Share Sleuth: Why I have sold Castings and added shares in Next

Richard Beddard waves goodbye to a long-term holding, he uses the proceeds to top up his Next holdings.

5th November 2020 09:36

by Richard Beddard from interactive investor

Richard Beddard waves goodbye to a long-term holding, and uses the proceeds to top up his position in Next.

I usually give myself the opportunity to trade just once a month. The timing is driven by my writing schedule. If the Share Sleuth column is looming, then I will crank up the Decision Engine and see if any of its suggestions appeal.

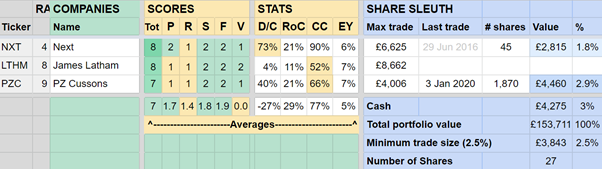

This month's trade day was 28 October. The Decision Engine presented me with the following snapshot:

Available trades

Table shows positions before any trades

Scores:Tot: Total, P: Profitability, R: Risks, S: Strategy, F: Fairness: V: Valuation

Stats: D/C: Debt as a % of operating capital, RoC: Average return on capital, CC: Average cash conversion, EY: Earnings yield (norm.)

Sources:Richard Beddard, SharePad and annual reports

Starting from the bottom right-hand side of the table, we can see the Share Sleuth portfolio has 27 members, which I described last month as more than enough.

The minimum trade size, which is 2.5% of the portfolio’s total portfolio value of £153,711, was £3,843. The portfolio’s cash balance was £4,275, just enough to add more shares.

The cash balance had increased since last month because of dividends, notably from Goodwin (LSE:GDWN) (£217), and also from Games Workshop (LSE:GAW) (£57) and XP Power (LSE:XPP) (£43).

Portfolio management guidelines encourage me not to trade a share if I have traded it within the last six months or if it scores less than seven out of ten.

The guidelines also dissuade trading shares that the portfolio already owns in substantial quantities (for a detailed explanation, see: Why valuation alone is not enough to trigger a sale).

Having applied these guidelines, three shares were available. I could increase the portfolio’s holding in Next (LSE:NXT) (ranked 4) or PZ Cussons (LSE:PZC) (ranked 9), or add a new holding in James Latham (ranked 8), which I profiled for the first time a few weeks ago.

I have been impressed by how fashion and homeware retailer Next has defended return on capital as sales have migrated to the internet, and I am also impressed by its strategy to become a platform for other retailers.

It was also the most highly ranked of the three, because I upgraded Next’s score recently.

PZ Cussons makes famous consumer health and beauty brands like Carex, but the old chief executive left under a cloud earlier this year and I want to hear more from the new one before committing money, perhaps once I have read its recently published annual report.

I surprised myself when I scored James Latham so highly. It is a timber importer and distributor. The attraction of James Latham is not the pace of growth, or the extent of profitability, which are modest, but the predictability of both.

The portfolio already owns shares in a number of good businesses that supply small builders and large construction projects, namely Dewhurst (LSE:DWHT) (lift components), FW Thorpe (LSE:TFW) (lighting systems) and Howden Joinery (LSE:HWDN) (fitted kitchens), so I am not in a hurry to add another.

The Decision Engine made no recommendations to remove or reduce holdings, but it is not the be-all and end-all when it comes to portfolio management.

I may still have some business to do...

Auto exposure

The Decision Engine ranks companies. It does not tell me how many companies to hold, or whether the balance of a portfolio is right. I still have to sweat over these decisions.

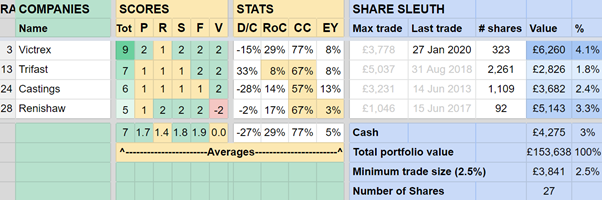

Four Share Sleuth companies, Castings (LSE:CGS), Renishaw (LSE:RSW), Trifast (LSE:TRI) and Victrex (LSE:VCT) supply auto manufacturers. Three of them also supply the aerospace industry. Because they supply other recession prone industries as well, I am wondering whether the portfolio is too exposed.

Castings makes parts for trucks mainly, Renishaw makes machine tools that make and check vehicle components, Trifast makes the nuts, bolts, screws and rivets that hold them together, and Victrex makes high-performance polymer used in some components.

Together these companies comprise nearly 12% of the portfolio.

Only one, Victrex, has earned decent returns through thick and thin in the past.

