Richard Beddard: it’s worth paying up for this small-cap share

6th May 2022 14:36

by Richard Beddard from interactive investor

It has a simple, established, repeatable strategy that’s being implemented by seasoned executives, which is why this company is one of Richard Beddard’s favourites.

Two things worry me about Judges Scientific (LSE:JDG): the cost of borrowing money so it can acquire more businesses, and the cost of the businesses. Neither of them worry me enough to put me off the investment.

A buy and build story

Judges Scientific buys and grows small manufacturers of scientific instruments. It is not too concerned about what the instruments measure, but the businesses that make them must have certain qualities.

First, they must be successful exporters in global niches, so there is limited competition.

They manufacture the workhorses of scientific and industrial research, established technology that earns high profit margins and reliable cash flows.

And the owners typically want to retire, although there should be managers within the businesses capable of taking over with Judges’ help.

Judges nurtures these businesses, so they quickly pay off its investment and it can invest surplus cash flow in more acquisitions.

- Share Sleuth: why this company has lost its place in the portfolio

- Shares for the future: my five best shares for long-term investment

Profit by numbers

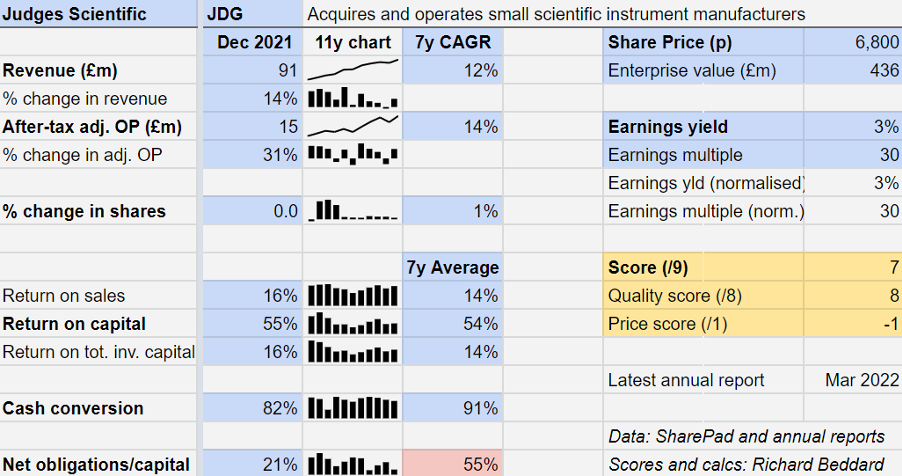

The statistics demonstrate the quality of these businesses.

Over the last 11 years Judges has achieved an average return on capital of 67%, an average profit margin of 15%, and average cash conversion of 89%, while growing revenue and profit at a compound annual growth rate (CAGR) in the high teens.

Growth is in the lower teens when measured over the last seven years, a period in which the company has funded acquisitions entirely from its own resources and diminishing levels of bank debt.

Past performance is not a guide to future performance.

The last two years have been unusual because of the pandemic, marked by the closure of universities, research institutes and manufacturers, and supply shortages.

In the year to December 2020, revenue and profit contracted. In the year to December 2021, it rebounded to record levels, although that does not mean business is as buoyant as it was in 2021.

Judges acquired three businesses in 2019 and 2020. If we deduct the £2.4 million contribution of these businesses from profit and also deduct £0.8 million in research and development costs that it has capitalised in this year’s results, profit is about 90% of what it was in 2019.

In the past, Judges has chosen not to capitalise development costs, an accounting convention that allows it to treat the cost of developing new products as an investment by recording the money spent as an asset on the balance sheet instead of deducting it from profit.

This asset is reduced in value (amortised) and deducted from profit gradually as the company sells the product, matching revenue to costs more effectively and smoothing out the impact of the investment. Judges has chosen to amortise development costs over three years.

Because this is the first time Judges has capitalised development costs, there was negligible amortisation, which means profit is flattered marginally, and is likely to be for the next few years until we have gone through a full cycle of amortisation.

Beautiful simplicity

The beautiful thing about Judges is the simplicity of its strategy. Each business is a specialist in manufacturing particular scientific instruments.

The company is not trying to do anything complicated like integrate these businesses, so they share operations. It just wants to help them make even better products more efficiently and sell them in even more countries.

There are, however, potential wrinkles. The first is the cost of borrowing. Judges typically uses bank debt to fund acquisitions and with inflation rising interest rates may rise further too, increasing the cost of borrowing.

