Richard Beddard: I want to believe in this speculative share

This small company boasts a fascinating history and has high hopes for a fast-growing part of its business. It could be preparing for something of a gold rush, so why isn’t our columnist more bullish?

27th October 2023 15:50

by Richard Beddard from interactive investor

Very soon, you may be wearing a poppy to remember the end of the First World War.

Cropper (James) (LSE:CRPR) is the venerable paper maker that makes them, and, more generally, high-quality colourful paper and packaging. Today though, paper is the least promising part of the business.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

In the 1980s, the company developed paper-making technology to make non-wovens: fibre veils that combined with resin-form composite materials used in all manner of industries where tough, light, components with specific electrical qualities or finishes are required.

Today, technical fibres are James Cropper’s principal source of profit and growth, but the business may be about to cede its growth crown as James Cropper positions itself to profit from the growth of the hydrogen economy.

Past present and future

A more succinct and perhaps more unkind description of James Cropper is it is an ailing paper maker dragging down a highly profitable manufacturer of non-woven materials that is taking a punt on hydrogen power.

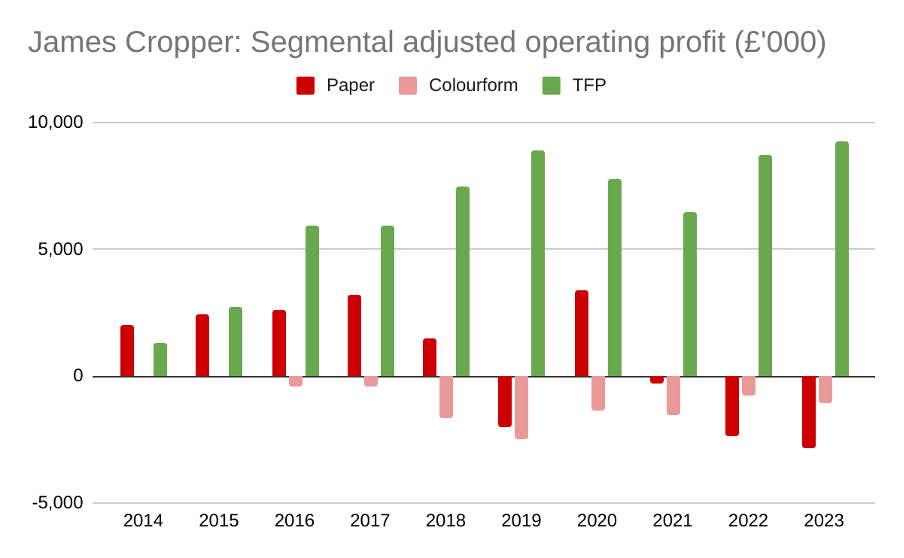

That is the way it looks in 2023 anyway. Currently, James Cropper reports the results of three divisions, TFP, which stands for Technical Fibre Products, Paper (the original James Cropper), and Colourform, a startup that makes packaging for luxury brands.

Source: James Cropper annual reports

The losses in the Paper division in four of the last five years stem from the globalisation and commodification of paper making and our increasingly digital lives. But even before the recent losses, the Paper division was not a particularly profitable business. Between 2014 and 2018 the average profit margin was just 3%.

Colourform makes luxury packaging from paper, moulded into extravagant shapes and wrapped around expensive brands of champagne and perfume. In seven years, it has grown into a small business turning over £4 million, but it has yet to make a profit.

- Stockwatch: a cheap quality share predicting strong sales growth

- Wild’s Winter Portfolios 2023-24: 10th anniversary edition

In contrast, profitability at TFP, which was founded in 1988, is not only positive, but strongly positive. In recent years, profit margins have fluctuated around the 30% level, although they declined to 25% between 2021 and 2023, initially as demand from industries like aerospace dried up during the pandemic and now demand has returned, as it invests to establish its newest venture.

In 2021, James Cropper acquired a company that makes coatings for components in hydrogen electrolysers and hydrogen fuel cells. At the time, it was losing money.

This diversification is not as drastic as it might sound. TFP was already a supplier to hydrogen fuel cell makers. It manufactures the carbon paper Gas Diffusion Layer (GDL) that controls the porosity of the Membrane Electrode Assembly (MEA), the heart of a hydrogen fuel cell.

Cutting to grow

The company is addressing losses in the Paper division by focusing on more profitable luxury packaging, creative papers, and sustainable products, which it describes as a policy of “value over volume”.

These are directions it was already travelling in, but a 15% reduction in staff across the Paper division in the current financial year, as it ceases the production of low value products, retires one of four paper making machines, and switches to continuous seven-day manufacturing may be a sign the company is becoming more decisive.

It may also be a sign it needs to stem the losses so it can invest in the other side of its business, particularly hydrogen.

The electrolyser and fuel cell part of TFP “is forecast to deliver unprecedented growth in the next five years”. TFP predicts revenue will grow at a 61% compound annual growth rate (CAGR) for electrolysers and a 26% CAGR for hydrogen fuel cells.

Preparing for this growth is costing TFP, though. It recently recruited three new senior managers and installed electrolyser coating technology at its US facility in Schenectady.

Electrolyser coatings improve the efficiency of PEM electrolysers, which is one of two mature technologies that convert water to hydrogen that can later be used in fuel cells to generate power. It is the technology behind about a third of global capacity.

