Richard Beddard: this stock is a good long-term play - and well priced

This company has had a mixed pandemic, but stands to gain as global lockdowns end.

21st May 2021 15:03

by Richard Beddard from interactive investor

This company has had a mixed pandemic, but stands to gain as global lockdowns end.

You learn a lot about companies in a crisis. Going into the pandemic I knew two things about 4imprint (LSE:FOUR) that gave me confidence it would survive and prosper.

It had lots of spare cash, and its business model, which connects manufacturers and customisers of promotional goods to the organisations that give them away, often at training events, fundraisers, and trade shows, does not actually make much.

Revenue would fall. Promotional activities are one of the activities companies tend to reduce during a recession to conserve cash and 4Imprint does 98% of its business in the US, where, for large parts of the year, people were encouraged not to meet.

Trade show products, like electronics and mugs imprinted with customers’ brands or messages, fared worst, and branded clothing fared better, but only the only category to do well was, unsurprisingly, personal protective equipment.

Without the high fixed costs of factories, machines and long-term contracts, perhaps 4Imprint would be able to manage its costs and defend profitability, though. It does not even have to carry large stocks, as typically orders are shipped directly to customers by the suppliers. The suppliers would, no doubt, fret about fixed costs.

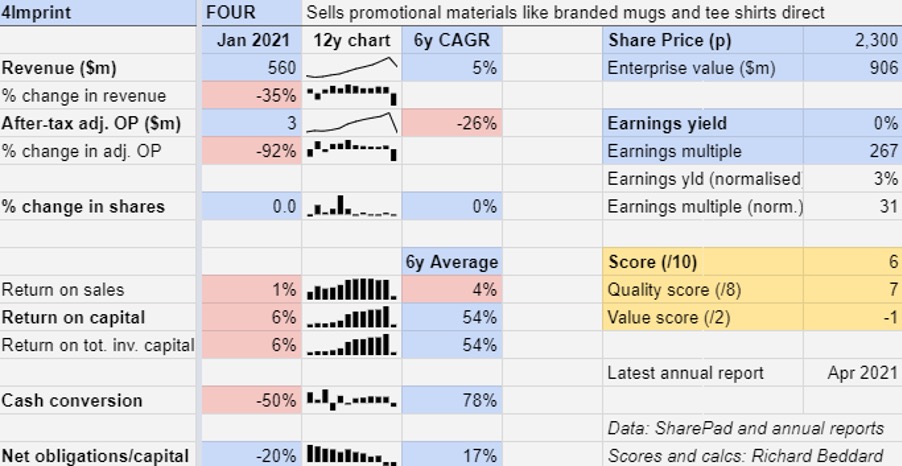

Actually, revenue fell 35% for the year to 2 January 2021, but profit fell 92%. Since profit is what is left over after costs are deducted from revenue, 4Imprint’s costs were not as flexible as might have been expected.

- Richard Beddard: the UK’s Amazon is already in the FTSE 100

- Richard Beddard: scoring a potential FTSE 100 stock

Free cash flow was negative, although that was because the company made a large one-off payment into a pension scheme, the liabilities of which are now very modest.

Were it not for the payment, cash flow would have been well in excess of the small profit the company made and, having cancelled the dividend, the company would have ended the year with an even stronger cash surplus than it started with.

As it happened, 4Imprint’s cash balance declined only 3% to a fraction below $40 million (£28.31 million). It has no debt.

The company more than halved its spending on marketing by suspending many direct marketing activities such as sending out catalogues and samples to customers who were working at home, and cutting search engine advertising. Instead it switched to TV advertising, which was cheaper than usual due to the pandemic, to keep the brand in customers’ minds.

Although marketing is 4Imprint’s biggest item of expenditure, it was not enough on its own because the company refused to lay off staff, cut salaries, or both.

In the year to January 2021, it spent fractionally less on wages than it did the previous financial year, because nobody earned a bonus, even though in April 2020 weekly orders were 80% below the same period in the previous year.

Although orders recovered as the year progressed, they were still 30% down in the fourth quarter. By the final three weeks of April, they had recovered to 15% below levels achieved in April 2019 (April 2020 was during the first lockdown and therefore it is not a useful comparison).

- Seven ‘buy and forget’ shares for investors with time on their side

- 10 shares set for earnings growth

Retaining the workforce on full pay, the company says, is an investment in a speedy recovery and protects its prior investment in recruitment and training. The amount it received (mostly from the US government )to keep workers in jobs was fairly trivial in comparison to the cost.

We learned two things about 4Imprint during the pandemic. 4Imprint has the courage of its convictions, and its treatment of employees should have increased their goodwill and propensity to perform. But loyalty comes at a price when times are tough.

Fortunately I now have one such year in my spreadsheet, which will make the averages I report more realistic and also the ratios comparing price to normalised profit.

Although return on capital was just 6% in 2021, the average for the last seven years is 54%, so 4Imprint remains an impressive business.

The current share price values 4Imprint at about 264 times after-tax profit, a meaningless statistic as the profit in 2021 was a freak result.

Had 4Imprint earned its average return on capital in 2021, the current share price of £23 values the enterprise at about 31 times profit.

That is not obviously cheap, but is 4Imprint worth it?

This is how I score it...

Scoring 4Imprint

I like 4Imprint. Promotional products are big business in the US, where the company earns almost all its revenue.

It is a highly fragmented market, in which 4Imprint has grown to be the largest distributor.

By focusing on selling into a big market it has developed an uncomplicated business that can grow simply by doing more marketing.

The company’s commitment to staff is clear. The first two paragraphs on the first page of the annual report state that the company places “particular emphasis on personal fulfilment”, to attract and retain staff. It is evident in its policies, from its golden rule (treat others as you would wish to be treated yourself) to paying them in full throughout the pandemic.

The company, which sent out its first catalogue in 1987, says it has mature, proprietary systems that it invests in on an ongoing basis and that its direct marketing is supported by data-driven analytics.

The website is slick, human (it features photographs of employees with their names and their length of service) and offers price, delivery, and satisfaction promises that make John Lewis seem cut-throat.

Unsurprisingly, at the moment it is showcasing the opportunity to buy logo-ed clothing and face masks.

Mature systems, motivated staff and little requirement to invest in production or stock should mean 4Imprint can continue to grow at the expense of smaller and less efficient rivals.

Does the business make good money? [2]

+ Very high average return on capital

+ Decent cash conversion

? Modest profit margins

What could stop it growing profitably? [1]

+ Strong financial position

? Customers cut promotional spend during recessions

? Covid-19 may change business practice forever

How does its strategy address the risks? [2]

+ Investment in technology and systems

+ Investment in people

? Acquisitions are a strategic option, yet to be taken

Will we all benefit? [2]

+ Experienced board, reasonable pay

+ Employee friendly policies

+ Strong customer focus

Is the share price low relative to profit? [-1]

? No. A share price of £23 values the enterprise at about 31 times normalised adjusted profit.

A score of six out of nine suggests 4Imprint is fairly priced. It probably is a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in 4Imprint

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.