Richard Beddard: only one problem with this new stock

24th March 2023 15:05

by Richard Beddard from interactive investor

After analysing its numbers for the first time, this billion-pound company would have been one of our columnist’s top shares. But it isn’t. Here’s why.

It is budget day, March 2023. You stray on to YouGov (LSE:YOU)’s home page and learn that 65% of us disapprove of the government, and 60% of us feel the economy is the most important issue facing the country.

Naturally, the home page is polling visitors about the widely trailed extension of the government’s energy support scheme and the imminent increase in corporation tax.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Answer the questions, and you get points, and you know what points mean? They mean prizes: cash, or shopping vouchers.

What the world thinks

YouGov is famous for fast, relevant, headline-grabbing polling. A glance at the home page on any day provides a taste of the zeitgeist.

It is budget day again. A chart shows that 39% of us describe our mood in the last week as “stressed”, exactly the same percentage as in July 2019, the first date. We are not as happy, though, even though we are fractionally more optimistic.

Strikers: we blame the government at least as much as we blame you, unless you are a train driver or railway worker.

Octopus Energy: you are the most loved utility.

The media feeds off YouGov data, which has made the company, it claims, the most quoted market research source in the world. This is how YouGov has made its name.

- 10 cheap growth shares for bullish investors

- Insider: directors buy this resilient best stock idea for 2023

It makes most of its money by continuously polling us and selling the data to the media, brand owners, and advertising agencies through cloud based interfaces that customers can increasingly interrogate themselves.

Improving as it grows

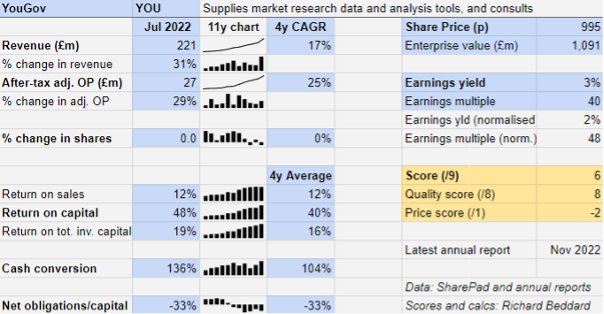

YouGov has just published half-year results for the period ending January 2023, so there has been more than six months trading since the latest full-year shown in my table summarising the last decade or so of full-year results.

The company grew so strongly in the first six months of the year that it is confident it will grow revenue over the full year to July 2023, and grow profit by more, despite fears for the economy.

The long-term trend is a happy one, fast-growing revenue and faster-growing profit. YouGov appears to be getting more efficient as it grows and its compound annual growth rates (CAGR) in revenue of 17% and adjusted profit (25%) are similar to its longer-term CAGRs.

For the last four years YouGov has been operating at a very high level, with average return on operating capital of 40% and cash conversion of over 100%. Not surprisingly perhaps, it is in a very strong financial position, with net cash on the balance sheet at the end of each financial year.

If my Decision Engine detects a potential problem in the numbers, it highlights it in pink. As you can see from the table, everything is blue.

The Decision Engine uses average return on capital to calculate a normalised profit figure, which is then used to calculate the earnings yield. This is because profits can fluctuate, so a single year’s profit can be misleading.

However, when companies have grown profitably, like YouGov, low returns on capital many years ago penalise them, probably unfairly. This is the reason I have used the average of only the last four years' return on capital to calculate normalised profit and the earnings yield.

The assumption is that current historically high levels of return on capital are sustainable.

Even so, the shares are not exactly cheap. The normalised earnings yield is 2%, equivalent to a multiple of 48 times adjusted profit.

Building a platform

YouGov’s annual report strapline is “Building our Platform”, but the motto on its website is, “What the World Thinks”. The second blurb tells us what the company does, the first tells us how it is doing it.

YouGov is one of many making the transition from a consultancy business model, a collection of employees working on bespoke projects, to a provider of data products and software services.

In fact, it is well on its way. In 2015, when YouGov switched its primary segmental reporting categories from geographical regions to product lines, it earned £50 million from custom research and £26 million from data products and services (about 34% of total revenue).

Seven years later, in 2022, the situation had reversed. YouGov earned almost twice as much as it did in 2015 from custom research (£96 million), but it earned £125 million, almost five times as much as before and contributing 57% of total revenue, from data products and services.