- Sector Screener: two retail stocks to own as inflation crisis recedes

- Richard Beddard: why these shareholders will continue to prosper

James Cropper says it is able to supply about 3 gigawatt (GW) of PEM electrolyser capacity, but with further investments it expects to triple that number to 9GW by the end of December. It plans to establish hydrogen coating lines near electrolyser manufacturers worldwide, using its US line as a blueprint.

To put those numbers into perspective, existing electrolyser capacity is paltry. The International Energy Agency (IEA) estimates global installed PEM electrolyser capacity at the end of 2023 will only be 1GW, but the realisation of all projects currently in development could result in capacity of 175 to 360GW by 2030, and even that is well behind schedule to meet the net zero 2050 target.

It looks like TFP is preparing for something of a gold rush.

To make things clearer to customers TFP will become two James Cropper brands: James Cropper Technical Fibres and James Cropper Future Energy. The paper divisions will also be rebranded to James Cropper Creative Papers and James Cropper Luxury Packaging.

Sustainability matters

The poppies may not be the most promising part of James Cropper, but they do tell us something about how the business is changing to meet the requirements of customers, reduce its costs and be more sustainable.

For the first time, this November the poppies will be 100% plastic free. James Cropper paper products have long included fibres from sources like discarded coffee cups and old denim jeans, but James Cropper wants the overall proportion of recycled fibres in paper and packaging to have reached 50% by 2025. Ecoveil, a new range of materials for composites, are made from recycled carbon, jute, and a polyamide derived from castor bean oil.

The company is also in the early stages of decarbonising its manufacturing operations, which it hopes to complete by 2030, principally by building a Low Carbon Energy Centre that will electrify the paper-making process. It is currently powered by natural gas.

Investing from a position of weakness

James Cropper’s devotion to paper, though, means its finances are somewhat stretched, especially considering ongoing investment that not only includes investments in greener energy and new coating lines, but a multi-million-pound IT system.

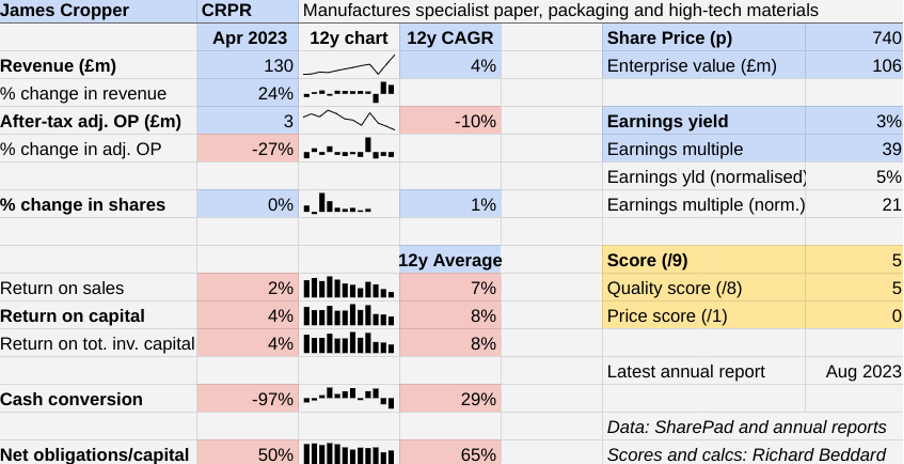

Every statistic relating to profitability and debt is flashing red in my dashboard. James Cropper is less profitable than its 12-year averages, and its single digit 12-year average returns on sales and capital are unimpressive.

For the second year running, the company spent more than it earned in cash terms, partly because it earned less due to high energy and raw material costs, and partly because of capital expenditure. Its pension fund also gobbles up cash to plug the deficit.

The strain is showing on the balance sheet, with financial obligations increasing to half of the value of operating capital.

James Cropper needs to return to positive cash flow soon to fund its strategy.

Scoring James Cropper

James Cropper is a fascinating company. Still run by the founding family, it embodies many of the long-term values I look for, including innovation and sustainability.

It used its paper making skills to develop a highly profitable niche business in technical fibres. That business has been run for the last two years by a managing director who previously worked at two companies well versed in commercialising technology – Halma and 3M.

The Paper division boasts of its 178-year presence at Burneside, the paper mill, and a 100-year partnership with a supplier. Despite demoralising losses in terms of profit and staff, it still reports a 68% employee engagement score.

The company’s goal is to grow its own talent, and underscoring its commitment it is reducing its reliance on external agencies as it improves its recruitment and evaluation processes.

But the prolonged losses suggest it may have been too slow to accept the decline of paper making, and it is investing from a position of financial weakness.

Growth depends in part on the development of a hydrogen powered economy that barely exists yet, and may not develop in the way that James Cropper expects.

These thoughts put the company at the speculative extreme of my universe of shares. I want to believe, but wanting is not enough.

Does the business make good money? [0]

‐ Low return on capital

‐ Low profit margin

‐ Poor cash conversion

What could stop it growing profitably? [1]

? Lack of investment due to stretched finances

? Misplaced loyalty to paper making

? Unanticipated developments in hydrogen production

How does its strategy address the risks? [2]

+ Investing in advanced materials

+ “Right-sizing” paper business

+ Emphasis on sustainability

Will we all benefit? [2]

? Management

+ Long-term ethos

+ Growing own talent

Is the share price low relative to profit? [0]

+ Not particularly. A share price of 740p values the enterprise at £106 million, about 21 times normalised profit.

A score of 5 out of 9 indicates James Cropper may be a good long-term investment.

It is ranked 39 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.