Richard Beddard: this share is near the top of my shopping list

18th March 2022 15:21

by Richard Beddard from interactive investor

Our columnist assesses prospects for a company which he believes is pretty much the perfect business, available to shareholders at a very reasonable price.

Let us start with the one thing we do not know about Howden Joinery Group (LSE:HWDN): whether its rollout in France will be as lucrative for the fitted kitchen supplier, as its 26-year and counting rollout in the UK.

Selling kitchen cabinets to the French

Though it keeps raising the bar, there is a limit to how many Howdens depots will be needed to supply the UK with kitchens.

For the next stage of growth, the company has tested the market in a number of European countries and settled on France as the focus of its expansion plans because, it says, the market is fragmented and most people do not have fitted kitchens – conditions resembling the UK in the 1990s when it began its rise to prominence.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Howden has adopted a city-focused expansion, which makes sense because it has to establish the brand and can focus its marketing on one city at a time. It reminds me of Jet2’s stealthy rollout in the UK.

During 2021, Howden opened 10 depots in France, but closed five that were not aligned to the city-based expansion. It expects to open at least 20 more in 2022, taking the total number of depots in France and Belgium from 40 to 60; half of them are in Paris.

It is also testing the market in Ireland, where it will open five depots around Dublin.

- Six value share tips for 2022 – and beyond

- How to invest £100,000

- Shares, funds and trusts for your ISA in 2022

Depot revenue in continental Europe is growing. It was £50.4 million in the year to December 202, up from £33 million in 2019. Compared to the company’s total £2 billion in annual revenue, it is barely significant, but that may change.

Howdens does not disclose the profitability or otherwise of its French operation. As a subscale business, which is still finessing its strategy, it would not surprise me if it were losing money. The good news, though, is that it can well afford the investment.

Banner year

In 2020 Howden had its weakest year for many years, although the profit it achieved would still have been the envy of many companies.

Revenue did not fall much, but people were reluctant to replace their kitchens during lockdowns when eating elsewhere was prohibited or difficult. This restricted sales of highly profitable cabinets, and although Howdens sold more door blanks and flooring products, profitability was relatively weak and profit fell 36%.

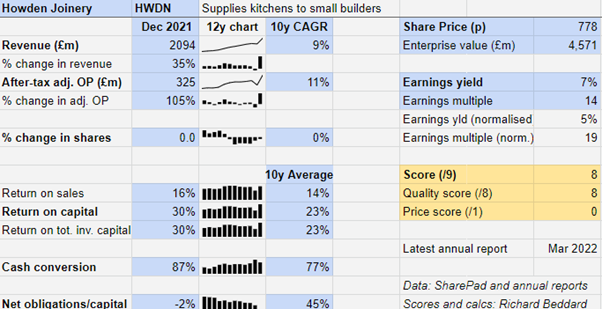

In 2021, the opposite happened. Tired of sitting in tatty kitchens, we binged on new ones and Howden’s results were extraordinary. Revenue increased by 35% and profit by 105%

The company’s average profit margin, return on capital and cash conversion are all high, but the averages were trounced in 2021 when the company earned a 30% return on capital and 16% profit margin. For the first time, Howden had more cash than bank debt and lease obligations. Its pension fund swung from a deficit to a surplus.

2021 will be tough to beat, but the company strikes a confident tone in its annual report. It says builders are still busy and that even though prices are going up, it is passing them on and managing shortages better than its competitors.

Statistically, Howden is pretty much the perfect business, available to shareholders at a very reasonable price. The facts tell me the same thing.

Does one thing well

The special thing about Howdens is that it only sells to small builders. From this guiding policy numerous mutually reinforcing actions follow.

Howden’s pricing is confidential, allowing local managers to be entrepreneurial and customers to set their own margins uncapped by retail prices. The company maintains near 100% stock availability so builders are not delayed, and provides enough credit so they can finish installing a kitchen before they have to pay for it.

The company designs and manufactures its own cabinets, so they are easy to fit, and it is increasing its capacity to manufacture doors and worktops. What it does not manufacture itself, it sources centrally and distributes through its own network.

Vertical integration and high levels of stock have left Howden sitting pretty during the last two years, which have been marked by shortages that have increased lead times for competitors.

Howden locates its depots on the edge of towns because they are cheap to rent and builders can get to them easily, and employs 1,600 designers to work with the end customers on specifying their kitchen.

Many of these policies – credit, high levels of stock and so on – cost Howden, but it also saves money because it does not have to operate expensive showrooms or spend large amounts on advertising. Its customers, small builders, are its sales force.

Net, the strategy is positive, which benefits Howden as well as its customers. It sells a third of all fitted kitchens in the UK, it is highly profitable, and over the last 10 years it has grown revenue and profit at a compound annual growth rate (CAGR) of about 10%.

Scoring Howden

Howden’s strategy is about two things: capitalising on its competitive advantage in the UK, where it had 778 depots at the year end and is targeting 950 (lifted from 850 last year), and creating competitive advantage in France.

I think there is very little doubt that it will continue capitalise on its competitive advantage in the UK as it rolls out a new space-saving depot format, revamps existing depots, improves its online customer platform, shifts more depots to daily stock replenishment (from weekly), and introduces more higher-priced kitchens.

But as Howden saturates the market in the UK it must find new markets or the growth rate will slow. We may be approaching an inflection point in terms of where Howden is investing.

In 2022 Howden plans to open almost as many new depots in France (at least 20) as in the UK (25). Include Ireland, and we reach parity in new openings. The momentum seems to be shifting in favour of continental Europe.

Although we cannot be as certain about the business’s prospects overseas, based on the slickness of the operation here, the similarity of the markets Howden has chosen, and the city-based strategy Howden is following, I am hopeful.

People tend to change kitchens when they move into a new home, so there is a risk to revenue when the housing market slumps or during recessions. But Howden sells to builders installing kitchens in rented accommodation as well as private homes, and its strong finances and commanding position in the market suggests it will survive and prosper over the long term.

Does the business make good money? [2]

- High return on capital

- Strong cash flow

- Solid profit margin

What could stop it growing profitably? [2]

- Strong finances

- Very strong competitive position in UK

- Unanticipated problems overseas

How does its strategy address the risks? [2]

- Policy not to draw on its bank facility

- Operational improvements in UK

- Measured city-based overseas rollout makes sense

Will we all benefit? [2]

- “Worthwhile for all concerned”

- Depot managers can receive life-changing rewards

- Howdens has already achieved carbon neutrality in manufacturing

Is the share price low relative to profit? [0]

- Yes. A share price of 778p values the enterprise at about £2 billion, about 19 times normalised profit.

A score of 8 out of 9 indicates Howden should be a very good long-term investment.

It is ranked 2 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.