Richard Beddard: the share that induces a sense of calm

Revenue and profits are growing at this extremely well-managed £400 million AIM company, which our columnist still thinks is a good long-term investment.

24th November 2023 15:05

by Richard Beddard from interactive investor

The front cover of FW Thorpe’s annual report this year features a dazzling picture of Big Ben at night.

It shows off the clock face newly illuminated by 228 luminaires and 55,000 individual LED chips, preserving the original gaslight colour and saving 60% in energy costs. It is a lighting project, started in secret in 2016, that the company can finally boast about.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Shining a light on FW Thorpe

Thorpe (F W) (LSE:TFW) makes commercial lighting systems, fixtures and controls that light factories, warehouses, shops, offices, schools, hospitals, roads, car parks and other public spaces.

Spotlight on FW Thorpe subsidiaries

Revenue (£m) | Domicile | Acquired | Founded | Description | |

Thorlux | 93 | UK | 1936 | Lighting systems, all sectors | |

Lightronics | 25 | NL | 2015 | Road, external, impact resistant lighting | |

SchahLED | 21 | D | 2023 | Industrial lighting systems | |

Zemper | 19 | ESP | 2022 | Emergency lighting | |

Famostar | 12 | NL | 2018 | Emergency lighting | |

TRT | 10 | UK | 2013 | Road, tunnel, amenity lighting | |

Solite | 4 | UK | 2009 | Clean room lighting | |

Philip Payne | 4 | UK | 1996 | Emergency exit signs | |

Portland Lighting | 3 | UK | 2011 | Sign lighting, road sign lighting | |

Ratio Electric | NL/UK | 2022 | EV charging |

Source: FW Thorpe annual report 2023. Ratio Electric is a 50% joint venture.

SchahLED revenue is annualised, FW Thorpe owned it for nine months of the year.

Its biggest subsidiary, Thorlux, was founded in 1936 and is as old as the company. It earns almost half of the group’s revenue. The rest comes from smaller specialised manufacturers of emergency lights, exterior lights and lighting for laboratories and clean rooms.

All its subsidiaries share the same purpose, which is to reduce the long-term costs of lighting by producing reliable, easy to maintain and energy efficient lighting. The products will probably not be the cheapest to buy, which is why FW Thorpe earns good margins, but they should be the cheapest to own.

This sales pitch is often welcomed by end customers, private companies and public organisations motivated to reduce costs and their carbon footprints. FW Thorpe’s systems last at least ten years and the quality of the products, the company’s reputation, and its sound finances, reassures customers it will be able to provide spares and service for their lifetimes.

The promise of reliability is delivered through self-sufficiency. FW Thorpe designs and manufactures its own products, writes its own software, and deals directly with end customers, the owners and operators of buildings, as well as their architects, designers and consultants.

Newly acquired Zemper, a Spanish manufacturer of emergency lighting, was particularly attractive because, FW Thorpe writes in its annual report, it is “...very self-sufficient, with ownership of all its intellectual property, and with its own laboratory test facilities and robotic manufacturing equipment.”

Zemper injection moulds its plastic components, giving FW Thorpe the opportunity to in-source this capability too.

Suppliers are specified at the design stage of construction and refurbishment projects, long before the lighting must actually be fitted. Remaining specified in the intervening period can be a major headache for companies like FW Thorpe.

Being close to the customer helps, and so too does the technology, which has advanced enormously over the last 20 years. This has resulted in a proliferation of capabilities like automation and wireless connectivity unique to each manufacturer.

- Richard Beddard: a share that’s easy to like, but should you buy it?

- Five hard-hit AIM stocks with recovery potential

FW Thorpe’s ability to supply a complete project “from boiler room to boardroom and beyond” also encourages customers to stick with it through the design and build stages.

As well as lighting the clock faces of Big Ben, Thorlux designed the new lighthouse-like Ayrton Light that sits on top of the tower to indicate when Parliament is sitting, luminaries for the clock mechanism, the bells, all of the rooms in the tower, the 340 steps, and the emergency lighting.

Its signature SmartScan wireless controls meant less cabling and therefore less tunnelling through the historic building.

Navigating peak LED

A near 20-year transition from traditional fluorescent lighting to LEDs created challenges and opportunities for lighting companies as customers sought to upgrade or replace their lighting.

FW Thorpe rose to the challenge, growing profitably as it invested in the new technology and fazed out the old, but much of the work has been done. Investors have long lived with the fear that growth might stall once the nation was mostly lit by LEDs. FW Thorpe has been working hard to make sure it will not.

Even though LED systems are designed to last a long time, they do not last forever and some of the earlier ones are now ready for replacement.

The company is also providing an incentive to upgrade older systems by introducing new functionality and sensors to enable wireless connectivity, occupancy profiling, air quality sensing, adjustable colour temperature, and the generation of data for emissions targets.

“Interesting technical innovations” are promised at TRT, FW Thorpe’s underperforming road and tunnel business, to improve profit margins.

Beyond continuous improvement, FW Thorpe has diversified, principally by acquiring European subsidiaries to open up new markets for Thorlux, bring new products, technologies, and capabilities to the UK, and develop collaborations between subsidiaries that make similar products.

FW Thorpe’s homegrown road and tunnel lighting company, TRT, is working with Lightronics, a Dutch subsidiary, which also makes exterior lighting for example.

In September 2022, FW Thorpe acquired SchahLED, a German reseller of SmartScan. It supplies some of Europe’s largest factories in Germany and neighbouring countries with complete lighting systems.

