Richard Beddard: our stock analyst picks a new share

11th June 2021 14:07

by Richard Beddard from interactive investor

Attractive financial figures made Richard want to get to know this innovative AIM company a bit better.

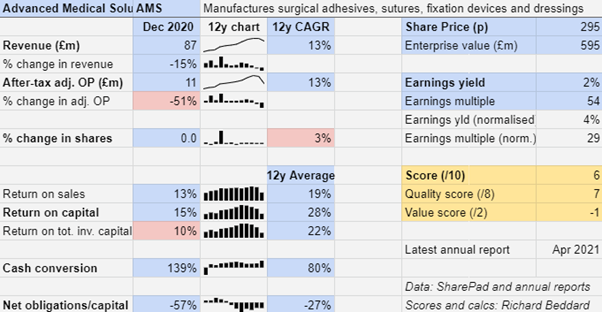

This week I am introducing a new share, one that I have been following for less than a year. This is my first attempt to score Advanced Medical Solutions (LSE:AMS).

AMS makes tissue adhesives, internal fixation devices, and sutures used to piece us back together again after surgery, and dressings that help wounds heal.

Its biggest brand is LiquiBand, a skin adhesive used in place of stitches. Skin adhesives are kinder to patients than sutures. They can be used internally, do not need to be removed, and protect wounds, sometimes taking away the need for a dressing.

The first thing that attracted me to AMS was the numbers.

Pandemic impact

Routine surgery in AMS’s biggest markets in the USA, Europe and the UK were cancelled during the pandemic, and demand for its products fell in the year to December 2020.

Because its factories produced lower volumes, fixed costs, including paying staff in full, rose as a proportion of revenue, and profit halved.

Even so, AMS remained highly profitable and, despite spending £22 million to acquire Raleigh Coatings, the company remained cash rich.

Over the last three years, AMS has acquired three companies, but a modest 10% Return on Total Invested Capital (ROTIC) in 2020 has as much to do with the impact of the pandemic on returns than the low, or negative returns from the acquisitions, which were bought because of their strategic potential.

Step up in acquisitions

The first of the three acquisitions was Sealantis in January 2019. Sealantis had developed but not yet fully commercialised a novel sealant that minimises gastrointestinal leaks after surgery. The company says its sealant is more convenient and carries lower risk of infection than the market leaders.

AMS says its first Sealantis products should be approved next year in Europe. They fulfil an unmet need for an effective sealant following bowel surgery, and mark AMS’s entry into the $1 billion global sealant market.

At the end of 2019, AMS acquired Biomatlante, which brought the company a patented portfolio of products used in surgery including synthetic bone substitutes, collagen membranes and bioabsorbable screws. Biomatlante also introduced AMS to new markets. Synthetic bone is a £0.5 billion industry.

The acquisition of Raleigh Coatings last November was slightly different. Raleigh was one of AMS’s suppliers, applying silicone coatings and perforations to AMS dressings and mesh. Bringing the capability in-house will reduce manufacturing costs and enable AMS to develop better products.

But Raleigh also coats bio-diagnostic strips, which the company says will enable it to enter the bio-diagnostics testing market, although it has not described the opportunity or put a number on its size.

Modest sized business with big competitors

AMS is a modest size business with some big competitors like Johnson & Johnson, Smith & Nephew and 3M, as well as low-cost competitors who undercut the big brands on price.

Customers – hospitals - also band together into buying groups to reduce the cost of supplies.

This tough competitive environment has not prevented AMS from gaining market share. In the USA it claims a 20% market share for LiquiBand tissue adhesive.

But the end of a long run of profit growth for AMS came in 2019, not 2020, and it was the result of competitive pressure.

AMS lost ground to competitors in the USA, when buying groups opted for cheaper products than LiquiBand. The company says new products and tighter regulations will bring about a recovery.

Development led strategy

AMS’s strategy is to invest in research and development, with an ambition to launch two new products a year.

Despite lower revenue in 2020, the company increased research and development spending in absolute terms. In proportionate terms it was over 9% of revenue.

The revival of LiquiBand in the USA should be helped by the launch of LiquiBand XL, probably later this year, and LiquiBandFix8 in 2022.

