markets small is beautiful, particularly in the UK, Europe and Japan. In these three regions, on both a five and a 10-year view, smaller company funds have outperformed funds that have the flexibility to be size-agnostic but generally speaking tend to have a larger company bias.

On the 10-year time horizon this outperformance is particularly striking, as the table below shows, with the smaller company sector average for each of the three regions beating the main stock market index.

In the US, the market with the biggest pool of smaller company shares for investors to fish in (around 1,700 to 1,800 names), smaller company funds handsomely beat the wider IA North America sector over the 10-year period by 50%, but on a five-year view they did not have the upper hand, underperforming by 5%.

But smaller company funds did not beat the S&P 500 index over either the five- or the 10-year timescale. While this is not the index these funds set out to beat, the performance figures show that investors who a decade ago bought a cheap tracker fund or ETF to track the biggest businesses America has to offer will have fared better than the typical actively managed US smaller company fund.

Smaller companies lose sparkle in Asia

Research by Money Observer has found that care needs to be taken in Asia and the emerging markets: it is questionable whether it does pay fund investors to favour small-company shares over large by backing these regions.

Investors in Asian smaller companies have not had the same success as their developed market counterparts over the past decade. Owing to a shortage of dedicated smaller company funds there is no dedicated fund sector, but in any case from an index perspective large companies have been the place to be.

Over both short and long timescales – one, three, five and 10 years – the MSCI All Countries Asia ex Japan Large Cap index has beaten the MSCI All Countries Asia ex Japan Small Cap index. Emerging market smaller companies, which differ from their Asian counterparts in also encompassing other emerging economies, notably Latin America, have outperformed large businesses on a 10-year view, but lag behind over one, three and five-year time periods. One factor behind the gap in performance between large and small in both regions has been the strong performance of the Asian tech giants, the likes of Tencent (SEHK:700), Alibaba (NYSE:BABA) and Baidu (NASDAQ:BIDU), over recent years.

Asia and the emerging markets are volatile regions and can leave investors nursing heavy losses, particularly when there is a crisis of some description. Some investors are therefore likely to be deterred from smaller companies by this additional risk, coupled with the fact that the correlation between size and returns has so far been less evident.

But Mustoe argues there is plenty of money to be made in the decades to come, pointing out that small companies in Asia and the emerging markets are "genuine local companies" and therefore offer investors the chance to tap into the much faster economic growth rates these economies are enjoying compared to the West.

Ewins is more circumspect, commenting: "There's a larger share of individual company problems in these economically less mature regions." He adds: "It is an area that is only going to grow in interest, but the past decade's performance figures do show that you do not have to go to exotic parts of the world to benefit from the smaller company effect."

Elston agrees, pointing out that smaller companies in Asia and the emerging markets have a reputation of being "notoriously bad for corporate governance". He adds that a higher proportion of companies in these less economically mature countries fail compared to their western counterparts, and this will play a part in dragging down the average performance for smaller companies as a whole in these regions. "As with baby turtles making their way to sea, some will survive and thrive but others will not make it. You do not, though, want to be betting on the average turtle, and the same principle applies to investing in smaller companies in Asia and the emerging markets."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.