Richard Beddard: how to score this rapidly evolving AIM firm?

The company has been making products for 100 years, but judging profit is tricky.

20th November 2020 14:07

by Richard Beddard from interactive investor

The company has been making products for 100 years, but judging profit is tricky.

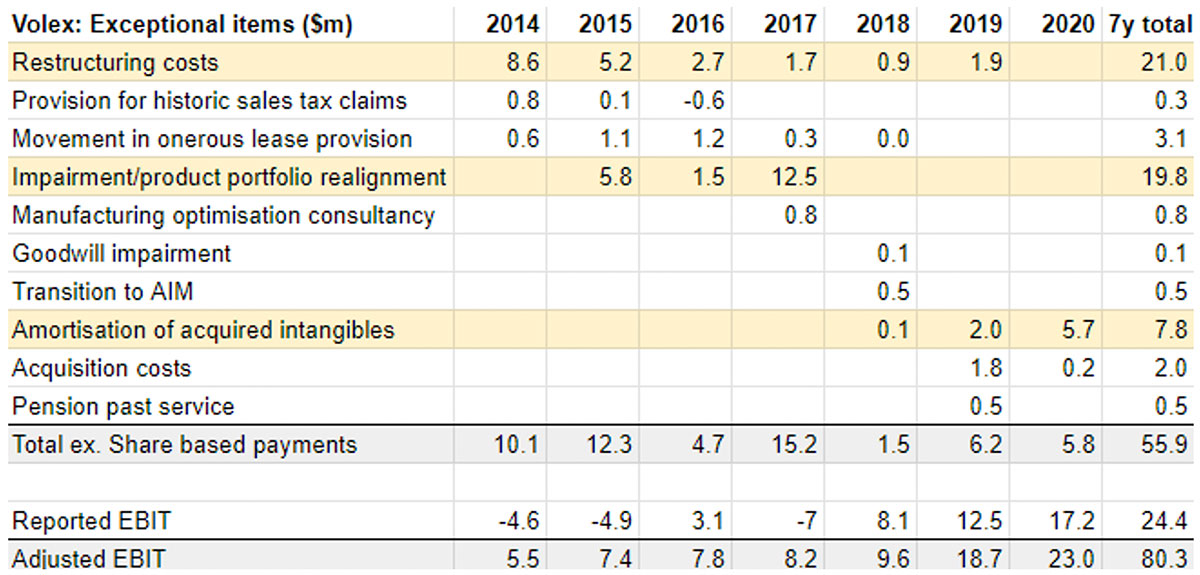

You can tell a lot about a company from the costs it chooses to ignore when it calculates its preferred measure of profit.

Source: Volex annual reports. The biggest exceptional items are highlighted in yellow.

Do not be put off by the complex table. It tells quite a simple story. These are the exceptional costs that wiring accessory maker Volex (LSE:VLX) has excluded from profit when communicating the performance of the business to shareholders.

Renovating the house before extending it

By comparing reported earnings before interest and tax (EBIT) and adjusted EBIT, at the base of the chart we can see exceptional costs are highly significant in comparison to profit.

In 2014, 2015 and 2017, the company reported a loss, but the exceptional costs were greater than the losses and so the company achieved an adjusted profit.

Volex reported a cumulative EBIT of $24 million (£18.1 million), but add back the exceptional costs and adjusted profit was nearly four times as much: $80 million.

Which profit is real? Well, neither, as all profit calculations are based on the judgements of accountants. But for investors judging how profitable the company might be in future, the adjusted profit figures may well be a better guide.

Casting our eyes over the list of exceptional items, from top left to bottom right, we can see their nature has changed. Until 2018, they were concerned with restructuring, a euphemism for redundancies, paying rent on unused property and writing down assets that would no longer be profitable.

- Richard Beddard: Carex owner needs more than strong hand gel sales

Share Sleuth: Why I have sold Castings and added shares in Next

- Why invest in AIM shares?

In the last two years, the exceptional items captured in the bottom right-hand side of the table relate primarily to acquisitions.

The direction of travel is good, insofar as judging by reported or adjusted profit, the company is making more of it. And the gruelling restructuring of less profitable businesses has abated.

The results for the first half of 2020, announced last week, show more of the same: an absence of restructuring bills and hefty acquisition costs.

Since the sloughing off of unprofitable aspects of the business appears to be over and acquisitions are by their very nature one-off events, perhaps we can ignore the associated costs in determining Volex’s profitability.

It looks as though Volex put its house in order before seeking to extend it.

Making wire for 100 years

The Volex story goes back way more than six or seven years. The company celebrated its 100th birthday in 2019.

Volex was an early brand of Ward & Goldstone, a seller of “English-made wires”, and it boasted of being “actual makers at lowest prices”, which is still part of the business model today.

Massive demand from telecommunications customers during the dot.com boom led to over-investment and the commodification and oversupply of power cord and data cables. The substitution of USB power chargers for mains charging cords also shrank Volex’s market.

A number of attempts to turn the company around failed, until financier Nat Rothschild, who had started building a stake in the company in 2008, took charge in 2015.