LiquiBand XL will be AMS’s entry into the large wound closure market and LiquiBandFix8, an adhesive that fixes hernia mesh through a minimally invasive device, takes it into the $250 million hernia fixation market.

The company says trials show LiquiBandFix8 is stronger than advanced tacking devices and patients suffer less pain after the operation. Once it is approved by the US Food and Drug Administration (FDA) it will be the “first product of its type”.

The company is also registering its products in new territories around the World. The Indian regulator approved LiquiBand in 2020.

AMS: divisional analysis

| 2020 | Revenue | Adj. op. profit | Profit margin |

|---|---|---|---|

| Surgical | 50,169 | 9,094 | 18% |

| Woundcare | 36,627 | 5,357 | 15% |

| 2019 | |||

| Surgical | 56,544 | 16,086 | 28% |

| Woundcare | 45,824 | 11,378 | 25% |

Source: annual report 2020

Although AMS talks more about Surgical products than Advanced Woundcare, the smaller and slightly less profitable of its two divisions, launches during the year indicate this division is also seeking to move into adjacent markets.

Dressings, which mop up excess fluid and control infection by incorporating antimicrobials, are sold under AMS’s ActivHeal brand and partner brands.

A strong commitment to investment in product and operations are laudable objectives, but they are not necessarily winning ones unless it can out-innovate competitors, and while AMS embraces a number of different routes to market, I am not sure this distinguishes it from the competition either.

While novel products suggest it is innovating successfully, setbacks for the established LiquiBand product and AMS’s increasing reliance on acquisitions to open up new markets, makes me wonder whether growth in future might be more bumpy than it was before 2019.

AMS: geographical analysis

| Revenue | 2020 | 2019 | % change |

|---|---|---|---|

| United Kingdom | 16,748 | 20,151 | -17% |

| Germany | 18,888 | 20,018 | -6% |

| France | 4,369 | 3,913 | 12% |

| Rest of Europe | 18,027 | 19,563 | -8% |

| United States of America | 23,690 | 34,879 | -32% |

| Rest of World | 5,074 | 3,844 | 32% |

Source: annual report 2020

The pandemic means it is impossible to know whether AMS is turning things around in the USA, the biggest market for LiquiBand, but it experienced its biggest decline there in 2020 too.

Scoring AMS

It is my first time scoring AMS, and I am nervous about it. The numbers indicate it is profitable and cash generative, and demand seems likely to recover now the impact of Covid-19 is diminishing and a new normal is emerging.

What is more, I like what I have read about the company’s culture, from which innovation emerges.

The company reports employee retention (93%) and engagement (78%) figures, which bodes well. 2020 was an unusual year of course, but the company achieved retention rates of 88% and 90% in the previous two years.

- Read more of our content on UK shares here

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Chief executive Chris Meredith is very experienced, having joined the company in 2005 and occupied various roles before taking the top job in 2011. Chief financial officer Eddie Johnson joined in 2011.

But perhaps because I do not know the company very well yet, competition and a more acquisitive strategy worry me.

Does the business make good money? [2]

+ High return on capital

+ High profit margins

+ Strong cash conversion

What could stop it growing profitably? [1]

+ Very strong balance sheet

? Cheaper competition may be shut out by tighter regulation

? More acquisitions mean more risk

How does its strategy address the risks? [1]

? Investment in R&D and regulatory approvals to address new markets

? Operational excellence

? “Flexible” routes to market: oems, direct sales and distributors

Will we all benefit? [2]

+ Very experienced board

+ Recruitment and development of talent is a strategic pillar

? Executive remuneration is modest, except perhaps CEO’s performance related Long Term Incentive Plan (LTIP), which can earn him up 200% of base salary

Is the share price low relative to profit? [-1]

− A share price of 295p values the enterprise at 29 times normalised profit

A score of 5 out of 10 means AMS may be a good long-term investment.

I am interested enough to give it a place in the Decision Engine and start to get to know it better.

Note: AcitvHeal® and LiquiBand® and derivative product names are registered trademarks of Advanced Medical Solutions.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.