The acquisition boosted Germany into third position in terms of revenue behind the Netherlands and the UK, and means almost half of revenue is now earned abroad.

- Stockwatch: what I’d do next with this successful share tip

- Five outperforming AIM shares that could keep rising

Its most intriguing recent diversification is a 50% investment in Ratio Electric, a Dutch manufacturer of electric vehicle (EV) chargers, which is bringing the brand to the UK.

Ratio has opened its new UK operation at FW Thorpe’s Redditch HQ, where it has its own sales and marketing team and preliminary manufacturing capabilities.

Although it makes domestic chargers, FW Thorpe is promoting the i07, a commercial product designed for workplaces. It has a built-in luminaire incorporating Thorlux components, and will also be sold through FW Thorpe’s lighting subsidiaries to their commercial customer bases.

This joint venture, like the acquisitions, seems to be a judicious way of growing and strengthening the group, a fact suggested by FW Thorpe’s Return on Total Invested Capital (ROTIC) of 16%, a measure that includes the cost of acquired goodwill and intangible assets.

For the time being, though, FW Thorpe has decided enough is enough. It has earnouts to pay (for recent acquisitions) and wants to focus on getting the businesses it has acquired to work together and rebuild its cash pile.

Financial self-sufficiency, the company says, remains a priority and so does another self-sufficient strategic priority.

Harking back to its family origins, FW Thorpe continues to develop employees (in collaboration with Warwick University).

This is perhaps exemplified by the chairman and co-chief executive Mike Alcock, who joined the business as an apprentice in 1984, and also its newest managing director, who heads up the UK Ratio operation.

He is a “young Thorlux design engineer”, recruited by FW Thorpe as an apprentice in 2008.

Sea of blue

Every year, when I update my spreadsheet, FW Thorpe induces a sense of calm. Once again, there are no pink flags in the numbers:

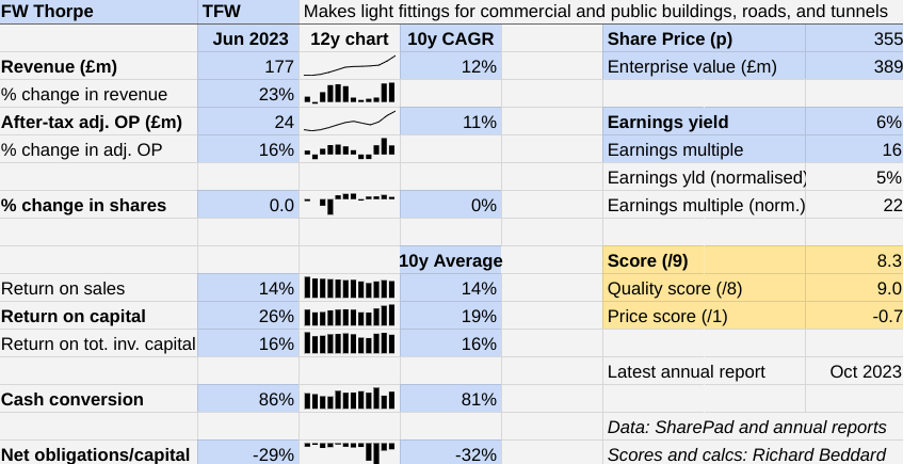

While revenue grew 23%, it includes a nine-month contribution from newly acquired SchahLED. Organic revenue growth was 11%. Return on capital ROC) was an above average 26% and cash conversion was also strong at 86%.

It was a good year because Thorlux delivered a backlog of orders delayed by shortages of microchips and electronic components in the previous financial year. Growth will not be so easy to come by in the current financial year.

While the acquisition of SchahLED has reduced FW Thorpe’s end of year cash pile, it has not eliminated it. Indeed, the amount of net cash on the balance sheet is typical of the last twelve years.

Scoring FW Thorpe

To my mind, FW Thorpe, is an extremely well managed business, and it has been for a long time. One of the four executive directors is a great grandson of the company’s founder and two grandsons have non-executive roles, one of them former chief executive Andrew Thorpe. Between them, the elder Thorpes own 44% of the shares.

The co-chief executives Mike Allcock, also chairman, and Craig Muncaster, also finance director, are extremely experienced.

The company’s environmental credentials are strong too. LED lighting saves energy and lasts a long time. FW Thorpe’s newest SkyCore luminaires are designed to be efficient, compact, modular, repairable and include recyclable components.

The company has been planting trees on its own land since 2009 to offset carbon emissions, and it has installed solar panels on most of its factories. It achieved independently verified carbon neutrality in its own operations in 2012.

Revenue and profit are growing, emissions are falling. FW Thorpe appears to be far-sighted in every respect.

The Past (dependable) [3]

● Profitable growth: Double digit compound annual growth rate in revenue and profit [1]

● Strong finances: Net cash at every year end [1]

● Through thick and thin: RoC has not dropped below 16% [1]

The Present (distinctive) [3]

● Discernible business: Vertically integrated specialist manufacturer [1]

● With experienced people: Very [1]

● That creates value for customers: lowest lifetime cost of ownership [1]

The Future (directed) [3]

● Addressing challenges: LED boom peaked [1]

● With coherent actions: innovation, European expansion, EV charging [1]

● That reward all stakeholders fairly: Yes [1]

The price (discounted?) [-0.7]

● No. A share price of 355p values the enterprise at about £389 million, 22 times normalised profit.

A score of 8.3 out of 10 indicates FW Thorpe is a good long-term investment even though the shares are not obviously cheap. That is because the company has been a stalwart, and shows many signs of continuing to be one.

It is ranked 12 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in FW Thorpe

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.