- Why Warren Buffett loves a stock market crash

- Stockwatch: bonds, equities or cash – my investing tactics

Software and data is more scalable than project work, that can only grow as fast as YouGov can employ market researchers, and the company has exploited this by expanding overseas.

In 2011, revenue from the company’s two biggest markets were not that far off parity. YouGov earned £19.75 million in the US and £16.5 million in the UK.

By 2022, although both markets had grown significantly and they remained the company’s biggest, the gap had also grown. In that year, YouGov earned £96 million in the USA and £53 million in the UK. Together, they contribute 67% of revenue, with the remainder spread broadly around the world.

Underlying the strategy to automate market research and roll out the platform are capabilities a long time in the making.

Ever since it was founded in 2000, YouGov recruited its own online panel, rather than buying lists of people willing to answer questions on the telephone from panel providers (businesses that recruit panels) or stopping people in the street.

Today, the company has grown its panel to over 22 million registered members worldwide, although some of those will be inactive, and in 2022 it paid out over £16 million in rewards during the year.

Such a large panel makes it easier to create representative population samples, which is the holy grail of market research because the more representative a sample the better the predictions extrapolated from it.

YouGov polls these members daily, creating “Living Data’ that clients can segment and interrogate. Surveys Direct, a new product launched in October, promises self-service results within an hour.

YouGov is also a pioneer of statistical techniques that improve predictions from less than representative population samples by factoring in other population data.

Polling representative samples at national and regional or constituency levels is very expensive, so these techniques probably give YouGov a cost advantage.

- Shares for the future: why I think these 24 shares are good value

- Richard Beddard: this share scores almost perfect marks

The company claims the research outperforms rival opinion polling firms, although I cannot see much difference in the comparative data it has published.

I think YouGov is winning principally because it can deliver research that is as good as its rivals, more quickly and cheaply than they can.

This not only benefits customers but also generates a lot of publicity for YouGov.

For a technology company, though, the annual report is strangely devoid of hype about artificial intelligence, which is being used by market researchers to analyse data and make predictions.

YouGov’s risk report recognises that it must keep up with developments in the field, and the company uses natural-language processing to weed out poor-quality responses to surveys, but that is about all it says.

It seems likely artificial intelligence will form a bigger part of YouGov’s analytical toolkit in future, but unlikely that it is a substitute for asking people questions directly, something YouGov excels at.

Perhaps it is more an opportunity than a threat.

Meanwhile, the jury is out on how intelligent artificial intelligence will be. YouGov reports that 45% of us believe robots will develop higher levels of intelligence than humans, down from 48% in 2019, when fewer of us had been exposed to artificial intelligence!

Scoring YouGov

I like YouGov. Co-founder Stephen Shakespeare is a major shareholder, and although he plans to stand down as chief executive in August, by which time the company expects to have recruited a successor, he will remain as non-executive chairman.

The company makes substantial research available free to the public and academics as a public service, which is interesting, useful, and no doubt raises YouGov’s profile.

The company says its mission is to give people a voice, and having answered a few surveys, I think many panellists may be in it for more than Asda vouchers. Perhaps they feel heard.

As an accredited Living Wage employer, it pays a living wage to all staff, including contractors.

Credit to investors who, when YouGov was much less profitable, could see the business would scale efficiently.

The question now is how long that process can continue. YouGov is still smaller than market research giants such as Nielsen, Kantar and Ipsos SA (EURONEXT:IPS), which all earn revenues in the billions, or many billions, of dollars.

Does the business make good money? [2]

+ High return on capital

+ Decent profit margin

+ Strong cash conversion

What could stop it growing profitably? [2]

+ Strong finances, recurring revenues mitigate recession risk

+ Cost advantages over competitors

? Technology

How does its strategy address the risks? [2]

+ Investment in panel

+ Investment in platform

+ International growth

Will we all benefit? [2]

+ Very experienced management

+ Living wage employer

+ Shares data publicly

Is the share price low relative to profit? [-2]

+ No. A share price of 995p values the enterprise at about £1.1 billion, about 48 times normalised profit.

If my score seems uncritical to you, it does to me too. That may be because YouGov is a great business. It may also be because this is the first time I have scored it, and sometimes it takes me longer to find what I do not like.

At first blush though, a score of 6 out of 9 indicates YouGov may well be a good long-term investment. It comes at a steep price.

YouGov joins the Decision Engine in place of RM. It is ranked 27 out of 40 shares.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.