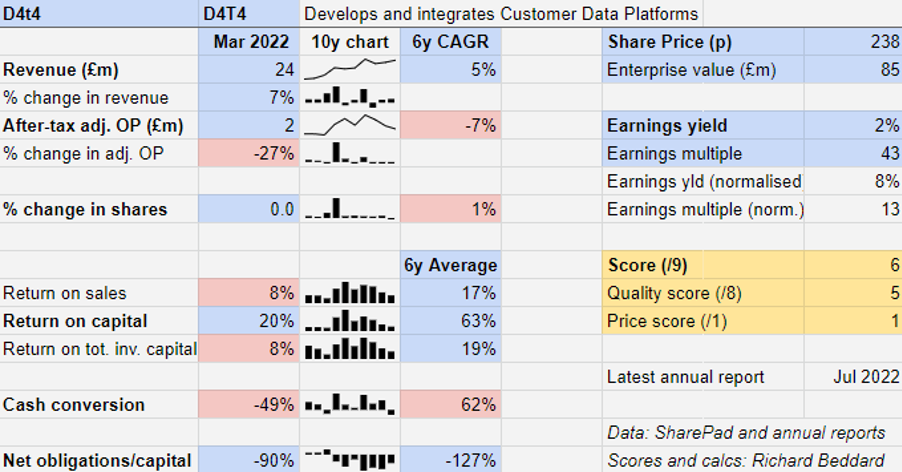

Richard Beddard: is this small-cap share worth the risk?

22nd July 2022 14:20

by Richard Beddard from interactive investor

This company makes good money and the share price is low, but it is one of the Decision Engine’s more speculative plays. Our companies analyst talks through his rationale.

D4t4 (LSE:D4T4) has become something of a jam tomorrow stock as it trades profit for growth. Perhaps the year to March 2022 was the peak pain point for shareholders though.

DAtA

The company owns two software platforms, Celebrus Customer Data Platform (CDP) and Celebrus Fraud Data Platform (FDP). It also builds data management systems for customers, integrating its own software with third party solutions.

FDP, the fraud platform, is a derivation of CDP, a marketing platform, launched a year ago after the company realised people were using CDP to detect fraud.

The platforms capture data from a company’s interactions with customers so its IT systems can react in real time to personalise responses and facilitate a sale or intercept a fraud.

The technology is patented and captures customer interactions with web pages and chat bots, every click, search, mouseover, and piece of text.

- Top investors spot opportunity in ‘cheap’ tech

- 12 stocks for dividend investors hunting for high yields

It can even capture whether we are left or right-handed, the size of our finger, and how much pressure we put on our touchpads. It uses natural language processing to detect emotion in our choice of words.

Celebrus combines the information it collects with data from the customer’s other systems to determine how to respond.

Since all the data is collected by a customer’s own systems, Celebrus does not break privacy regulations restricting the sharing of information between companies, or depend on third-party cookies which from 2023 will be blocked in browsers.

Transitional year

Traditionally, D4t4 sold Celebrus with a perpetual licence, meaning customers paid once and used the software until they no longer required it, or they wanted to upgrade to a newer version.

In recent years, the company has encouraged customers to contract for three years and pay annually, and in 2022 it stopped providing quotes for new perpetual licenses.

The change in payment terms makes it difficult to judge how D4t4 has performed because perpetual licenses earn a large amount of revenue and profit in the year they are sold, while annual payments trade that windfall for a regular income stream.

Annual payment depresses revenue and profit growth in the first year of a contract, but the money should be recouped over time. As the business has transitioned from one type of contract to another, revenue and profit have contracted.

The hit to revenue growth may already be behind us. Annual recurring revenue made of subscriptions and support and maintenance contracts grew 32% in 2022, and D4t4’s total revenue grew 7%.

- Stockwatch: is this well-known small cap share a recovery play yet?

- Five AIM share tips for 2022: a brutal first half

Revenue of £24.5 million in 2022 nearly breached the company’s all-time high of March 2019, when it achieved £25.2 million.

The unnerving thing for shareholders is that profit in 2022 was not only lower than it was in 2021, it was lower than it was seven years ago, when D4T4 acquired the Celebrus platform.

In addition to the transition to annual payments, D4t4 says it has traded off profit in the year to March 2022 for growth in 2023 and beyond, by investing in sales and marketing through the acquisition of consulting firm Prickly Cactus, making high level appointments and improving its administrative systems.