Two-pronged strategy

Through rationalisation and acquisitions, Rothschild’s Volex has recast the power-cord business as a low-cost supplier, which it is achieving through scale, vertical integration and automation.

It has also developed its cable assembly business into a contract manufacturer of electro-mechanical components and equipment that earn high profit margins.

Volex subsidiary GTK says 98% of the cable assemblies are bespoke. It also does Printed Circuit Board (PCB) assembly, injection moulding and other manufacturing processes. Source: GTK

With 14 manufacturing sites around the world, Volex believes it is one of very few companies with the scale to supply global multinationals who are trying to reduce the number of suppliers they use, while still ensuring they have the flexibility to source from a number of countries to mitigate the impact of tariffs.

The company has secured new business in sectors where there is burgeoning demand: electric vehicles, data centres and medical equipment, for example.

By lowering costs in the power-cord business, and making higher value components in contract manufacturing, profitability should improve.

Good news in the numbers

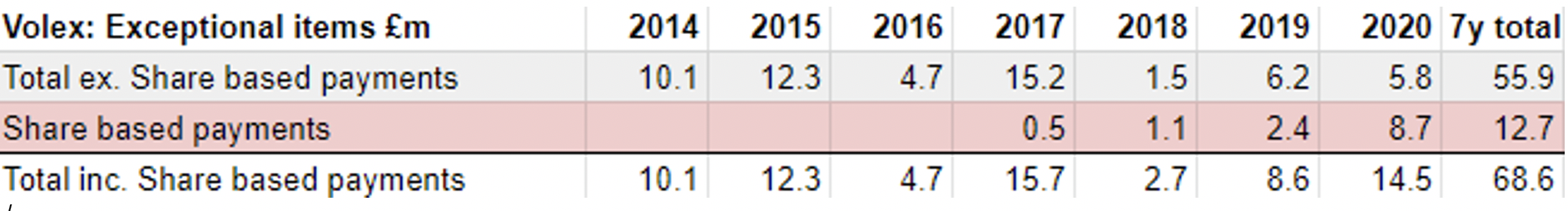

First, a confession. I left one cost out of the table of exceptional charges at the beginning of this article because I do not consider it to be exceptional.

It is share-based payments, which have become a standard method of remuneration at most companies, particularly for executives.

Source: Volex annual reports

In comparison to the company’s preferred statistic, my calculation of profit is lower because share-based payments are included and cash conversion, the percentage of profit earned as cash, is correspondingly higher.

Volex’s share-based payments are escalating to unusually high sums. In the year to April 2020, they amounted to nearly $9 million. In the half-year to October 2020, they were $6.5 million. This could be a red flag, an indication that executives are using share options to hide their true renumeration.

- Shares for the future: the latest rankings

- Find out more about interactive investor SIPP and pensions

At Volex, it is a bit more complicated than that. Like most companies, Volex uses share options to reward executives and senior managers. But it also uses them to encourage senior managers at acquired companies to stay on, so the rewards are a little more widely spread. Of 17 million share options outstanding at the end of the year, nearly seven million were so-called acquisition retention shares.

Even so, executive chairman Nat Rothschild is pretty well remunerated and, as owner of 25% of the shares, is the single biggest beneficiary both of dividends and a rising share price.

The company achieved a 4% increase in revenue and a 31% increase in adjusted profit in the half year to 4 October 2020 compared to the same period in 2019. This was helped somewhat by an additional four months of revenue from Servatron, which Volex acquired in July 2019, and a plunge in copper prices.