Table shows positions before any trades

Scores:Tot: Total, P: Profitability, R: Risks, S: Strategy, F: Fairness: V: Valuation

Stats:D/C: Debt as a % of operating capital, RoC: Average return on capital, CC: Average cash conversion, EY: Earnings yield (norm.)

Sources:Richard Beddard, SharePad and annual reports

Two of these businesses, Castings (ranked 24) and Renishaw (ranked 28), have quite low scores, and I wonder about Trifast too (it is ranked 13).

It would be easiest to dispose of the lowest ranked, Renishaw, because of its extraordinarily high valuation. At £55.90, The market valued the enterprise at 37 times normalised profit (it didn’t make much profit in the year to June 2020, and the single year multiple is 99!)

Normalised profit is the return the company would have made if it had earned its average return on capital using the capital employed in the most recent financial year.

Renishaw has fantastic technology, an innovative culture, and the business will surely prosper, but I wonder how long it will take long-term investors buying at this price to make a decent return.

Castings and Trifast are valued much more modestly, at seven and twelve times normalised adjusted profit respectively, but I have doubts about the quality of the businesses.

I do not feel confident about any aspect of Castings except its balance sheet which is as strong as the iron it casts.

Profitability is variable, and the strategy focuses on a select group of existing large customers in an industry that could be disrupted by Brexit or a switch to electric or hydrogen power.

Castings does not tell shareholders much more than it has to, which makes me doubt whether I can hold on to it for another ten years or more (I first added the shares in 2009).

Trifast invests very heavily to win the confidence of major equipment manufacturers around the world, yet its average return on capital is 8%, the lowest in the portfolio.

I think management is doing the right thing, but all the endeavour has brought comparatively little reward for shareholders over the long-term and maybe that will not change.

Writing these potted summaries, makes me wonder whether the Share Sleuth portfolio should be invested in any of these three shares.

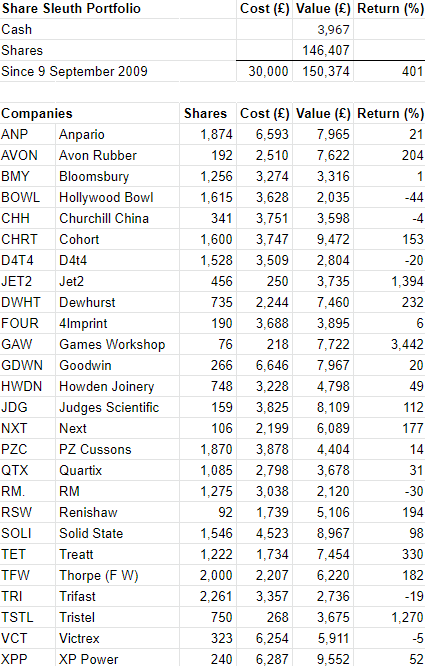

This month I decided to remove Castings from the portfolio and add to the portfolio’s holding in Next.

Trades

On Wednesday 28 December I removed all 1,109 Castings shares from the Share Sleuth portfolio. The share price, quoted by a broker, was 322p and after a £10 deduction in lieu of broker fees the transaction raised £3,596.

Castings was a poor trade, but not a disaster. I added shares to the portfolio three times, in 2009, 2012, and 2013, and SharePad tells me they earned it a 5.5% annual return including dividends.

On the same day, I added 61 shares in Next at a price, also quoted by a broker, of £62.99 per share. The transaction cost £3,871.56 after deducting £10 in lieu of broker fees and over £19 in lieu of stamp duty.

Removing one holding and enlarging another has helped me towards my goal of reducing the number of shares in the Share Sleuth portfolio to less than 25 shares (with portfolio now holding 26 shares).

Notes:

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

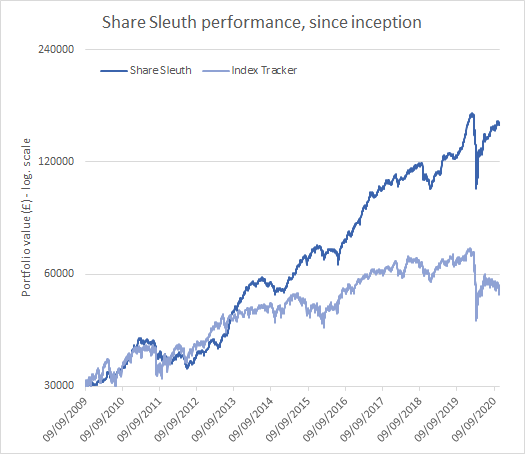

£30,000 invested on 9 September 2009 would be worth £150,374 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £53,955 today

Objective: To beat the index tracker handsomely over five-year periods

Prices: SharePad, 2 Nov 2020

Richard owns all the Shares in the Share Sleuth portfolio.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.