D4t4 also sold a higher proportion of third-party software than usual, which earned it lower profit margins in 2022. The company expects the mix to swing back towards its own more profitable intellectual property this year.

Typically, the sales cycle of CDP and FDP is a year so FDP, launched in June 2021, has only attracted two paying customers. Now the product has been in the market for a year, more should follow in 2023.

D4t4 did not lose a single customer during the year (it lost an airline the previous year in the midst of the pandemic). If it can keep that record up, every new CDP and FDP contract is incremental growth.

It seems probable that, having invested heavily and substantively transitioned its customers onto contracts with annual payment terms, the current financial year will be the year in which profit starts growing again.

Meanwhile, D4t4’s poor cash conversion in 2022 may also be a blip. Some of D4t4’s partners owed it large sums comprising multiple sales to end customers at the year end.

The payments were received soon after, allowing the company to pay a special dividend.

Barriers to growth

D4t4’s strategy is focused on increasing sales of CDP and FDP. Software licenses are the company’s highest margin and most consistent source of income, but the rapidly growing annual recurring revenue figure also includes less profitable maintenance and service elements.

Despite the focus on CDP and FDP, and the fact the Customer Data Management division incorporates proprietary software too, D4t4 only earned 25% of revenue from sales of its own intellectual property in 2022, which means the company still relies on less dependable sources of profit.

Another potential source of concern is D4t4’s partners, which bundle Celebrus and other D4t4 technology in their products. These are big multinational software companies like SAS, Teradata and Pega.

Pega, for example, has recently launched Always-On Insights, a product that combines CDP with Pega’s own Pega Customer Decision Hub. CDP captures information in real-time and Pega decides what happens next.

These relationships create a big dependency. D4t4 earned 68% of revenue from its largest customer in 2022, and another 11% of revenue from its second largest customer.

The company does not disclose which customer is its biggest, but reportedly it is SAS. D4t4 has been a SAS partner since 2006, so the relationship is long-lived, but the power of big customers is demonstrated by their imposition of 90-day payment terms.

Superior software

Celebrus makes customer interactions quicker and easier by understanding more about customers than the data they put into companies’ systems reveals, much as a skilled salesman or bank manager (in the old days) might during a face-to-face transaction.

By personalising and automating transactions in real time, it makes them more efficient, winning more customers for D4t4’s customers, and saving them money.

Few companies currently demand this level of sophistication. Banks and insurance companies are in the vanguard, but D4t4 also sells Celebrus to retailers and airlines for example, so the potential market is very large.

The company thinks it is on to a winner. Aspects of Celebrus are patented and the customers that have adopted it do not go back.

To grow, it must keep improving the software through twice yearly releases. It must also continue to strengthen its relationships with partners while diversifying its routes to market by finding new partners and appealing directly to end customers.

Direct sales are at a very early stage, and judging by the share of its biggest partner, D4t4 needs to recruit and build additional partnerships.

Ultimately, the evidence that the sales drive is succeeding will come from growing profit.

New board

Founder and former chief executive Peter Kear retired from the board in 2021, although he retains a 3% shareholding.

His replacement Bill Bruno joined the company in 2018 as VP of North America, the company’s biggest geographical market by far.

The only other member of the restructured board, chief financial officer Ash Mehta, is also a new appointment.

Scoring D4t4

I see the promise, but I also doubt D4t4.

We cannot ignore software, it is an essential enabler of businesses and the ability to quickly capture and analyse data is the latest incarnation of that trend.

But the overlapping capabilities of different software services, and the fact that companies build their own data management systems, means the competitive landscape confounds me.

D4t4’s strategy is sensible and uncomplicated, but until profit growth validates it and the company reduces its dependency on its biggest partners, I will be cautious in my scoring.

Does the business make good money? [2]

+ High return on capital

+ High profit margins (temporarily depressed in 2022)

? Cash conversion is merely decent

What could stop it growing profitably? [1]

+ Financially strong, revenue should be resilient

? Own IP is only 25% of total revenue

? Dependence on large partners

How does its strategy address the risks? [1]

+ Improve the product

+ Strengthen partner relationships

? Direct sales and new partners

Will we all benefit? [1]

? Founder Peter Kear has left the business

? New board has made culture a strategic priority

+ Presentations for private investors are informative

Is the share price low relative to profit? [1]

+ Yes. A share price of 238p values the enterprise at about £85 million, about 13 times normalised profit.

A score of 6 out of 9 indicates D4t4 is probably a good but somewhat speculative long-term investment.

It is ranked 31 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in D4t4

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.