A second potential wrinkle is the cost of acquisitions. Typically, Judges has paid between three times EBIT, a measure of profit, and six times EBIT. There tends to be more competition for larger companies and, as Judges itself grows, it may feel it needs to make larger acquisitions to maintain its growth rate, increasing their cost.

If we turn the EBIT multiples on their heads, we get a crude measure of the return Judges can expect from its acquisitions.

If it pays three times EBIT, the earnings yield is 33%. If it pays six times, the earnings yield is 17%.

Borrowing at 2% for 33% returns is easy money, especially as Judges expects these companies to earn more profit over time under its ownership. But if the cost of borrowing goes up and the cost of acquisitions does too, the deals will become less profitable.

Of course, the two are not unconnected. If it becomes more expensive to fund acquisitions, sellers might be forced to drop their prices.

And Judges points out that a higher interest environment would probably harm competitors like private equity firms more because they rely much more heavily on borrowing.

Judges’ model is to substantially pay off debt ready for the next acquisition, indeed it had net cash at the end of its financial year in December 2021.

Neither is Judges reliant on debt. It is highly profitable and growing organically anyway. Funding acquisitions entirely from its own cash flow would slow growth, but Judges would still be a decent business.

A final potential wrinkle is austerity. Government funding of universities, which are responsible for about 50% of revenue, is likely to come under pressure as states pay the bill for the pandemic.

The company is not heavily exposed to austerity in any particular country though. It earns only 16% of revenue from the UK. Its biggest markets are elsewhere in Europe, and in North America.

Rinse and repeat

Judges’ strategy is not to overreach. It keeps on good terms with its bank by repaying debt and staying well within the terms of its covenants, and it sticks to its guns on valuation.

Judges made no acquisitions in 2021 because owners were paralysed by the uncertainty during the pandemic. It increased its stake in a subsidiary to 88% at a cost of £1.8 million, about 4.5 times EBIT.

The acquisition strategy has been in place since 2005, and since then Judges has made 19, more than one a year. It has not closed or sold any of them, demonstrating, along with the numbers, it is buying businesses that generate returns for shareholders long after the investment has been paid for.

But although the businesses it acquires have successfully invented equipment and sold it around the world, they are small and often quite unworldly.

Their finance functions, IT systems, recruitment practices, production processes or research and development focus may be underdeveloped.

Judges helps them improve these more generic aspects of business so they can grow, an aspect of its strategy that it has emphasised since it recruited Mark Lavelle as chief operating officer from Halma in 2017.

Halma is a kind of template for Judges. It has bought and grown companies making safety, environmental, and health technologies for much longer than Judges has, and demonstrated the strategy can scale to over £1.4 billion in revenue (Judges’ revenue in 2021 was £91 million).

Straight dealer

Judges says it can buy companies on such low multiples because of its reputation for straight dealing.

The company’s founder, chief executive, and dealmaker David Cicurel says it picks up deals that have fallen apart when a previous buyer has attempted to renegotiate after terms have been agreed, something he refuses to do.

Owners can also be confident their business will go on to thrive under its ownership.

- Find out what is now being tipped to be the best investment of 2022

- 60 reasons to sell your UK shares

Mr Cicurel is in his seventies, so the question of retirement looms. While he has been instrumental in the development of the business, that does not mean it would fall apart without him.

Operationally Judges’ businesses are autonomous, and responsibility at board level for developing them is split between Mr Lavelle and chief financial officer Brad Ormsby. Mr Cicurel’s input is most critical in the acquisition process, for which the company says there is a succession plan.

All three executives are paid quite modestly by current standards, and the key indicators they use to judge their performance demonstrate long-term commitment.

Scoring Judges Scientific

You know by now that I like Judges Scientific. It has a simple, established, repeatable strategy that is being implemented by seasoned executives in a restrained and sustainable manner.

It is proud of its reputation, probably rightly so.

Does the business make good money? [2]

+ High returns on capital

+ High profit margins

+ Strong cash conversion

What could stop it growing profitably? [2]

+ Cost of borrowing may increase

? Cost of acquisitions may increase

+ Austerity may hit university funding

How does its strategy address the risks? [2]

+ Keeps on good terms with bank

+ Disciplined about valuation

+ Targets companies that export

Will we all benefit? [2]

+ Experienced managers

+ Employee friendly policies

+ Straight with shareholders

Is the share price low relative to profit? [-1]

+ No. A share price of £68 values the enterprise at £435 million, about 30 times normalised profit.

A score of 7 out of 9 indicates Judges is a good long-term investment. The shares may not be cheap, but I think they are a reasonable price to pay for a high-quality business.

Judges is ranked 11 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Judges Scientific

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.