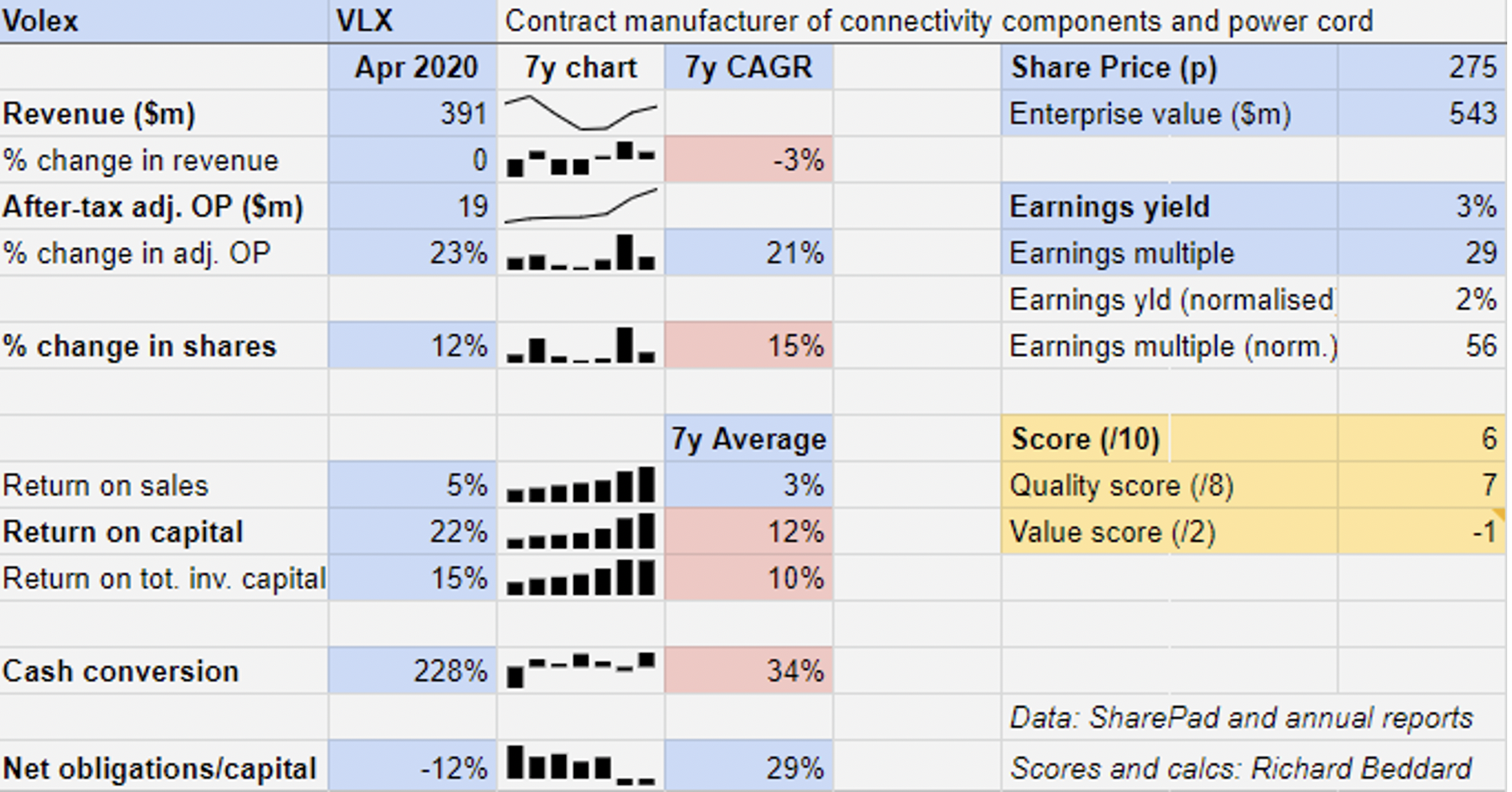

The results were the latest in a series of improved results that pretty much span Rothschild’s tenure as executive chairman:

Volex has executed a long but successful turnaround. At the year-end in April, profit margins (return on sales) had risen steadily to a still modest 5%. Return on capital had risen to a commendable 22%. And return on total invested capital (ROTIC), including the cost of acquisitions, was also high at 15%.

ROTIC may take a knock in 2021 due to the cost of Volex’s biggest acquisition so far, but as long as DEKA is as good a buy as Volex thinks it will be, the returns will accrue over time.

Rothschild described DEKA, a profitable and growing Turkish power cord business, as a “terrific deal” in a recent presentation.

Cash flow was impressive in 2020, but that was partly the result of the unusual circumstances of the pandemic, which impacted the end of the financial year. Volex ran down its stock supplying customers while its Chinese factories were shut at the beginning of the pandemic.

The company says it prioritises cash flow over revenue to give it the resources to make more acquisitions, so perhaps we can expect to see more stable cash flow in future.

Acquisitions, like DEKA, increase the scale of the low-cost power cord business, while acquisitions like Servatron increase its capabilities in higher margin manufacturing.

Scoring Volex

I am predisposed to like Volex. It is a business with a proud heritage that has been dragged into the 21st century by its owner/manager. It says it manufactures products that “ensure a critical communication never fails”.

Does the business make good money? [1]

? Strong profitability now, but track record is patchy

? Power cord is a low-margin business

? Strong cash conversion in 2020, but it is historically weak

What could stop it growing profitably? [2]

+ Strong finances

+ Botched acquisitions (no evidence of that so far)

? Recession and raw material prices could impact power cord division particularly

How does its strategy address the risks? [2]

? Scale and automation drive down costs in power cord business

? Moving up the value chain in assembly and manufacturing

? Global expansion to meet needs of multinational companies

Will we all benefit? [2]

+ Executive chairman owns 25% of the shares and led the turnaround

+ Communications with shareholders are clear and informative

? High share-based payments for senior managers

Is the share price low [-1]

+ No. A share price of 275p values the enterprise at nearly $550 million, 29 times adjusted profit.

Volex is a rapidly evolving business and should be more resilient in the future than it has been in the past.

The backward-looking profitability criterion docks Volex’s score a point for weak profitability and cash flow, when that might not be true in the future.

But I have been generous in assuming Volex can sustain current levels of return on capital when calculating the valuation. Had I used the average, its valuation would have dragged its score down even further.

A score of 6/10 ranks Volex 25 out of 35 in my Decision Engine table. Although I think the higher ranked shares are probably better long-term investments, in my opinion it should be rewarding too.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.