Richard Beddard: a new hot stock for the portfolio?

15th October 2021 14:29

by Richard Beddard from interactive investor

Our columnist is just getting to know this £700 million AIM stock. Find out if it’s good enough to win a place in his top.

Most weeks I score one of the 40 or so companies ranked by my Decision Engine. I score them as soon as possible after they have published their annual reports and usually there is a backlog of three or four.

Today, there is only one company in the backlog, lighting manufacturer FW Thorpe (LSE:TFW). I will score it next week. This week I want to introduce a company vying for inclusion in the Decision Engine should I drop one of the existing 40.

My score is provisional because I am just getting to know Hotel Chocolat (LSE:HOTC).

More cacao, less sugar

Christmas is coming and so too is the marketing. Yesterday, I received an email from Hotel Chocolat offering me a 25% discount if I spend £80 on chocolate. I might actually do it.

Hotel Chocolat’s mantra is “more cacao, less sugar”. The product, chocolate, is delicious and because of the relatively high cost and relatively low sugar content, it is only mildly unhealthy in necessarily low quantities. Its cachet makes it ideal for gifts, although some members of my family can be bought off with Tony’s Chocolonely.

Perhaps the most amazing statistic in this year’s annual report indicates that over the last two years Hotel Chocolat, which started in the 1990’s as a subscription service, has turned itself back into a chocolate as a service company!

- Richard Beddard: why this is my number one stock

- Read more of our content on UK shares here

- Check out our award-winning stocks and shares ISA

I exaggerate, but in the year to June 2021 70% of revenue was derived from digital sales, partner sales (for example exclusive alcoholic drinks), and continuity products. Continuity products are subscriptions, and sales of Velvetiser hot chocolate machines which also generate repeat sales of hot chocolate.

Obviously, stores were closed during the pandemic, and people were reluctant to go to them even when they were open, but despite that, Hotel Chocolat is selling more chocolate than ever so the expansion of the online business has been extraordinary.

Post-lockdown the split between traditional retail sales and digital, partner and continuity products has settled close to 50:50, with retail regaining a slight advantage, but well below the pre-pandemic level of 70%.

My interest in Hotel Chocolat goes beyond the product. The company is run by its founder, Angus Thirwell, who appears to be the archetype; passionate and driven to empower employees and give customers what they want. His co-founder Peter Harris is the company’s development director.

It is also a pioneer in treating suppliers, small cacao farmers, fairly, exemplified in a new Gentle Farming Charter that promises a living income and training in return for the adoption of sustainable farming practices that eschew illegal child labour.

Hotel Chocolat is vertically integrated, it grows cacao, manufactures chocolate and sells it directly to customers online and through its own stores as well as certain retailers. While it sources from other farmers in the main, it treats them as partners and its experience as a grower enables it to be more involved in their activities.

This self-sufficiency both differentiates the brand and makes Hotel Chocolat more resilient to the kind of shocks we have experienced during the pandemic, and as a result of it.

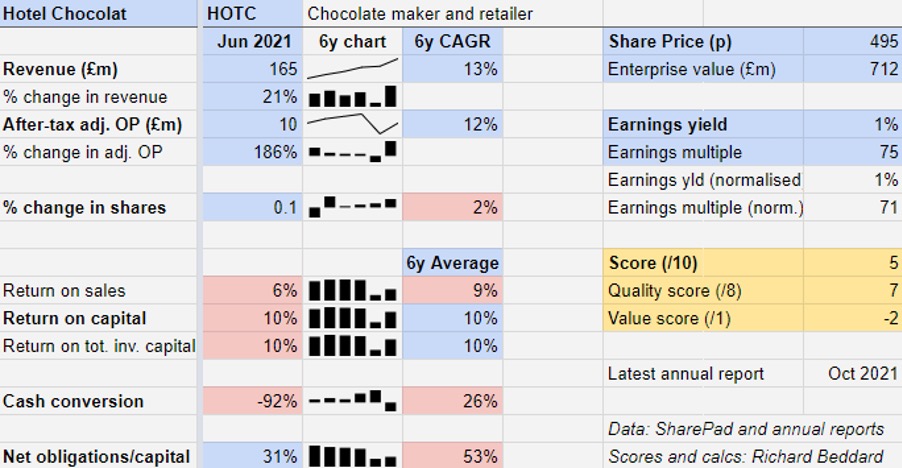

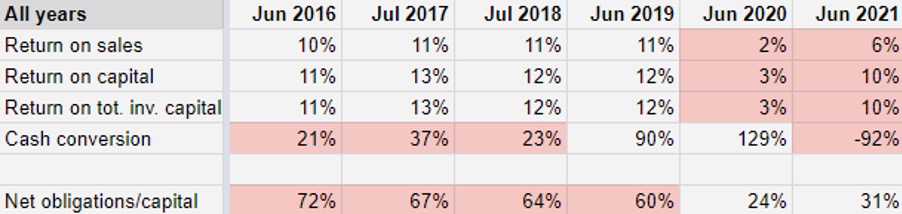

My table is covered in pink warning signs concerning the financials. A 6% profit margin and a 10% Return on Capital in 2021 (lower in 2020) are the kinds of returns we might expect from a modest business.

Before the pandemic, though, when Hotel Chocolat’s shops were making the company money, not losing it, returns were better

Source: SharePad and annual reports

Melting up

Low double-digit returns on capital and profit margins are signs of a decent business but not a great one unless the company is sacrificing profit for growth.

This is what is happening. Hotel Chocolat has been investing heavily. In March 2020 it raised £23 million from investors to double the capacity of its distribution centre and almost double the capacity of its factory in Huntingdon, where it manufactures 95% of the chocolate it sells. This July, after the year end, the company raised £40 million from investors to double the factory’s capacity again over the next three years.

High levels of capital expenditure also explain weak cash flows, which absorb the full cost of investment immediately (unlike profit, where the impact is spread over time through depreciation). In 2021, Hotel Chocolat spent more on property, plant, and equipment than it earned in operating cash flow. Capital expenditure was almost two times depreciation.

- Don't be shy, ask ii...how do I tidy up my investment portfolio?

- Shortlist of AIM’s best companies in 2021 revealed

The company’s focus on digital channels means growth in the future may be less capital intensive than a roll out dominated by physical stores, especially abroad where the company’s ambitions increasingly lie.

In taking a capital-light approach though the company has relinquished control of one aspect of its operations though, fulfilment, which is supplied by the Hut Group.

And International revenue is a very modest 3% of the total, so Hotel Chocolat has yet to demonstrate anything like the level of appeal it has at home.

I am hardly alone in having mostly positive thoughts about Hotel Chocolat. Traders have been buying the shares and, at 495p, the enterprise is valued at £712 million, a heady 71 times profit.

Scoring Hotel Chocolat

Does the business make good money? [1]

? Modest profit margins impacted by investment

? Ditto return on capital

? Ditto cash conversion

What could stop it growing profitably? [2]

+ Strong finances

+ Differentiated product makes it resilient against competition

? International appeal yet to be established

How does its strategy address the risks? [2]

+ Vertical integration makes it resilient

+ Heavy investment in product and capacity

+ Overseas expansion is digital first and less capital intensive

Will we all benefit? [2]

+ Founder-led

+ Treats employees, customers and suppliers well

+ Explains itself well to shareholders

Is the share price low relative to profit? [-2]

− No

I have not yet added Hotel Chocolat to the Decision Engine. A score of five out of nine means it may be a good long-term investment, but it is not attractive enough to replace one of the existing members.

Price, though, is the main reason for this low score. While the price is melting up now, that can always change.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.